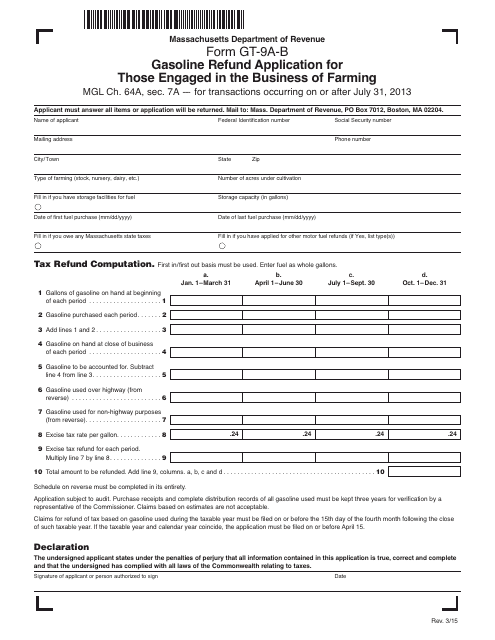

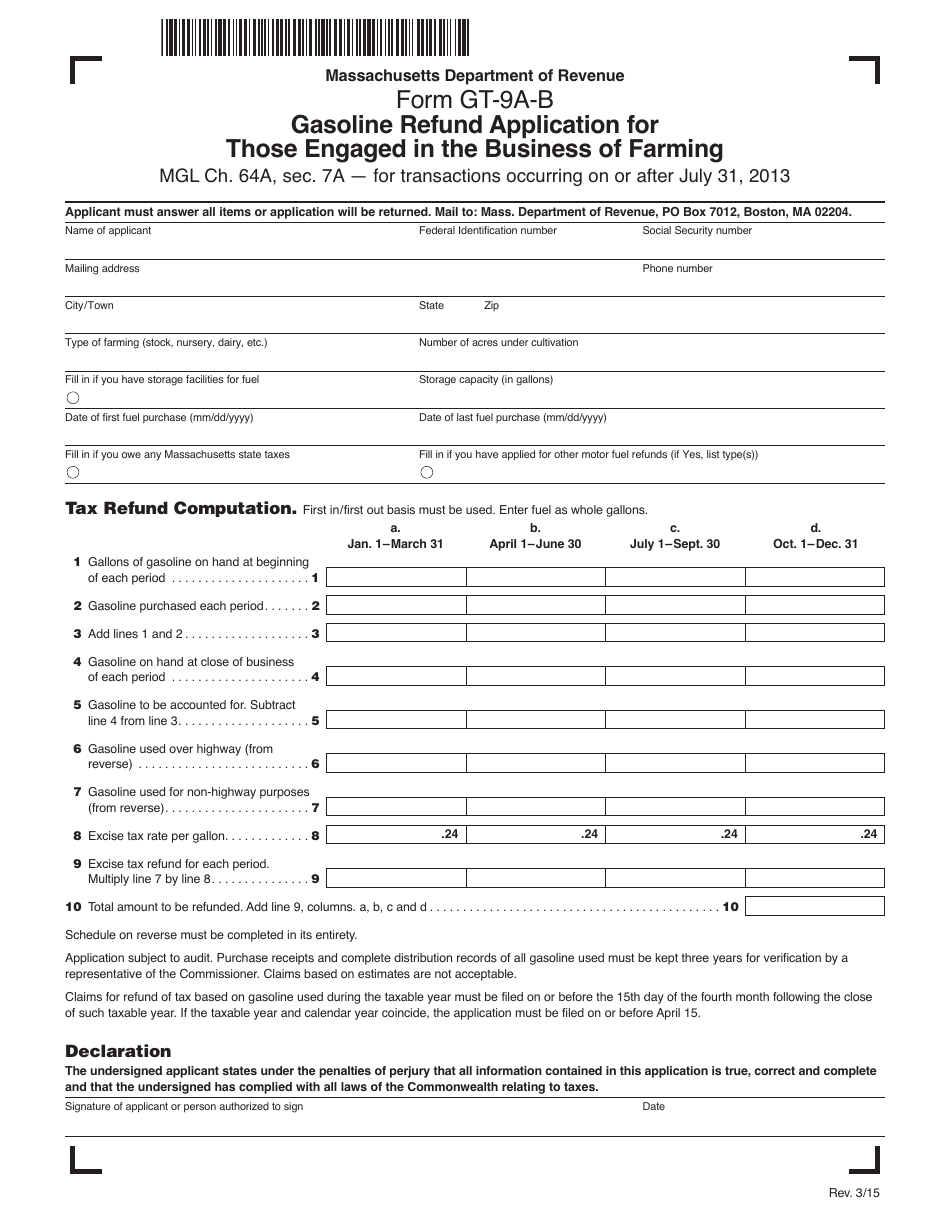

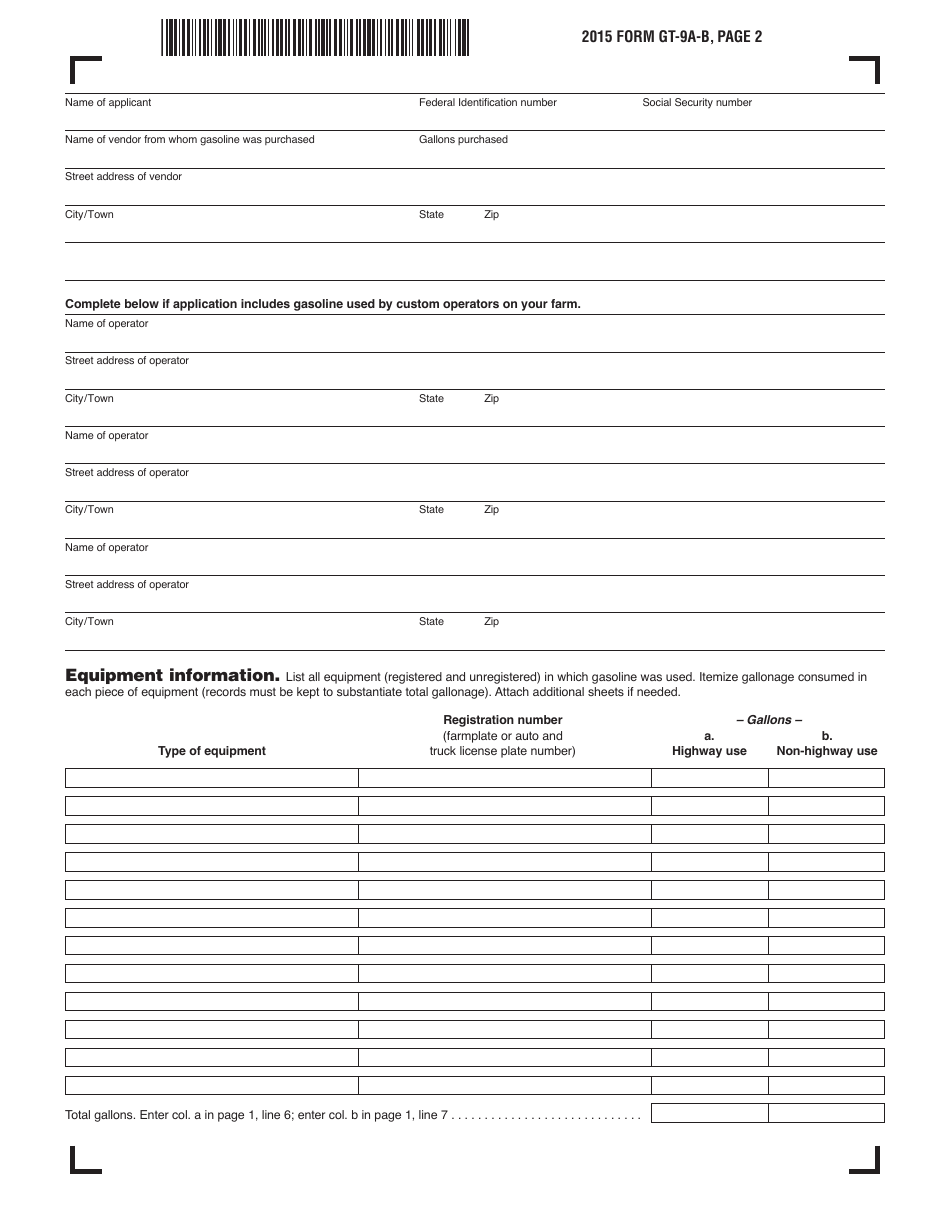

Form GT-9A-B Gasoline Refund Application for Those Engaged in the Business of Farming - Massachusetts

What Is Form GT-9A-B?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GT-9A-B?

A: Form GT-9A-B is the Gasoline Refund Application for Those Engaged in the Business of Farming in Massachusetts.

Q: Who can use Form GT-9A-B?

A: Form GT-9A-B can be used by individuals or businesses engaged in farming.

Q: What is the purpose of Form GT-9A-B?

A: The purpose of Form GT-9A-B is to apply for a refund of gasoline taxes paid by those engaged in farming.

Q: What information is required on Form GT-9A-B?

A: Form GT-9A-B requires information such as the taxpayer's name, address, farming activities, and the amount of gasoline used for farming purposes.

Q: When should I submit Form GT-9A-B?

A: Form GT-9A-B should be submitted quarterly, within 30 days after the end of each calendar quarter.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GT-9A-B by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.