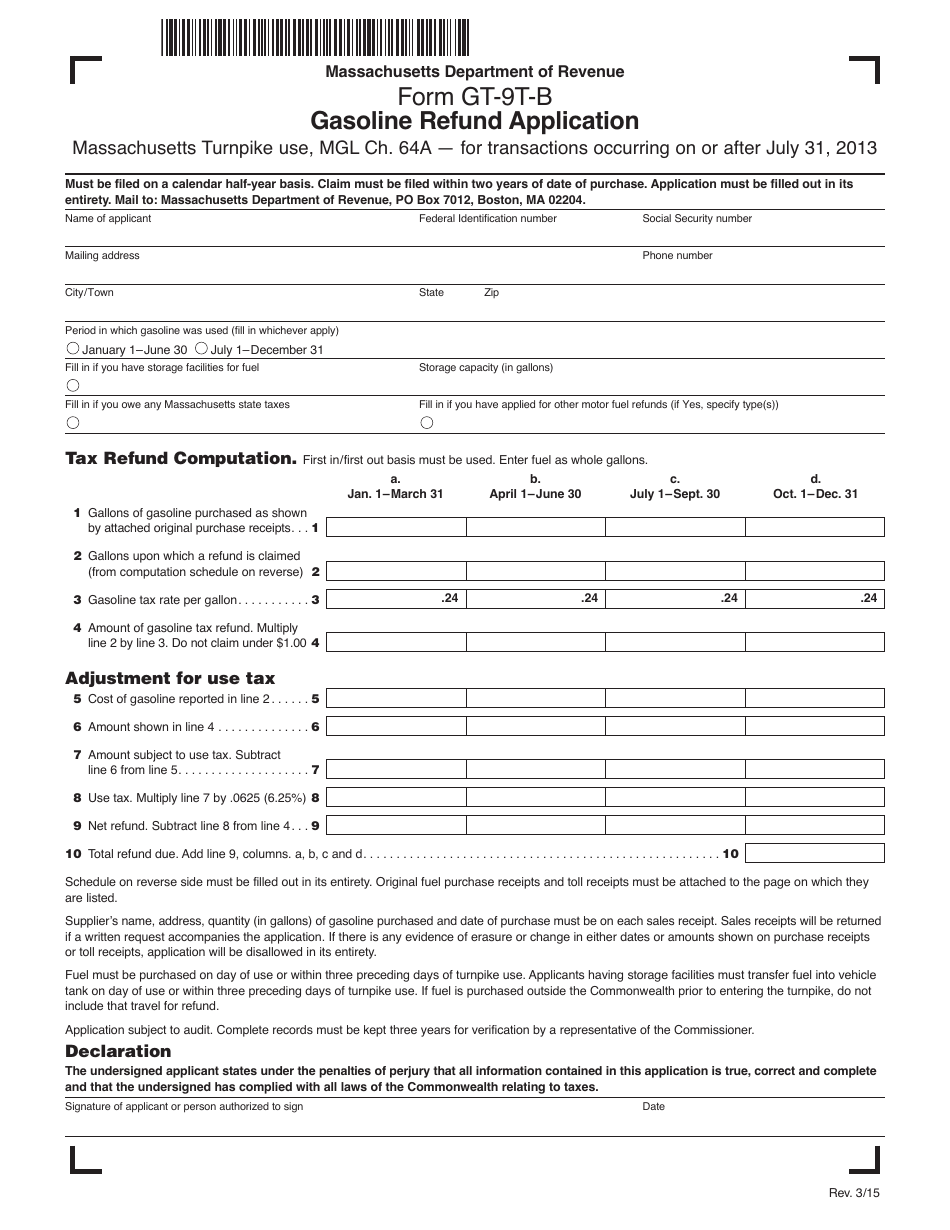

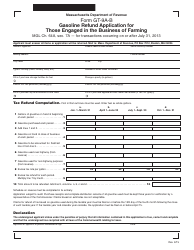

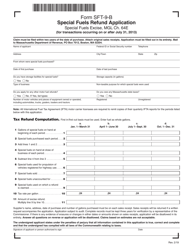

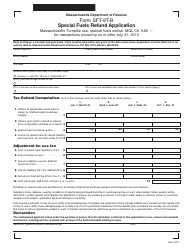

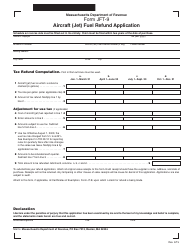

Form GT-9T-B Gasoline Refund Application - Massachusetts

What Is Form GT-9T-B?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GT-9T-B?

A: Form GT-9T-B is a Gasoline Refund Application specifically for residents of Massachusetts.

Q: Who can use Form GT-9T-B?

A: Residents of Massachusetts who want to apply for a refund on gasoline taxes paid.

Q: What is the purpose of Form GT-9T-B?

A: The purpose of this form is to claim a refund on gasoline taxes paid in Massachusetts.

Q: How can I submit Form GT-9T-B?

A: Form GT-9T-B can be submitted by mail to the Massachusetts Department of Revenue.

Q: What information do I need to provide on Form GT-9T-B?

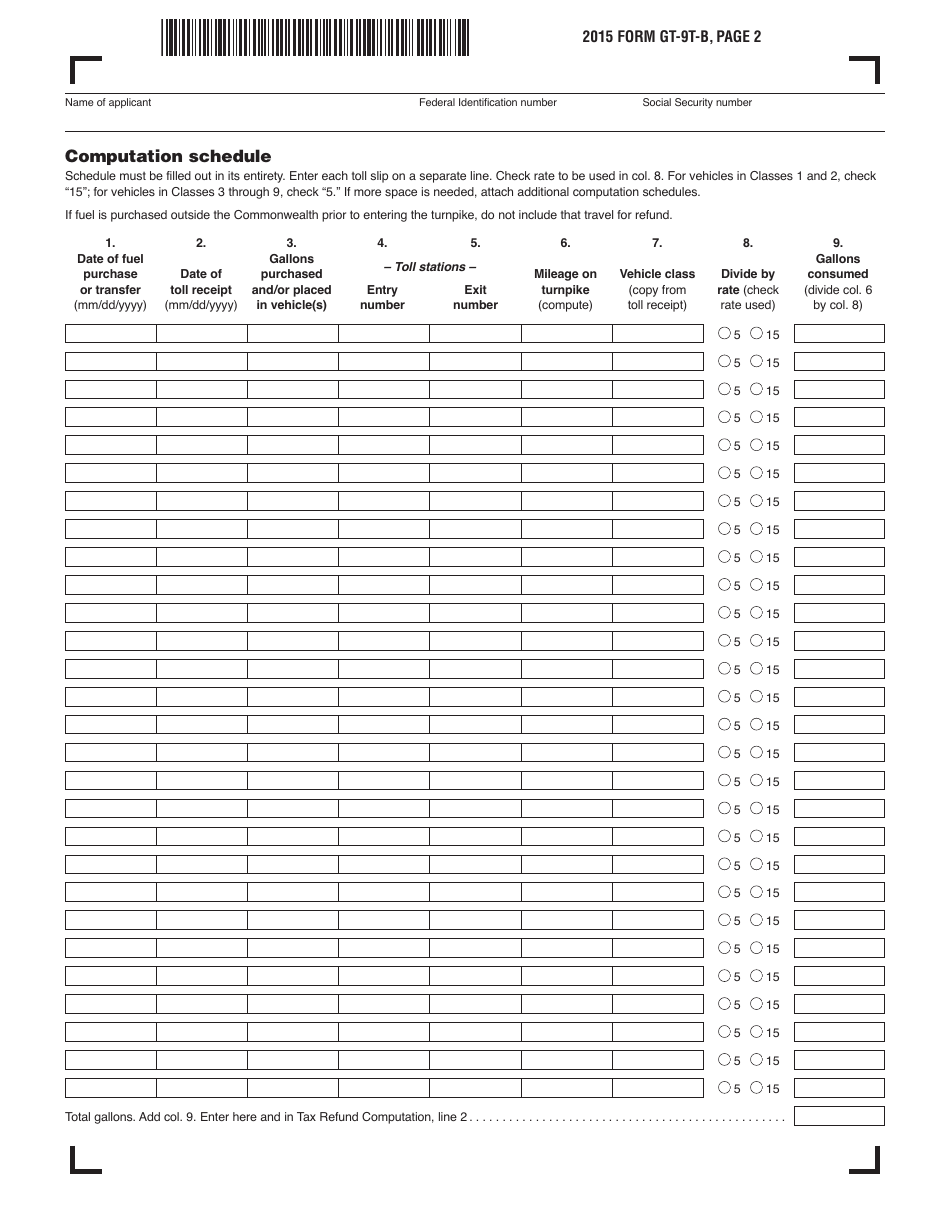

A: You will need to provide information such as your name, address, vehicle information, and details about the gasoline purchases.

Q: Is there a deadline for submitting Form GT-9T-B?

A: Yes, Form GT-9T-B must be submitted within three years from the date the gasoline was purchased.

Q: How long does it take to process Form GT-9T-B?

A: The processing time for Form GT-9T-B may vary, but it typically takes several weeks to receive a refund.

Q: Can I file Form GT-9T-B electronically?

A: No, at this time Form GT-9T-B can only be filed by mail.

Q: Is there a fee for submitting Form GT-9T-B?

A: No, there is no fee to submit Form GT-9T-B.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GT-9T-B by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.