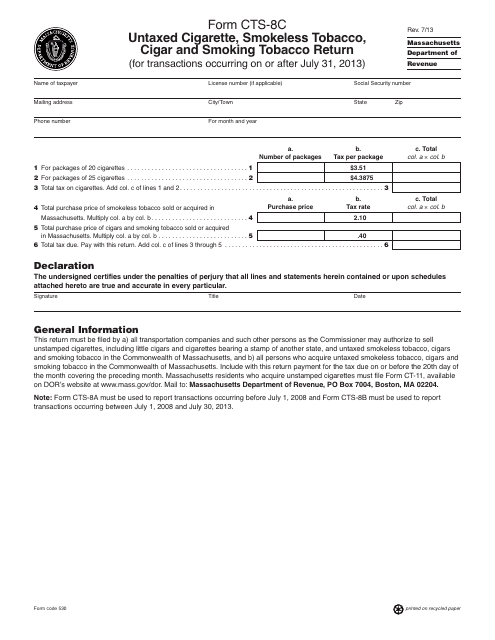

Form CTS-8C Untaxed Cigarette, Smokeless Tobacco, Cigar and Smoking Tobacco Return (On or After July 31, 2013) - Massachusetts

What Is Form CTS-8C?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CTS-8C?

A: Form CTS-8C is a return for reporting untaxed cigarettes, smokeless tobacco, cigars, and smoking tobacco in Massachusetts.

Q: When is Form CTS-8C applicable?

A: Form CTS-8C is applicable for reporting untaxed cigarette, smokeless tobacco, cigar and smoking tobacco sales on or after July 31, 2013 in Massachusetts.

Q: What information is required on Form CTS-8C?

A: Form CTS-8C requires information including the name and address of the seller, purchaser, and the quantity and type of untaxed tobacco products sold.

Q: Is Form CTS-8C for individuals or businesses?

A: Form CTS-8C is primarily for businesses engaged in the sale of untaxed cigarettes, smokeless tobacco, cigars, and smoking tobacco.

Q: Are there any penalties for not filing Form CTS-8C?

A: Failure to file Form CTS-8C or underreporting untaxed tobacco sales may result in penalties and fines.

Q: What is the deadline for filing Form CTS-8C?

A: The deadline for filing Form CTS-8C in Massachusetts is typically the last day of the month following the end of the reporting period.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CTS-8C by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.