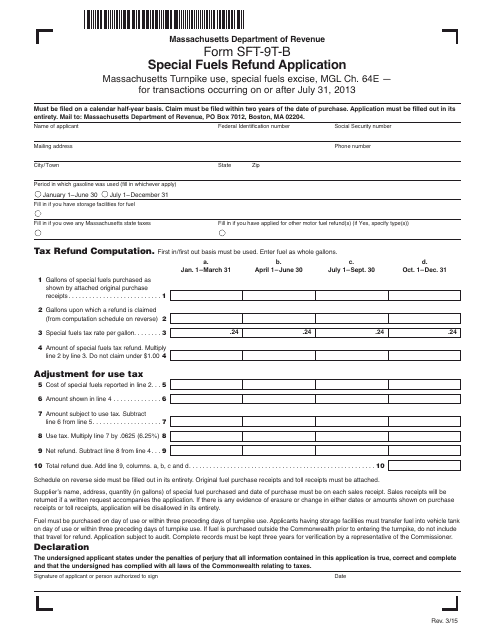

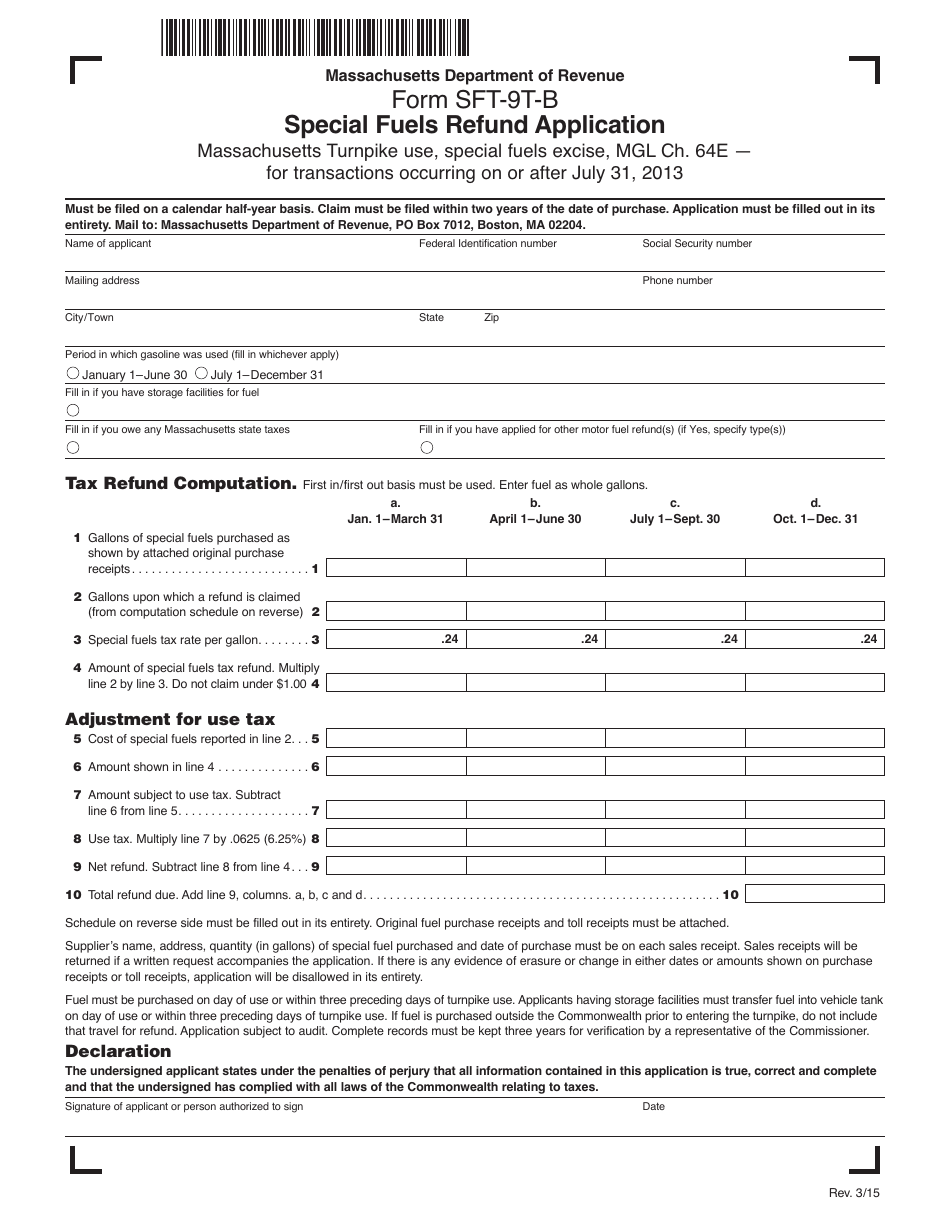

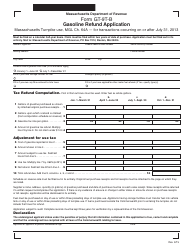

Form SFT-9T-B Special Fuels Refund Application - Massachusetts

What Is Form SFT-9T-B?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFT-9T-B?

A: Form SFT-9T-B is the Special Fuels Refund Application for Massachusetts.

Q: Who can use Form SFT-9T-B?

A: Any person or entity who purchased special fuels for non-highway use in Massachusetts may use Form SFT-9T-B to apply for a refund.

Q: What are special fuels?

A: Special fuels include gasoline, diesel fuel, compressed natural gas (CNG), liquefied petroleum gas (LPG), and other fuels used to power motor vehicles or equipment.

Q: What is the purpose of the refund?

A: The purpose of the refund is to reimburse the purchaser for the state fuel excise tax paid on special fuels used for non-highway purposes.

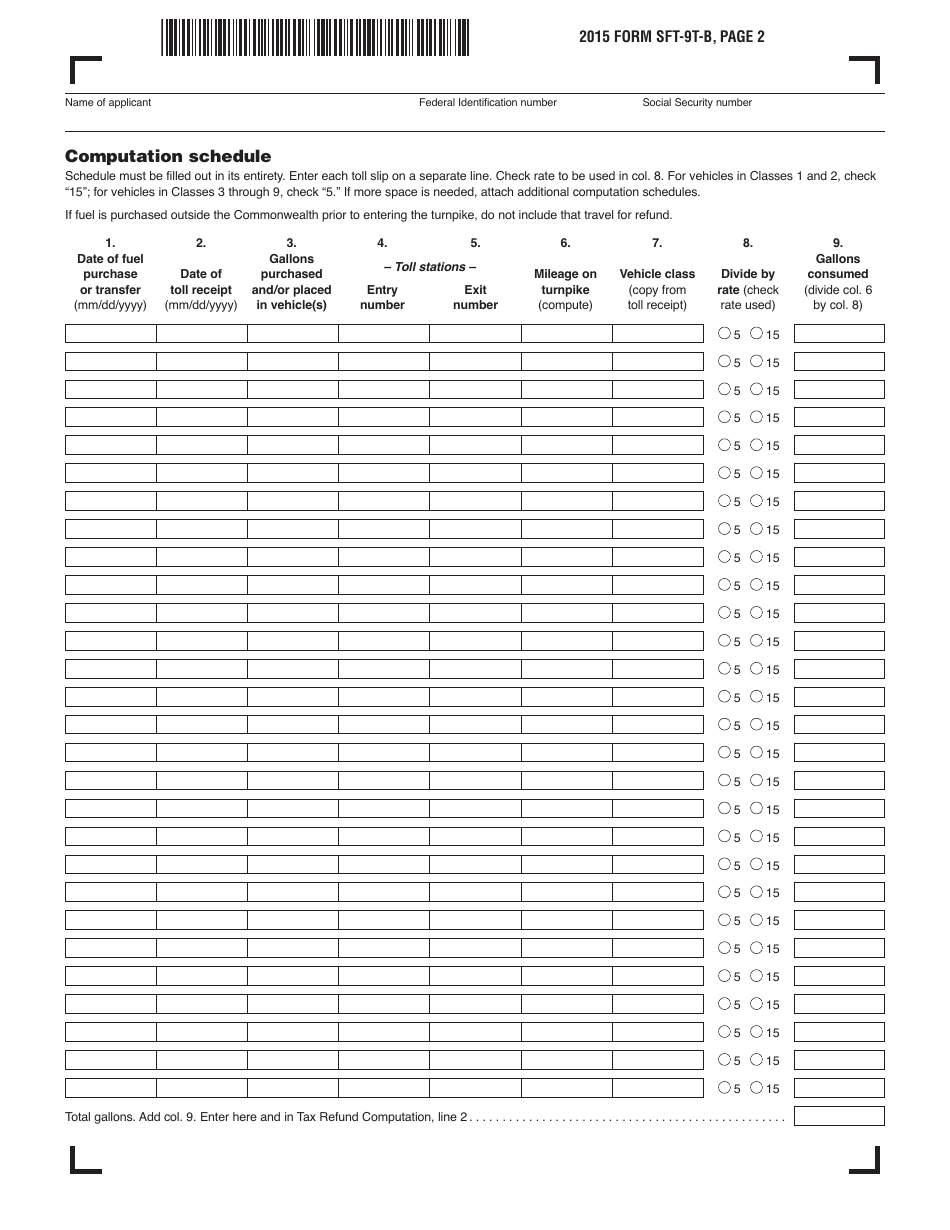

Q: What information is required on Form SFT-9T-B?

A: Form SFT-9T-B requires information such as the purchaser's name, address, date of purchase, quantity of fuel purchased, and documentation of the tax paid.

Q: When should I file Form SFT-9T-B?

A: Form SFT-9T-B should be filed annually, no later than three years from the end of the calendar year in which the fuel was purchased.

Q: What supporting documentation should I include with Form SFT-9T-B?

A: Supporting documentation may include invoices or receipts showing the purchase of special fuels and documentation of the state fuel excise tax paid.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFT-9T-B by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.