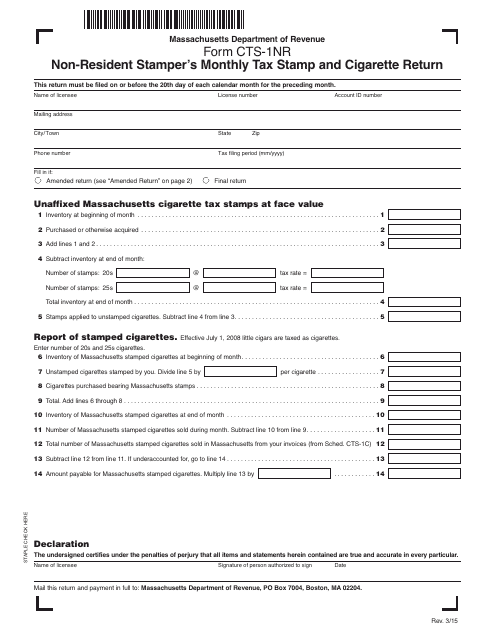

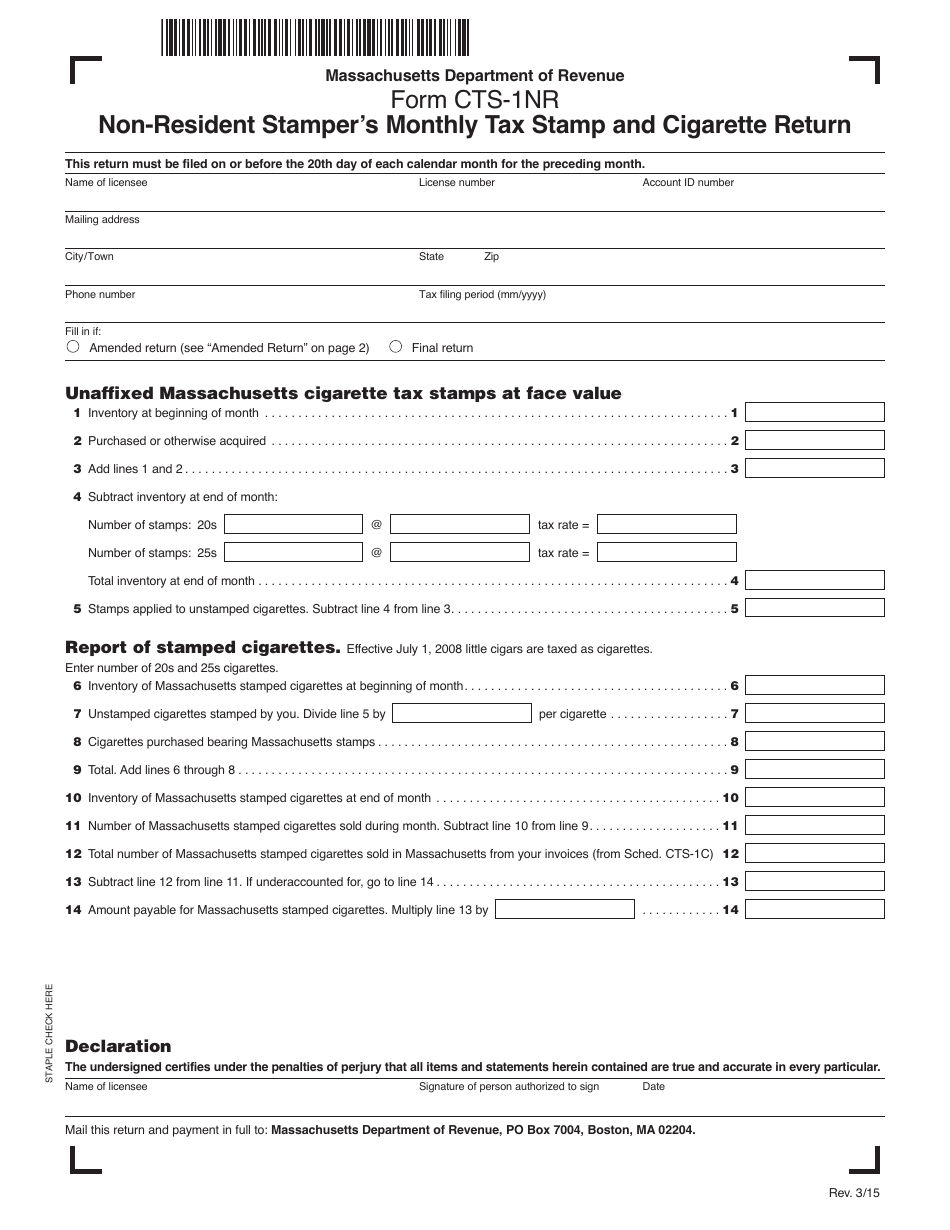

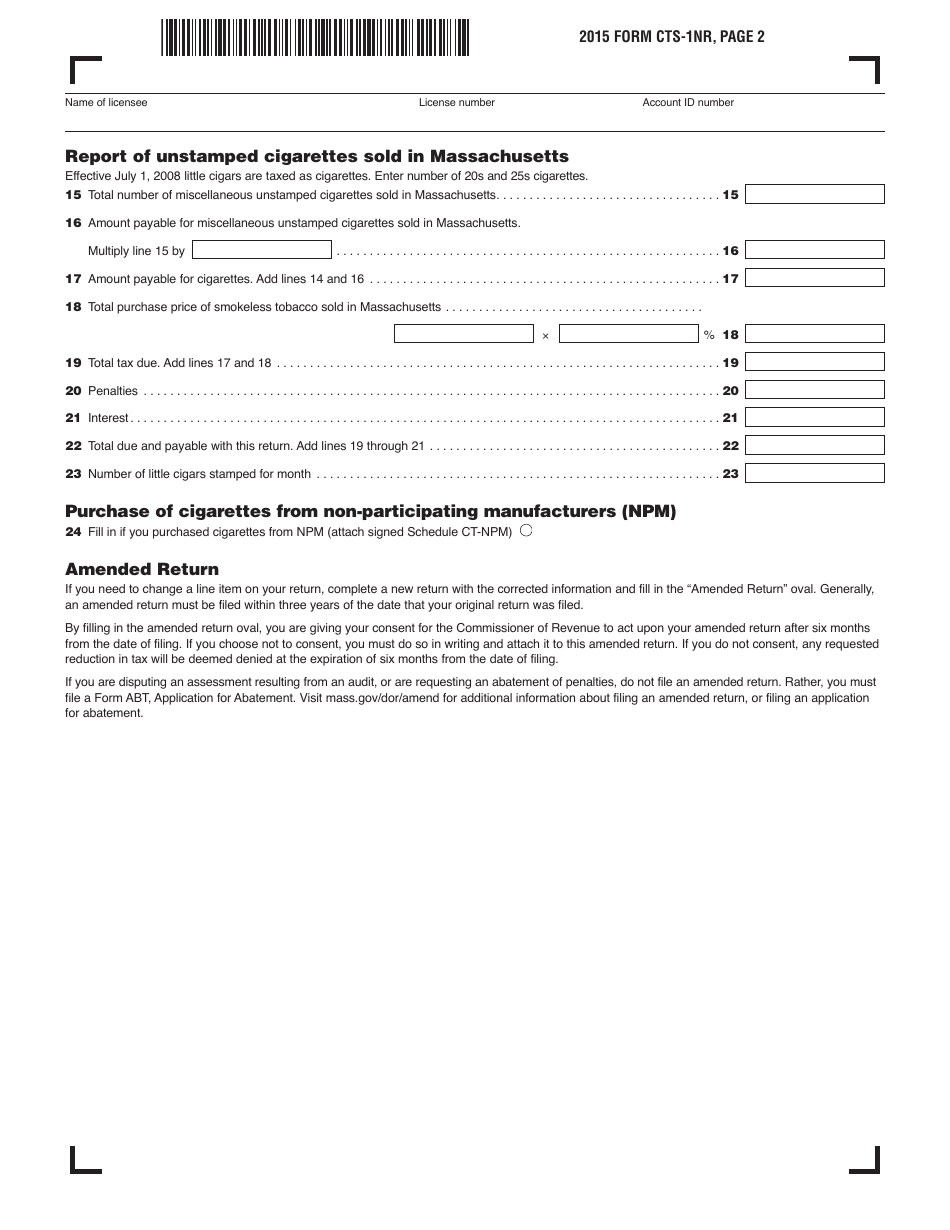

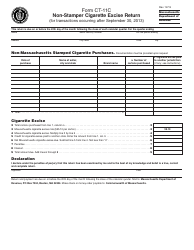

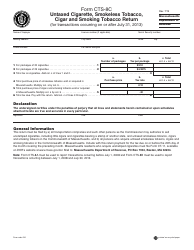

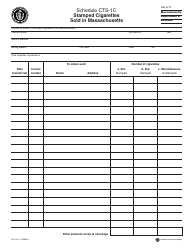

Form CTS-1NR Non-resident Stamper's Monthly Tax Stamp and Cigarette Return - Massachusetts

What Is Form CTS-1NR?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CTS-1NR?

A: Form CTS-1NR is the Non-resident Stamper's Monthly Tax Stamp and Cigarette Return.

Q: Who is required to file Form CTS-1NR?

A: Non-resident cigarette stampers are required to file Form CTS-1NR.

Q: What is the purpose of Form CTS-1NR?

A: The purpose of Form CTS-1NR is to report and pay the monthly cigarette tax liability for non-resident cigarette stampers in Massachusetts.

Q: How often should Form CTS-1NR be filed?

A: Form CTS-1NR should be filed monthly.

Q: Is Form CTS-1NR only for non-residents?

A: Yes, Form CTS-1NR is specifically for non-resident cigarette stampers.

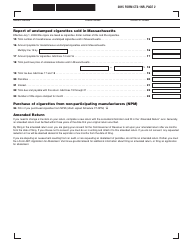

Q: What information is required on Form CTS-1NR?

A: Form CTS-1NR requires information such as the total number of cigarettes stamped, total tax due, and the non-resident stamper's contact information.

Q: Is there a deadline for filing Form CTS-1NR?

A: Yes, Form CTS-1NR must be filed and the tax payment must be made on or before the 20th day of the month following the month being reported.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CTS-1NR by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.