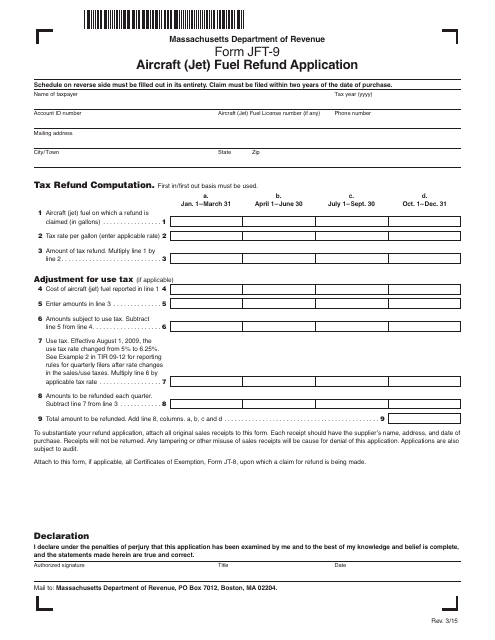

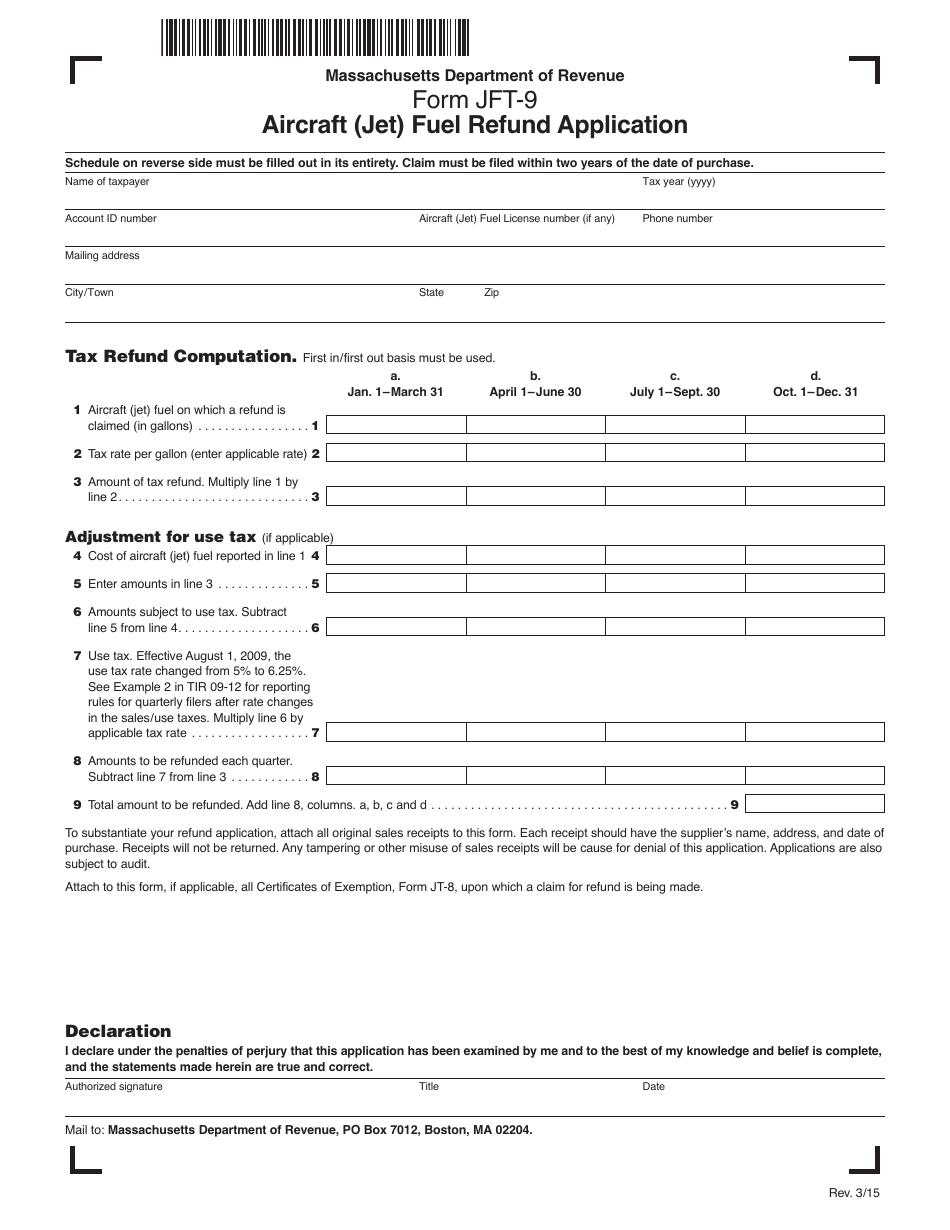

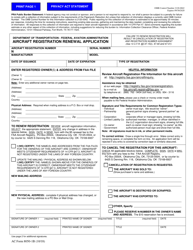

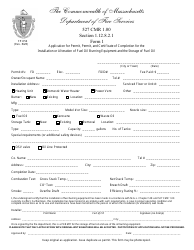

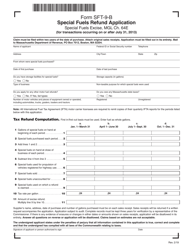

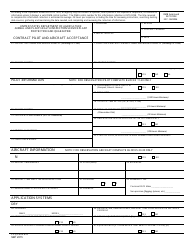

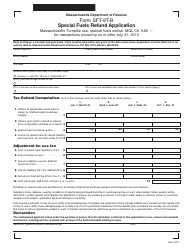

Form JFT-9 Aircraft (Jet) Fuel Refund Application - Massachusetts

What Is Form JFT-9?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form JFT-9?

A: Form JFT-9 is an Aircraft (Jet) Fuel Refund Application.

Q: What is the purpose of Form JFT-9?

A: The purpose of Form JFT-9 is to apply for a refund of aircraft (jet) fuel taxes paid in the state of Massachusetts.

Q: Who should use Form JFT-9?

A: Aircraft owners, operators, and carriers who have paid aircraft (jet) fuel taxes in Massachusetts may use Form JFT-9 to apply for a refund.

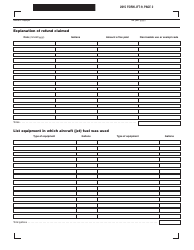

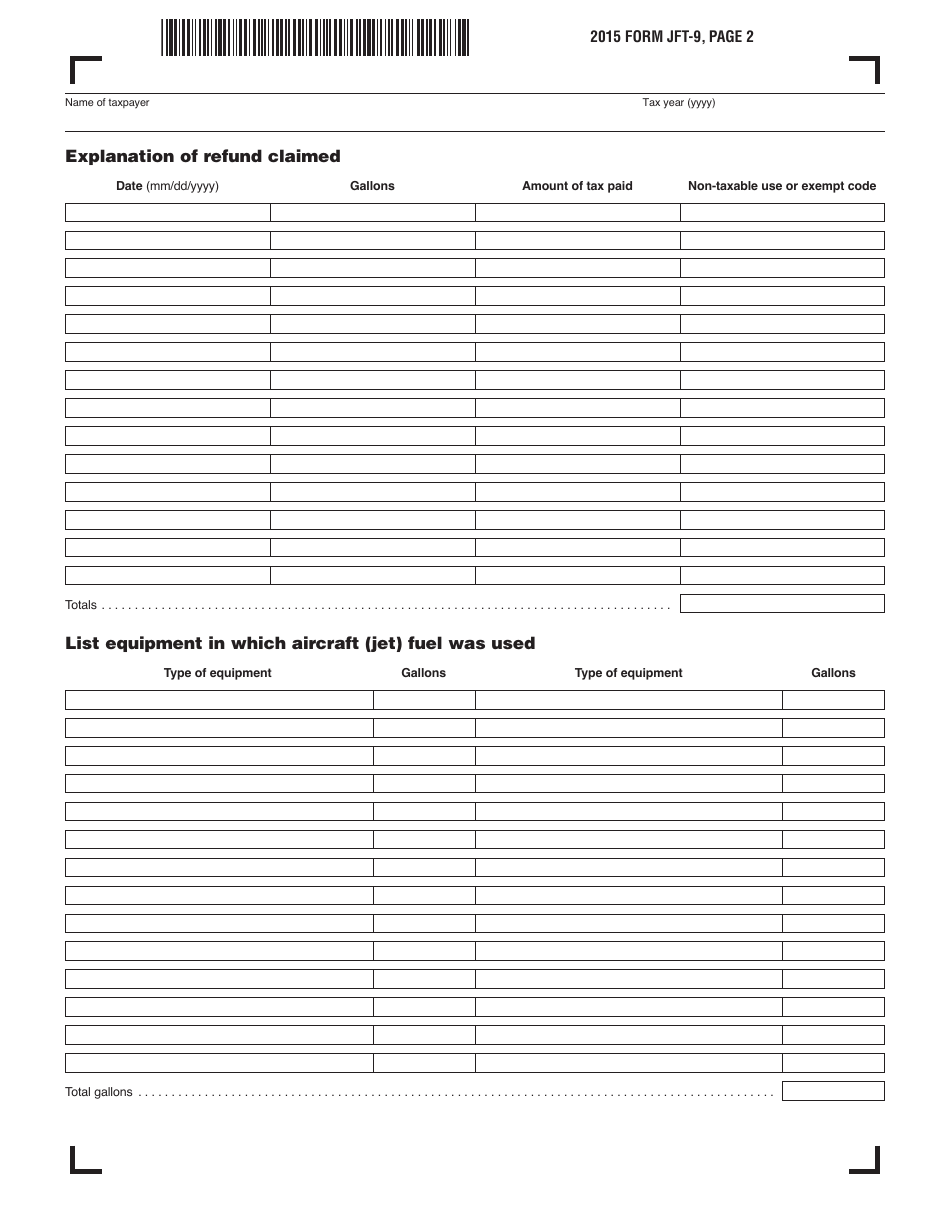

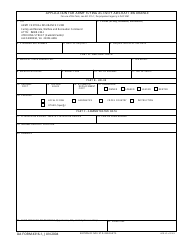

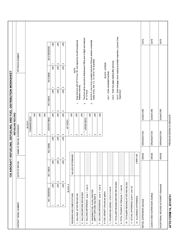

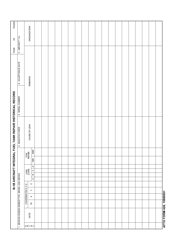

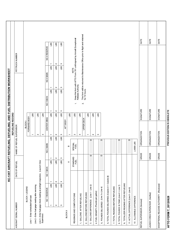

Q: What information is required on Form JFT-9?

A: Form JFT-9 requires information such as the taxpayer name, address, tax identification number, type of aircraft, fuel purchase details, and supporting documentation.

Q: How should I submit Form JFT-9?

A: Completed Form JFT-9 should be mailed to the Massachusetts Department of Revenue along with any required supporting documentation.

Q: What is the deadline for submitting Form JFT-9?

A: Form JFT-9 must be filed within three years from the date the fuel tax was paid.

Q: How long does it take to process Form JFT-9?

A: The processing time for Form JFT-9 varies, but it generally takes several weeks.

Q: Can I apply for a refund of aircraft (jet) fuel taxes paid in other states through Form JFT-9?

A: No, Form JFT-9 is specific to aircraft (jet) fuel taxes paid in Massachusetts. Refunds for other states must be claimed through their respective forms and procedures.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form JFT-9 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.