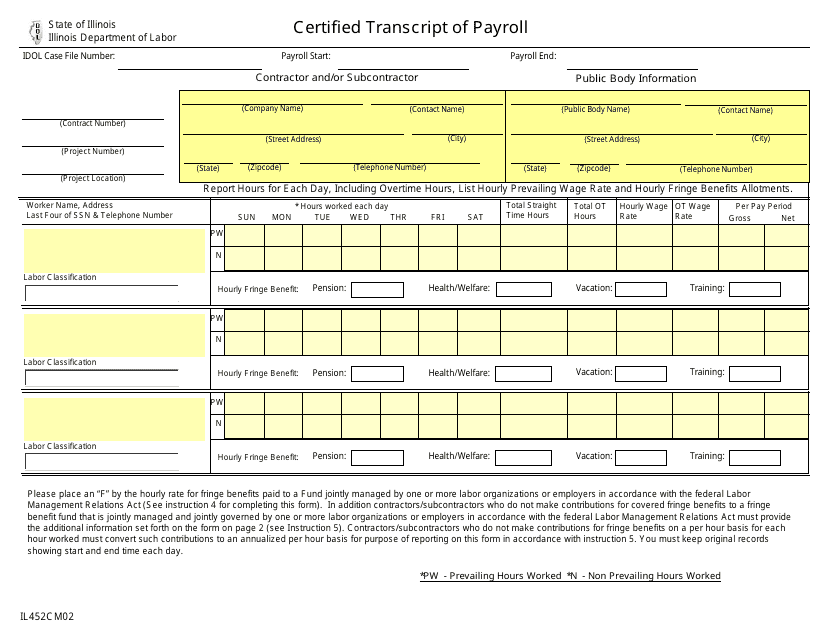

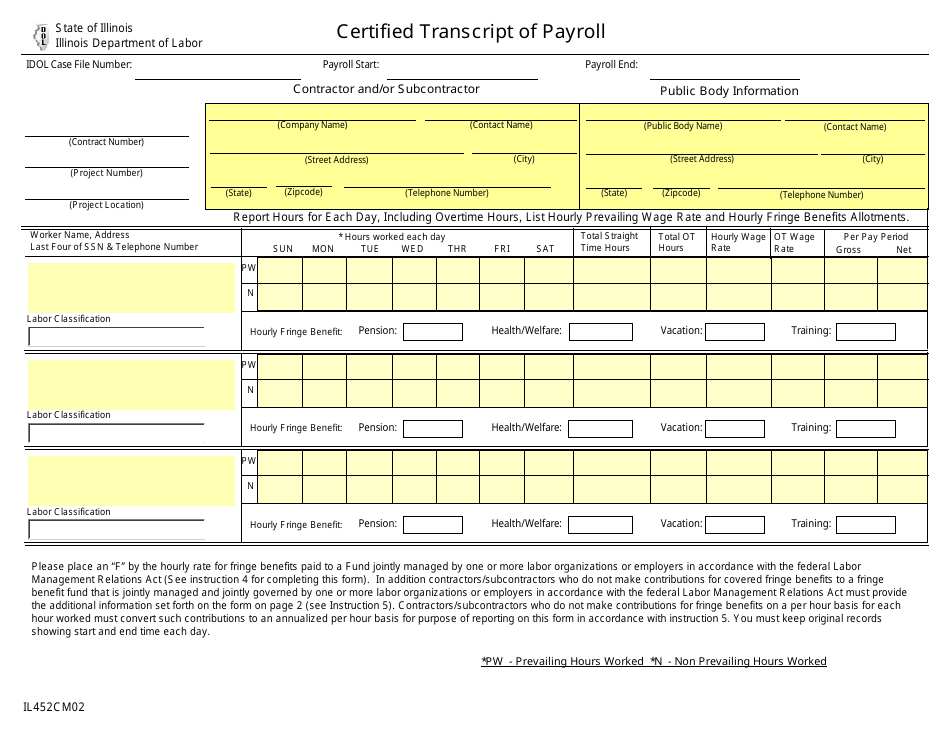

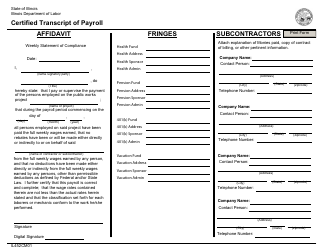

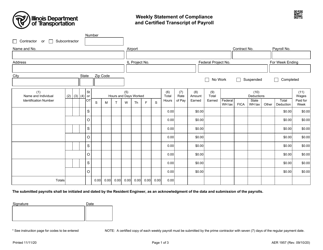

Form IL452CM02 Certified Transcript of Payroll - Illinois

What Is Form IL452CM02?

This is a legal form that was released by the Illinois Department of Labor - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL452CM02?

A: Form IL452CM02 is a certified transcript of payroll for businesses operating in Illinois.

Q: Who needs to file Form IL452CM02?

A: Businesses operating in Illinois may be required to file Form IL452CM02.

Q: What is the purpose of Form IL452CM02?

A: The purpose of Form IL452CM02 is to provide a certified transcript of payroll information to the Illinois Department of Employment Security.

Q: What information is required on Form IL452CM02?

A: Form IL452CM02 requires detailed information about the employer's payroll, including wages, hours worked, and withholdings.

Q: How often does Form IL452CM02 need to be filed?

A: Form IL452CM02 is typically filed on a quarterly basis.

Q: Is there a deadline for filing Form IL452CM02?

A: Yes, Form IL452CM02 must be filed by the specified deadline for each quarter.

Q: Are there any penalties for late filing of Form IL452CM02?

A: Yes, there may be penalties for late filing of Form IL452CM02, including potential fines or interest charges.

Q: Do I need to keep a copy of Form IL452CM02 for my records?

A: Yes, it is recommended to keep a copy of Form IL452CM02 for your records.

Form Details:

- The latest edition provided by the Illinois Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL452CM02 by clicking the link below or browse more documents and templates provided by the Illinois Department of Labor.