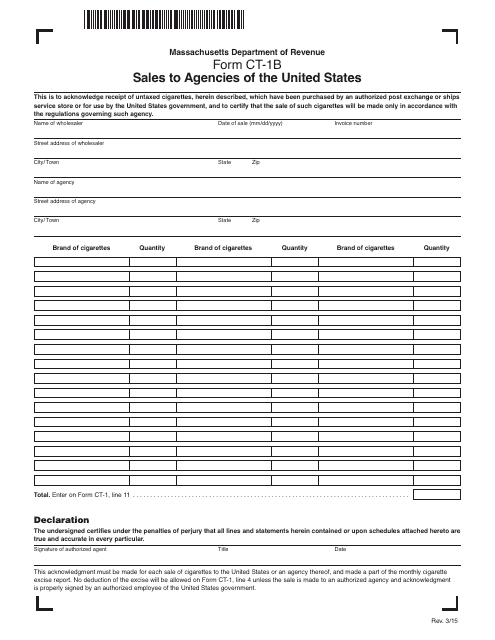

Form CT-1B Sales to Agencies of the United States - Massachusetts

What Is Form CT-1B?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1B?

A: Form CT-1B is a tax form used in Massachusetts for reporting sales to agencies of the United States.

Q: Who should file Form CT-1B?

A: Businesses in Massachusetts that make sales to agencies of the United States should file Form CT-1B.

Q: What is the purpose of filing Form CT-1B?

A: The purpose of filing Form CT-1B is to report and pay taxes on sales made to agencies of the United States.

Q: What is the due date for filing Form CT-1B?

A: Form CT-1B must be filed by the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form CT-1B?

A: Yes, there are penalties for late filing of Form CT-1B, including interest and late payment penalties.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1B by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.