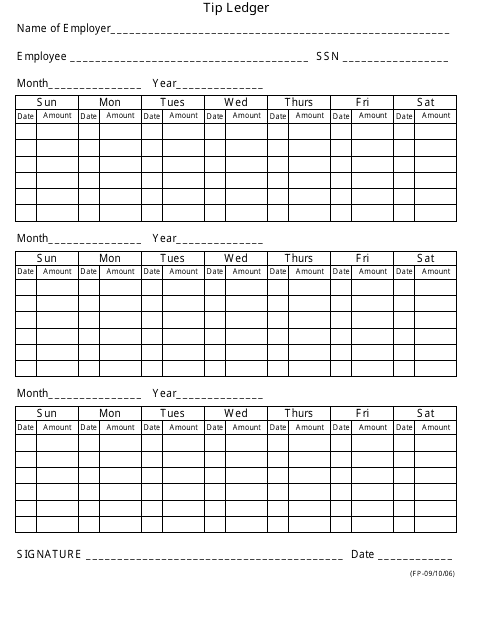

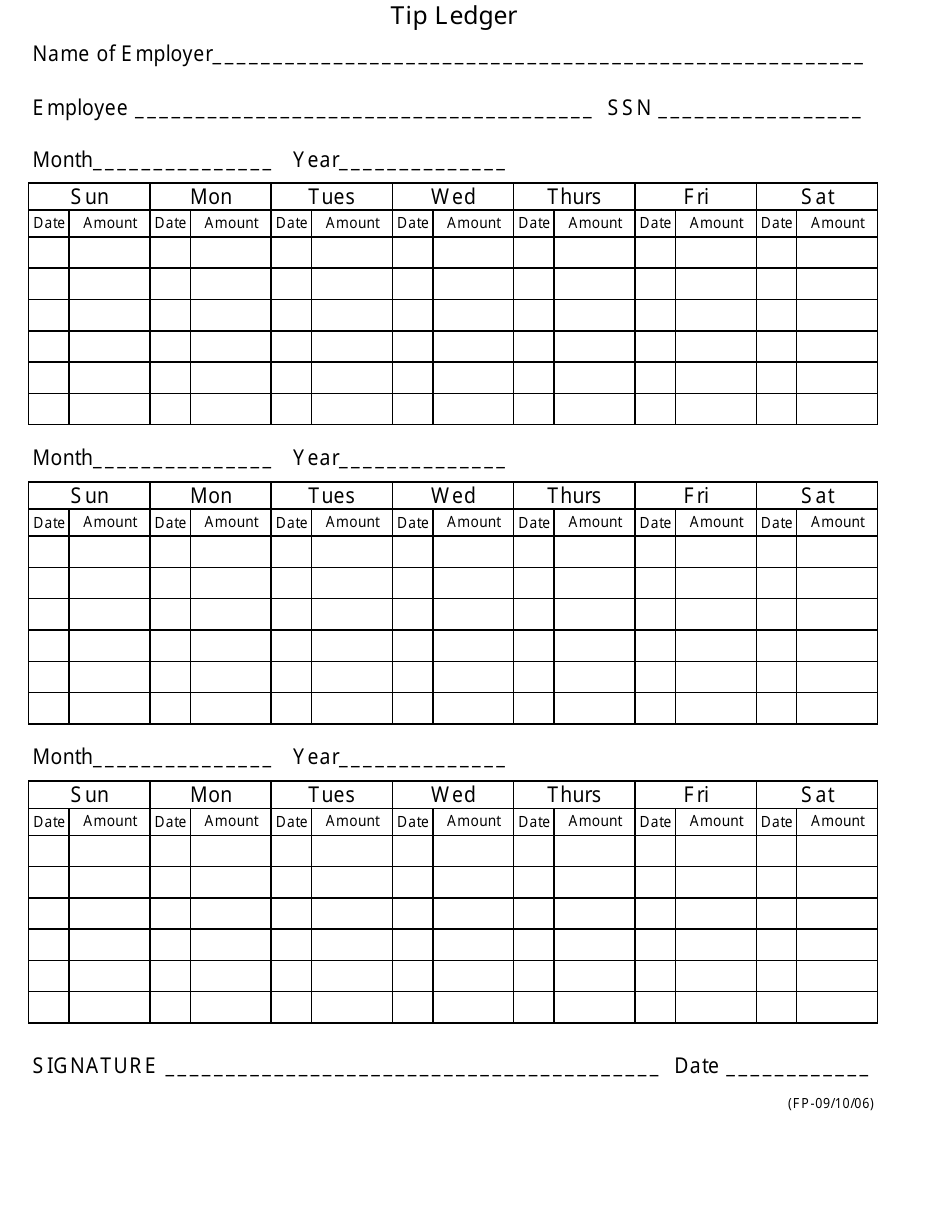

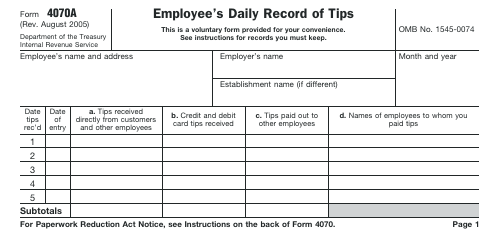

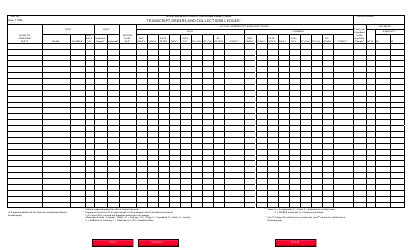

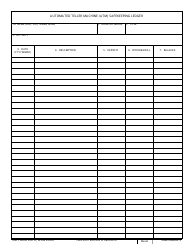

Tip Ledger - Nebraska

Tip Ledger is a legal document that was released by the Nebraska Department of Health and Human Services - a government authority operating within Nebraska.

FAQ

Q: What is the Tip Ledger in Nebraska?

A: The Tip Ledger is a system used in Nebraska to document tip income reported by employees.

Q: Who is required to use the Tip Ledger?

A: Employers in Nebraska are required to use the Tip Ledger if they have employees who receive tips.

Q: What is the purpose of the Tip Ledger?

A: The purpose of the Tip Ledger is to accurately track and report tip income for tax compliance.

Q: How does the Tip Ledger work?

A: Employers record the amount of tips their employees receive in the Tip Ledger, which is then used for tax reporting purposes.

Q: Is it mandatory to use the Tip Ledger?

A: Yes, employers in Nebraska are mandated to use the Tip Ledger if they have employees who receive tips.

Q: Is there a specific form for the Tip Ledger?

A: There is no specific form for the Tip Ledger, but employers can create their own tracking system or use software that provides a Tip Ledger feature.

Form Details:

- Released on September 10, 2006;

- The latest edition currently provided by the Nebraska Department of Health and Human Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Health and Human Services.