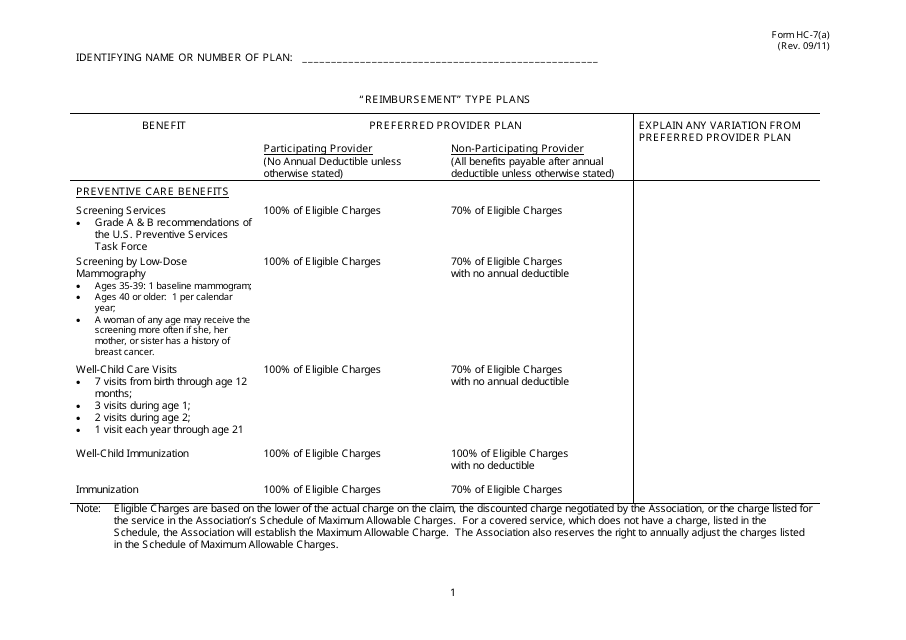

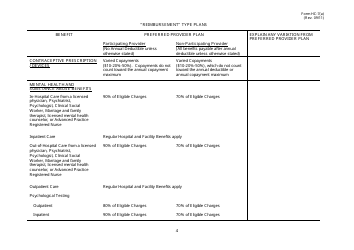

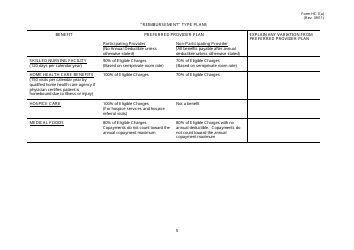

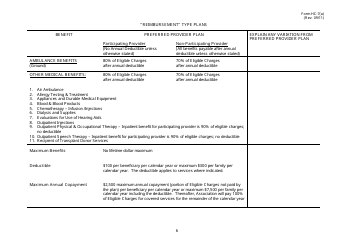

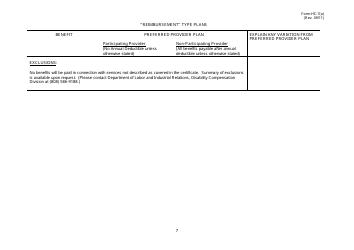

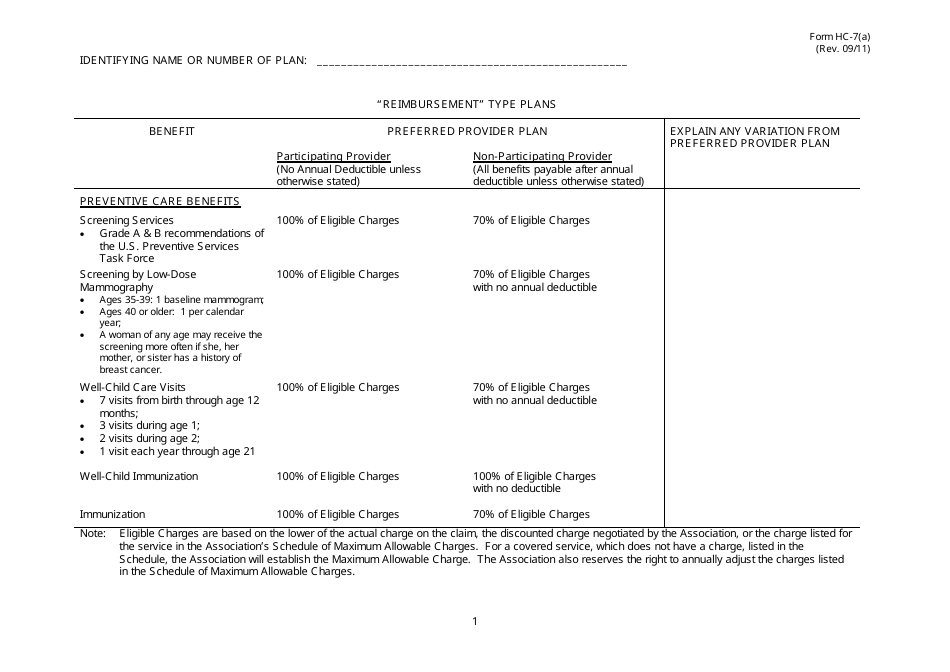

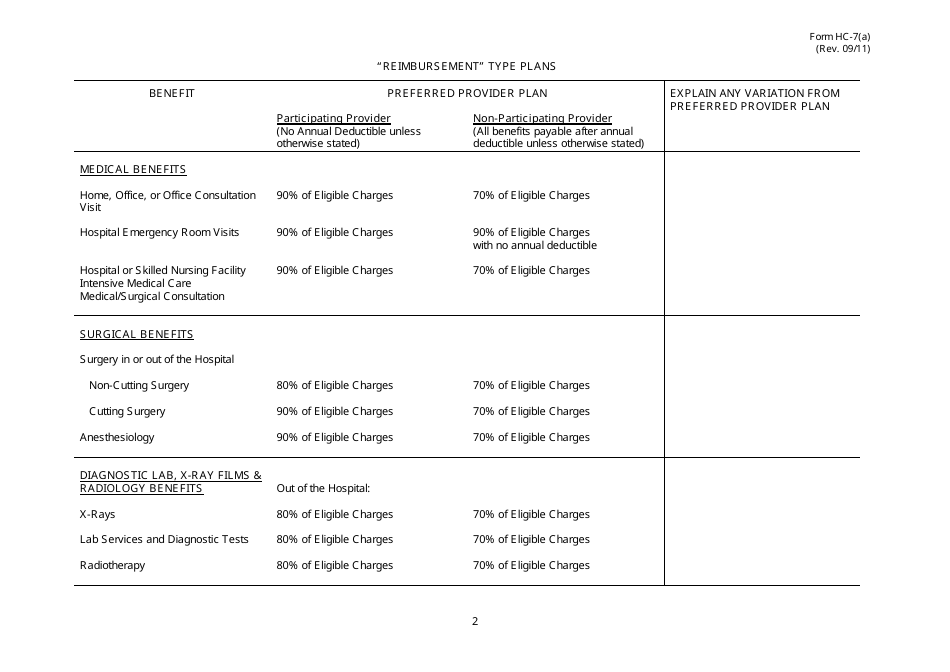

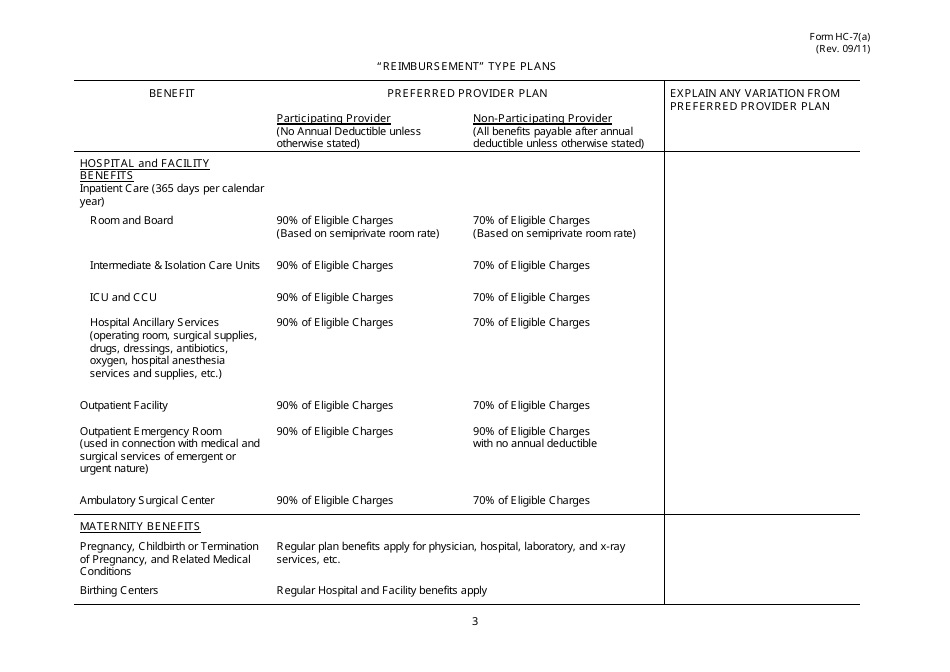

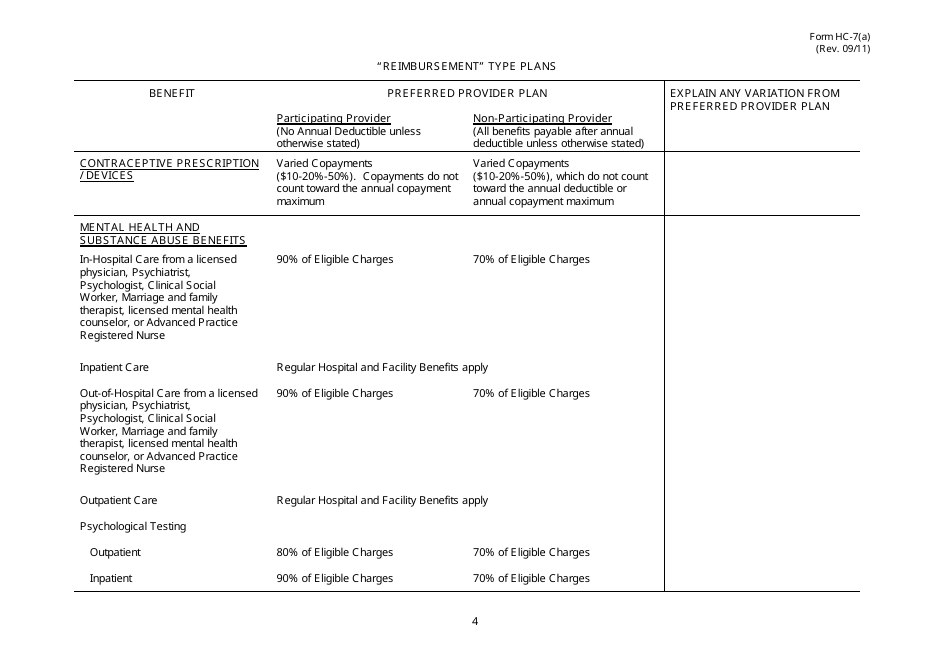

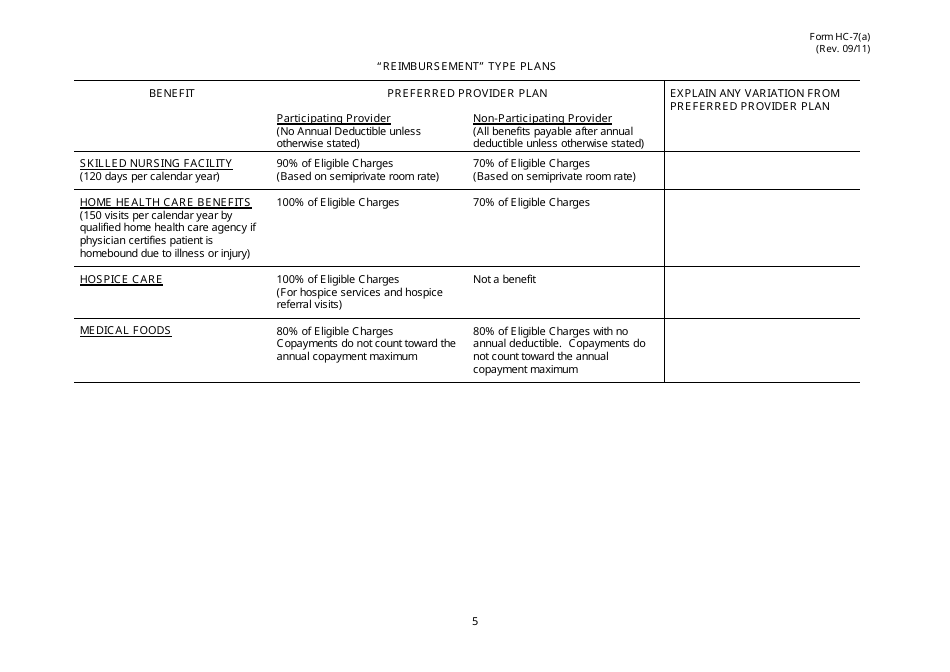

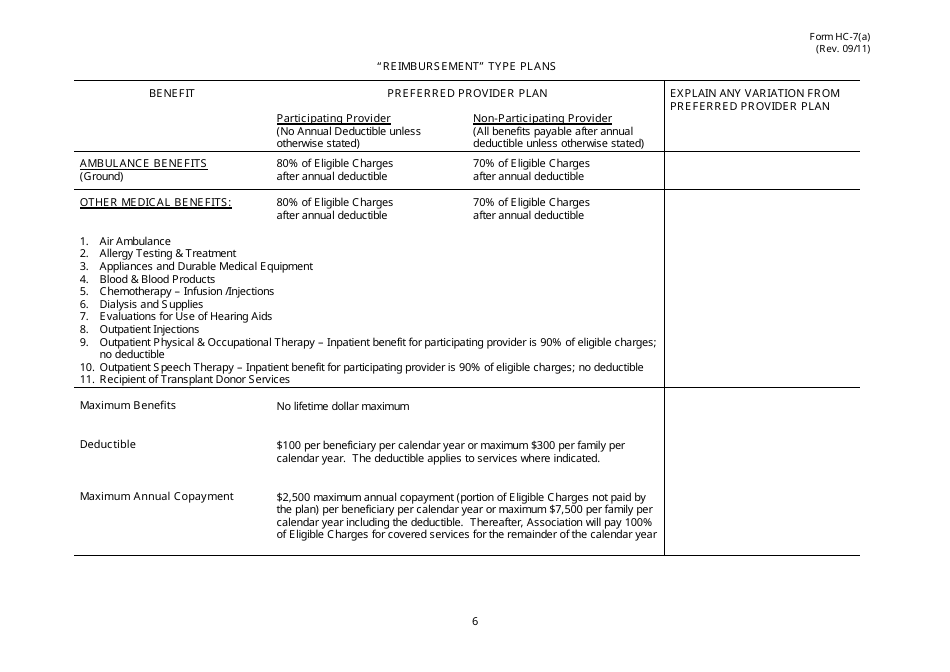

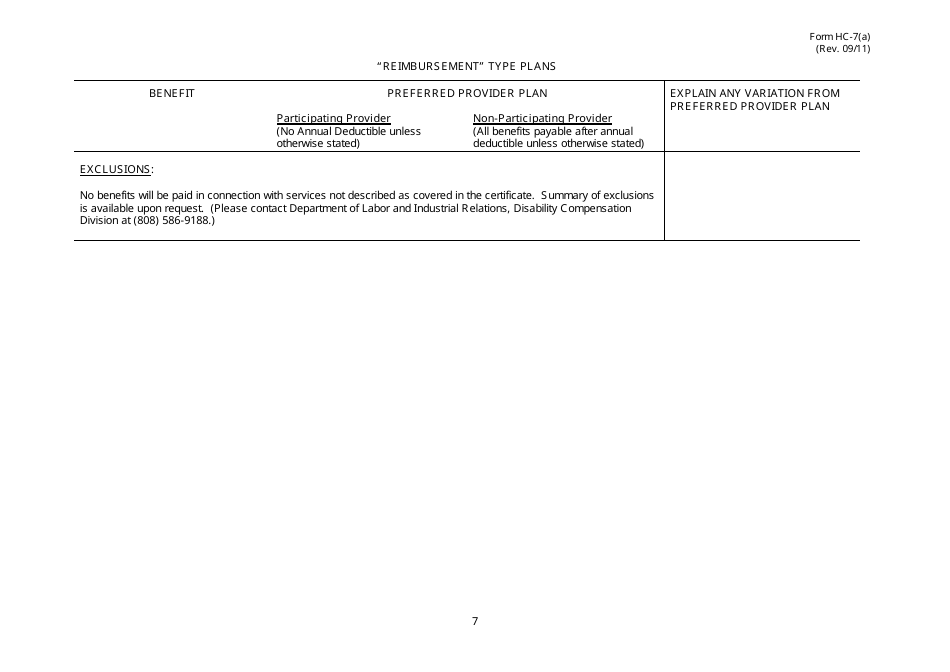

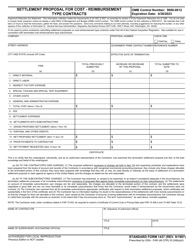

Form HC-7(A) Reimbursement Type Plans - Hawaii

What Is Form HC-7(A)?

This is a legal form that was released by the Hawaii Department of Labor & Industrial Relations - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HC-7(A)?

A: Form HC-7(A) is a reimbursement type plan form in Hawaii.

Q: What is a reimbursement type plan?

A: A reimbursement type plan is a type of healthcare plan where the insured person pays for medical services upfront and then gets reimbursed by the insurance provider.

Q: Who needs to fill out Form HC-7(A)?

A: Anyone who has a reimbursement type plan in Hawaii needs to fill out Form HC-7(A).

Q: What information is required on Form HC-7(A)?

A: Form HC-7(A) requires information such as the insured person's name, address, Social Security number, and details about the healthcare expenses.

Q: Is Form HC-7(A) only for residents of Hawaii?

A: Yes, Form HC-7(A) is specifically for residents of Hawaii.

Q: When should Form HC-7(A) be filed?

A: Form HC-7(A) should be filed by April 20th of each year, for the previous calendar year's expenses.

Q: What happens after filing Form HC-7(A)?

A: After filing Form HC-7(A), the insurance provider will review the expenses and reimburse the insured person accordingly.

Q: Are there any penalties for not filing Form HC-7(A)?

A: Yes, there may be penalties for not filing Form HC-7(A), such as a loss of reimbursement or potential tax consequences.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Hawaii Department of Labor & Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HC-7(A) by clicking the link below or browse more documents and templates provided by the Hawaii Department of Labor & Industrial Relations.