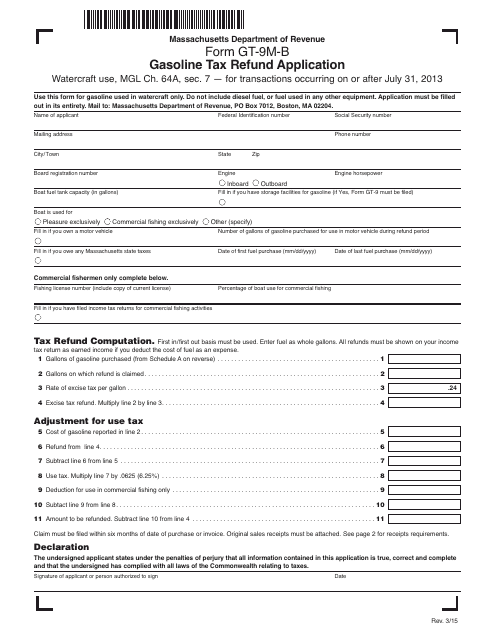

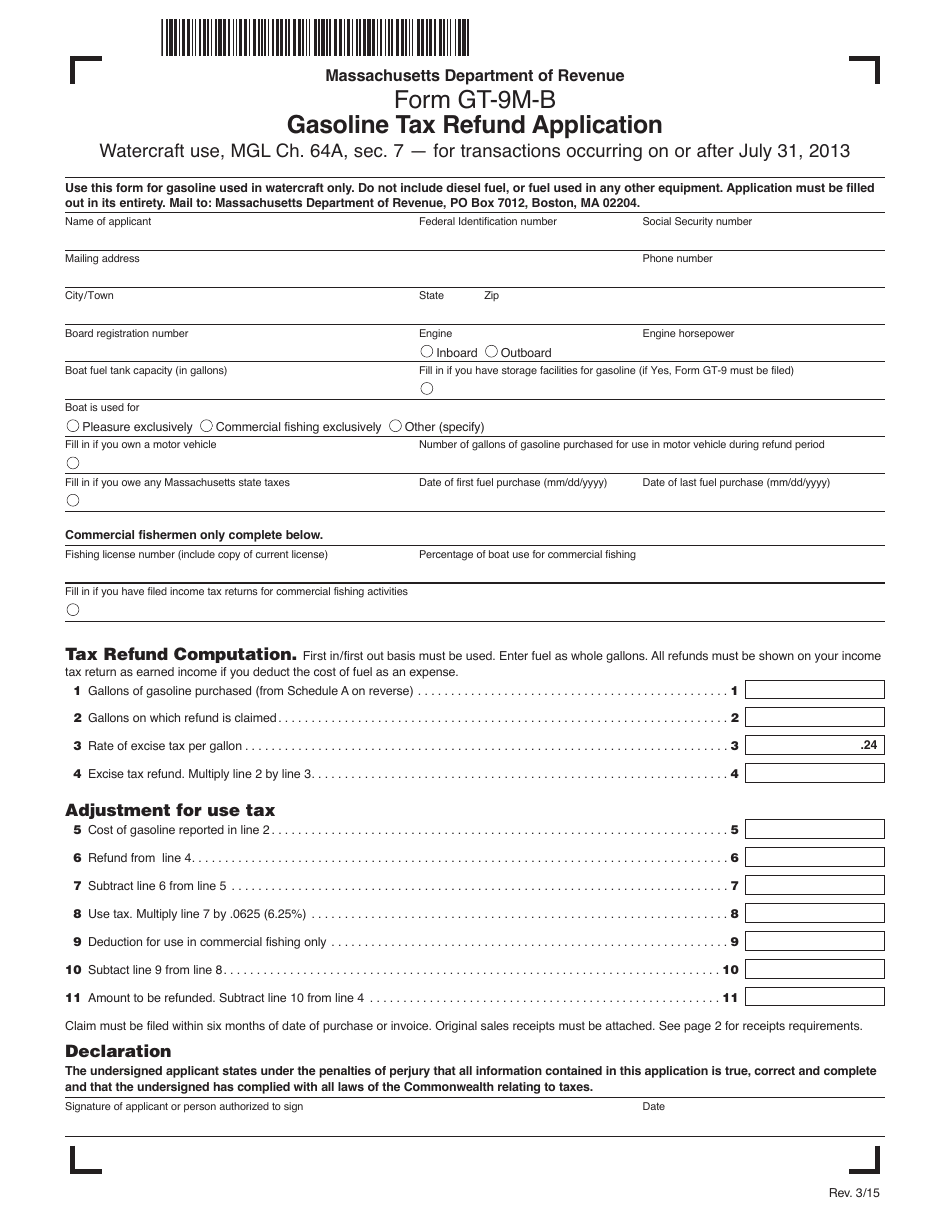

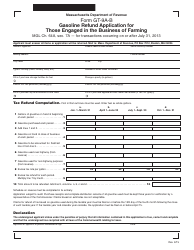

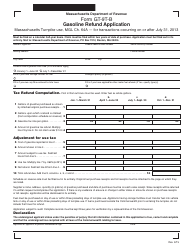

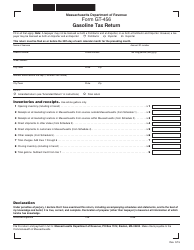

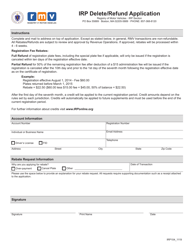

Form GT-9M-B Gasoline Tax Refund Application - Massachusetts

What Is Form GT-9M-B?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

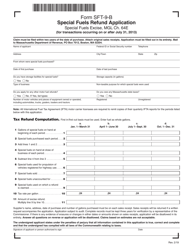

Q: What is Form GT-9M-B?

A: Form GT-9M-B is the Gasoline Tax Refund Application for Massachusetts.

Q: Who can use Form GT-9M-B?

A: Form GT-9M-B can be used by individuals and businesses who are eligible for a gasoline tax refund in Massachusetts.

Q: What is the purpose of Form GT-9M-B?

A: The purpose of Form GT-9M-B is to claim a refund for the gasoline tax paid in Massachusetts.

Q: What information is required to complete Form GT-9M-B?

A: To complete Form GT-9M-B, you will need to provide information such as your name, address, gasoline purchases, and supporting documentation.

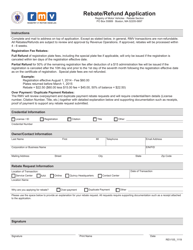

Q: Is there a deadline for submitting Form GT-9M-B?

A: Yes, there is a deadline for submitting Form GT-9M-B. The deadline is usually within three years from the date of purchase.

Q: How long does it take to receive a refund after submitting Form GT-9M-B?

A: The processing time for a refund after submitting Form GT-9M-B can vary, but it typically takes around 6-8 weeks.

Q: Are there any restrictions or limitations on the gasoline tax refund?

A: Yes, there are restrictions and limitations on the gasoline tax refund. It is important to review the instructions and guidelines provided with Form GT-9M-B for more information.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GT-9M-B by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.