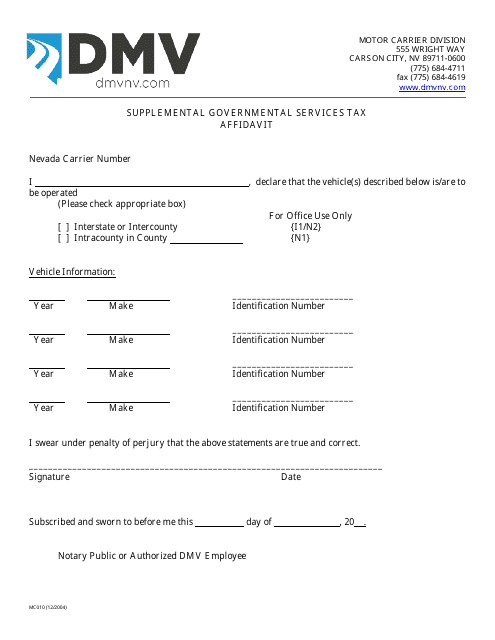

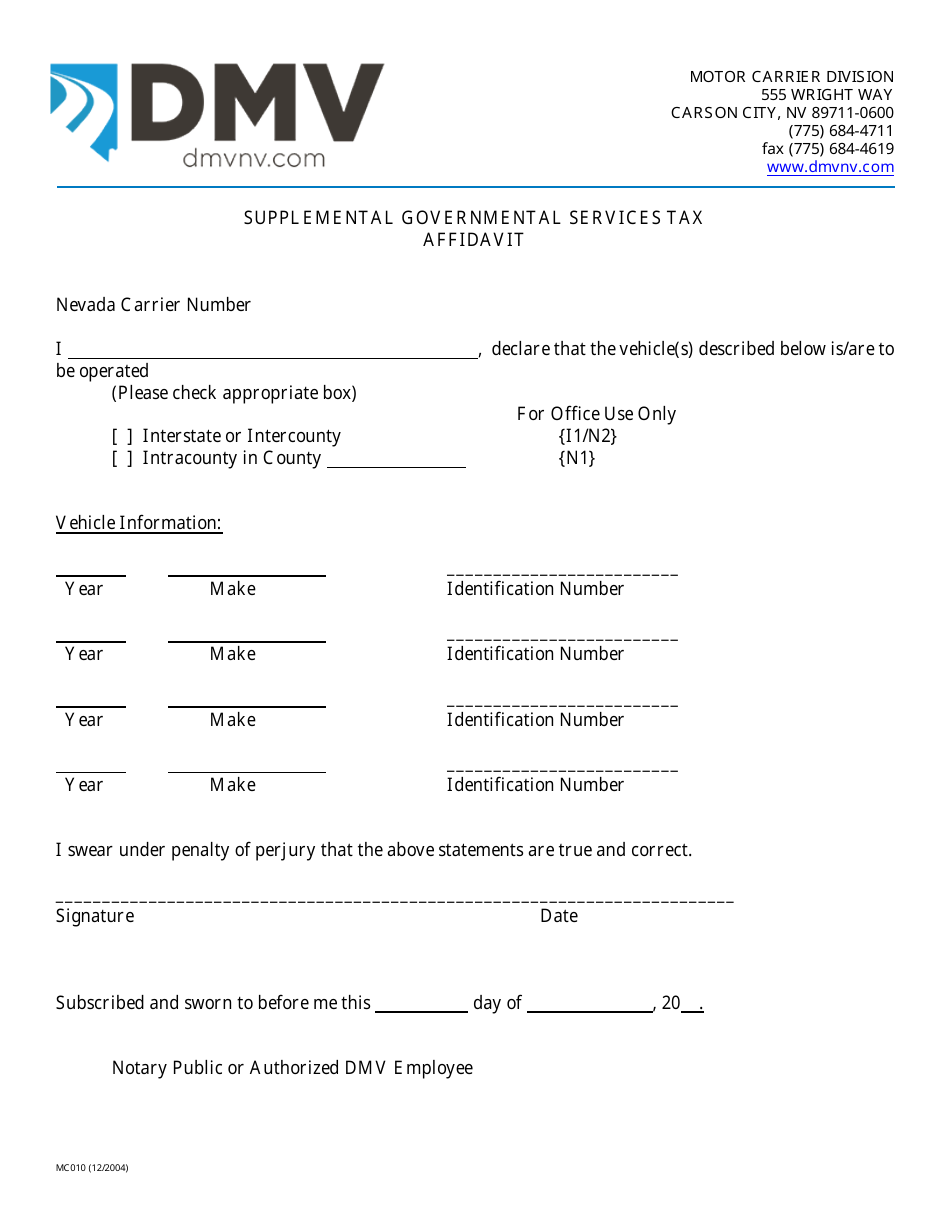

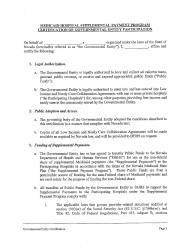

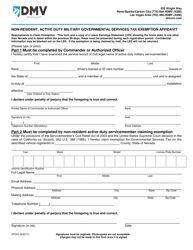

Form MC010 Supplemental Governmental Services Tax Affidavit - Nevada

What Is Form MC010?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

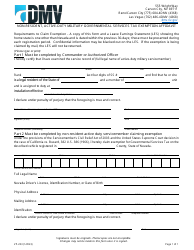

Q: What is the MC010 Supplemental Governmental Services Tax Affidavit?

A: The MC010 Supplemental Governmental Services Tax Affidavit is a form used in Nevada to report and pay taxes on certain governmental services.

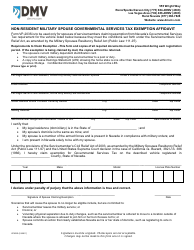

Q: Who needs to complete the MC010 Supplemental Governmental Services Tax Affidavit?

A: Any person or business that provides taxable governmental services in Nevada must complete this form.

Q: What are taxable governmental services in Nevada?

A: Taxable governmental services in Nevada include services related to transportation, gaming, telecommunication, energy, and water and sewer systems, among others.

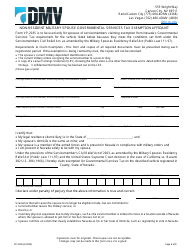

Q: When is the MC010 Supplemental Governmental Services Tax Affidavit due?

A: The form must be filed and the taxes paid quarterly, with the due dates being April 30, July 31, October 31, and January 31 of each year.

Q: What happens if I fail to file the MC010 Supplemental Governmental Services Tax Affidavit?

A: Failure to file the form and pay the required taxes can result in penalties and interest being assessed by the Nevada Department of Taxation.

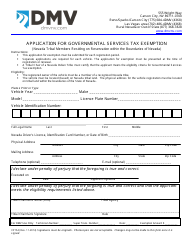

Q: Are there any exemptions or deductions available for the taxes paid on taxable governmental services?

A: Yes, there are certain exemptions and deductions available. You may want to consult with a tax professional or refer to the instructions provided with the form for more information.

Form Details:

- Released on December 1, 2004;

- The latest edition provided by the Nevada Department of Motor Vehicles;

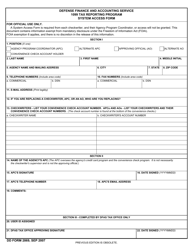

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC010 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.