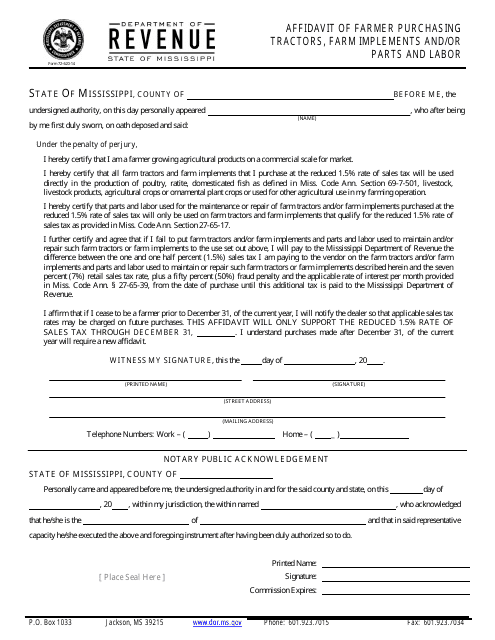

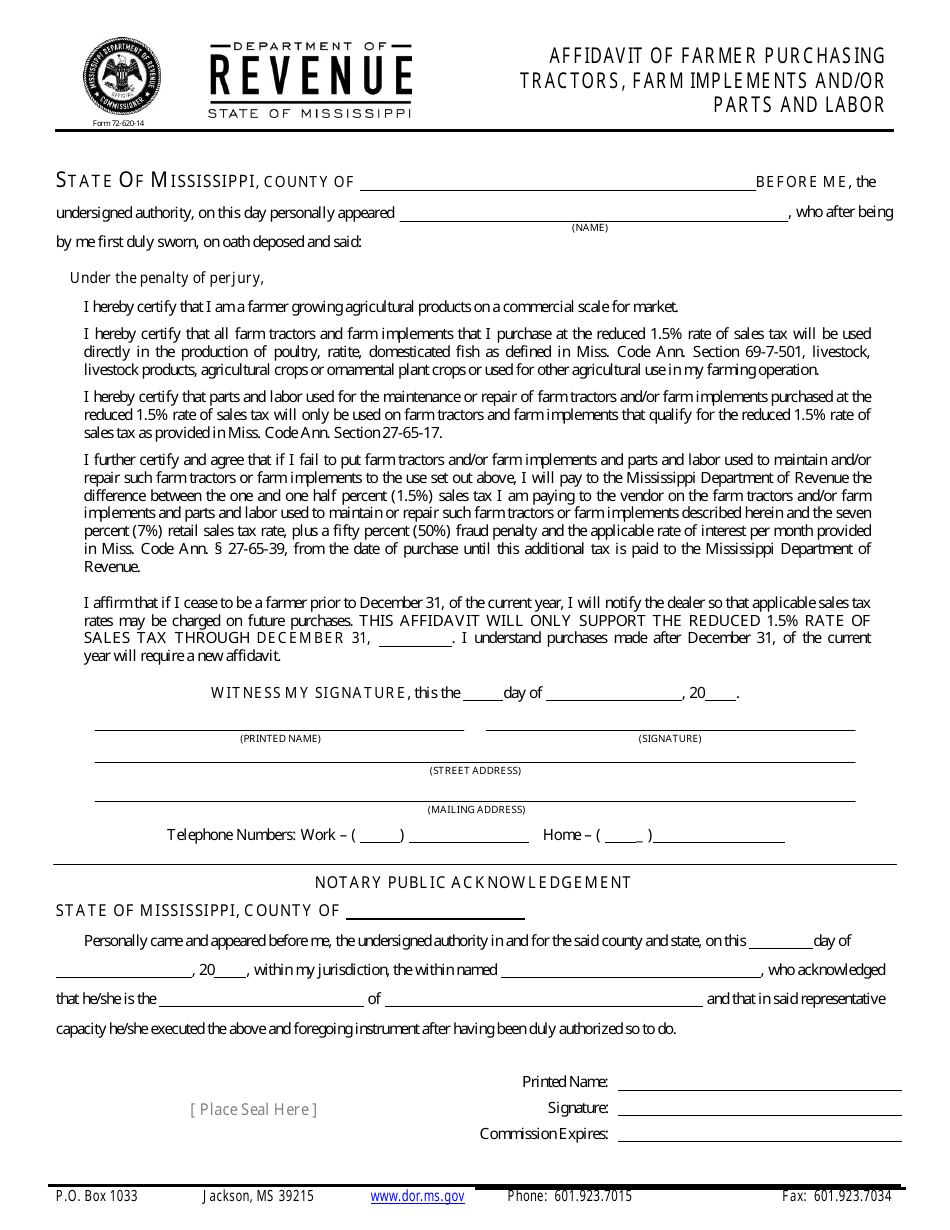

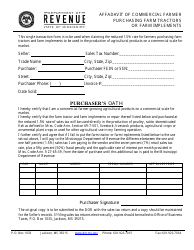

Form 72-620-14 Affidavit of Farmer Purchasing Tractors, Farm Implements and / or Parts and Labor - Mississippi

What Is Form 72-620-14?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72-620-14?

A: Form 72-620-14 is the Affidavit of Farmer Purchasing Tractors, Farm Implements and/or Parts and Labor in Mississippi.

Q: Who needs to fill out Form 72-620-14?

A: Farmers in Mississippi who are purchasing tractors, farm implements, and/or parts and labor need to fill out Form 72-620-14.

Q: What is the purpose of Form 72-620-14?

A: The purpose of Form 72-620-14 is to provide documentation for farmers purchasing tractors, farm implements, and/or parts and labor to claim a sales tax exemption in Mississippi.

Q: What information is required on Form 72-620-14?

A: Form 72-620-14 requires information such as the farmer's name, address, social security number or tax ID number, and details about the equipment or services being purchased.

Q: Are there any fees associated with filing Form 72-620-14?

A: No, there are no fees associated with filing Form 72-620-14.

Q: When should Form 72-620-14 be filed?

A: Form 72-620-14 should be filed at the time of purchase or within 30 days of the purchase date.

Q: What should I do with Form 72-620-14 after it is filled out?

A: After Form 72-620-14 is filled out, it should be given to the seller of the equipment or services.

Form Details:

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72-620-14 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.