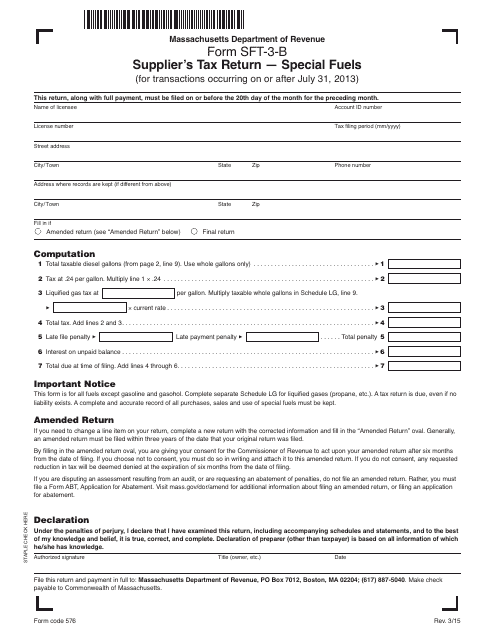

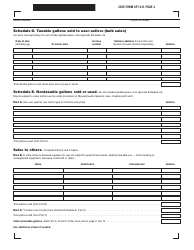

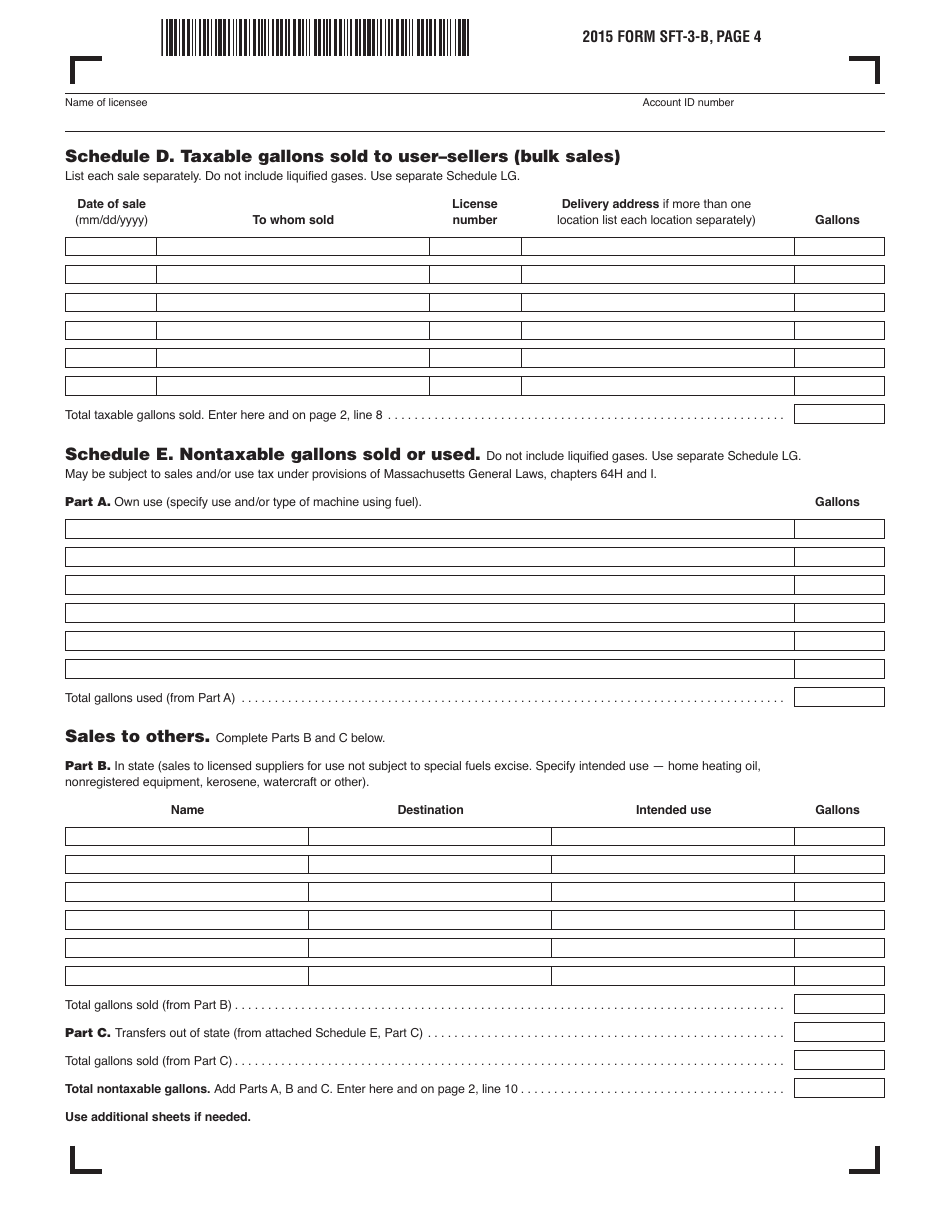

Form SFT-3-B Supplier's Tax Return - Special Fuels - Massachusetts

What Is Form SFT-3-B?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFT-3-B?

A: Form SFT-3-B is the Supplier's Tax Return for reporting special fuels in Massachusetts.

Q: Who needs to file Form SFT-3-B?

A: Suppliers of special fuels in Massachusetts need to file Form SFT-3-B.

Q: What are special fuels?

A: Special fuels refer to certain types of fuel, such as diesel fuel or natural gas, used in specific applications.

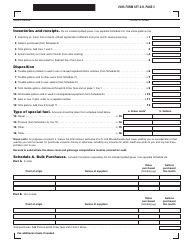

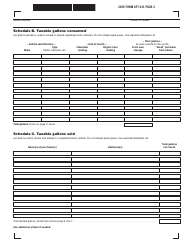

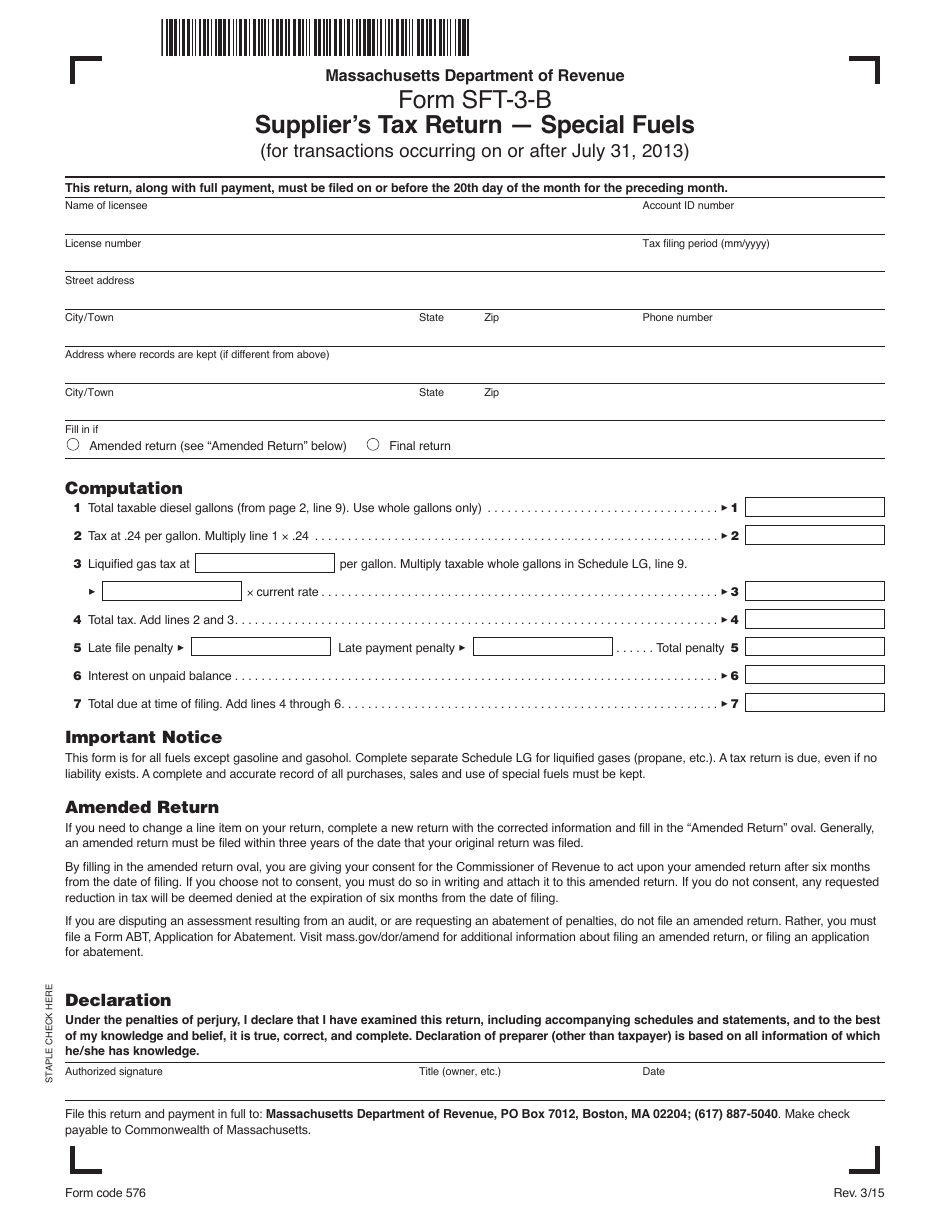

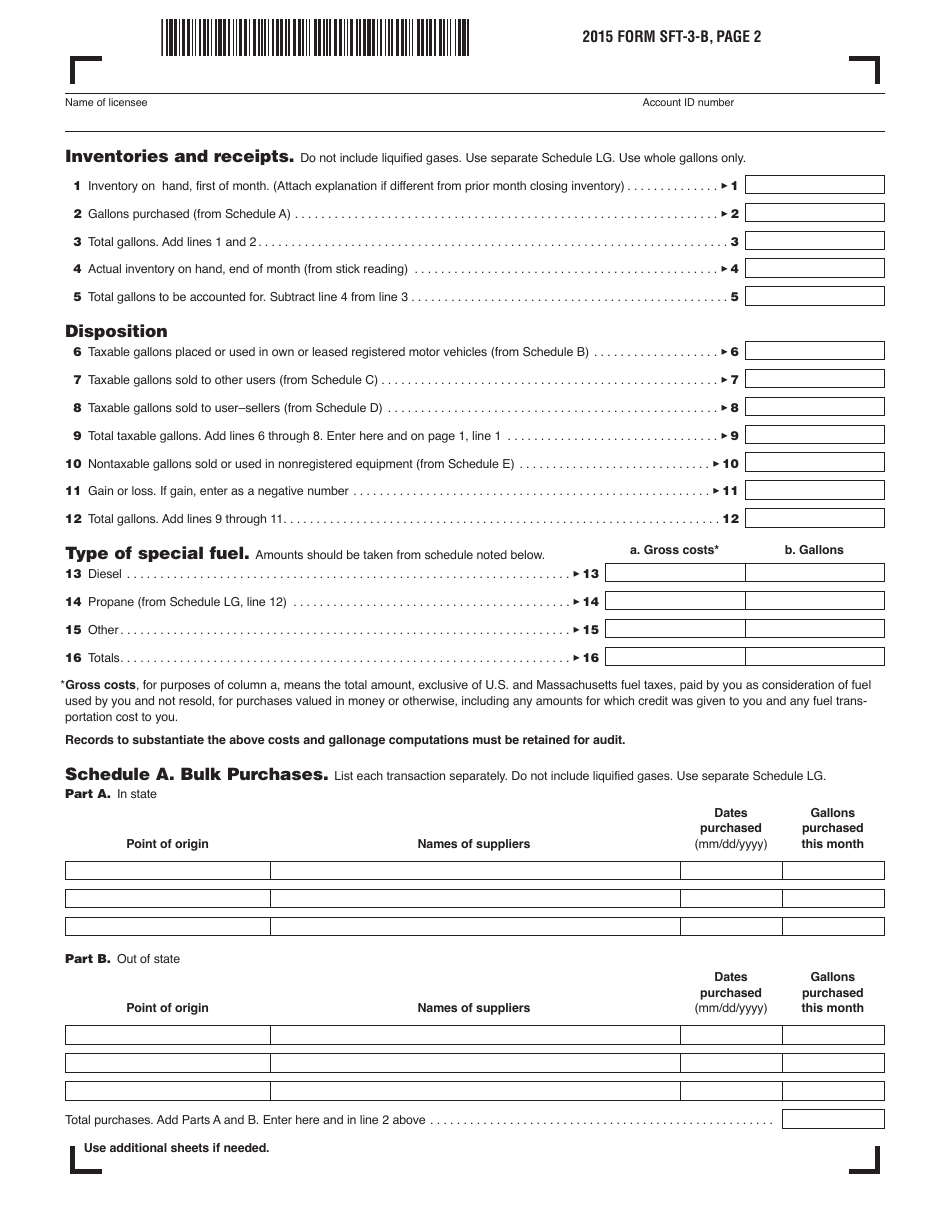

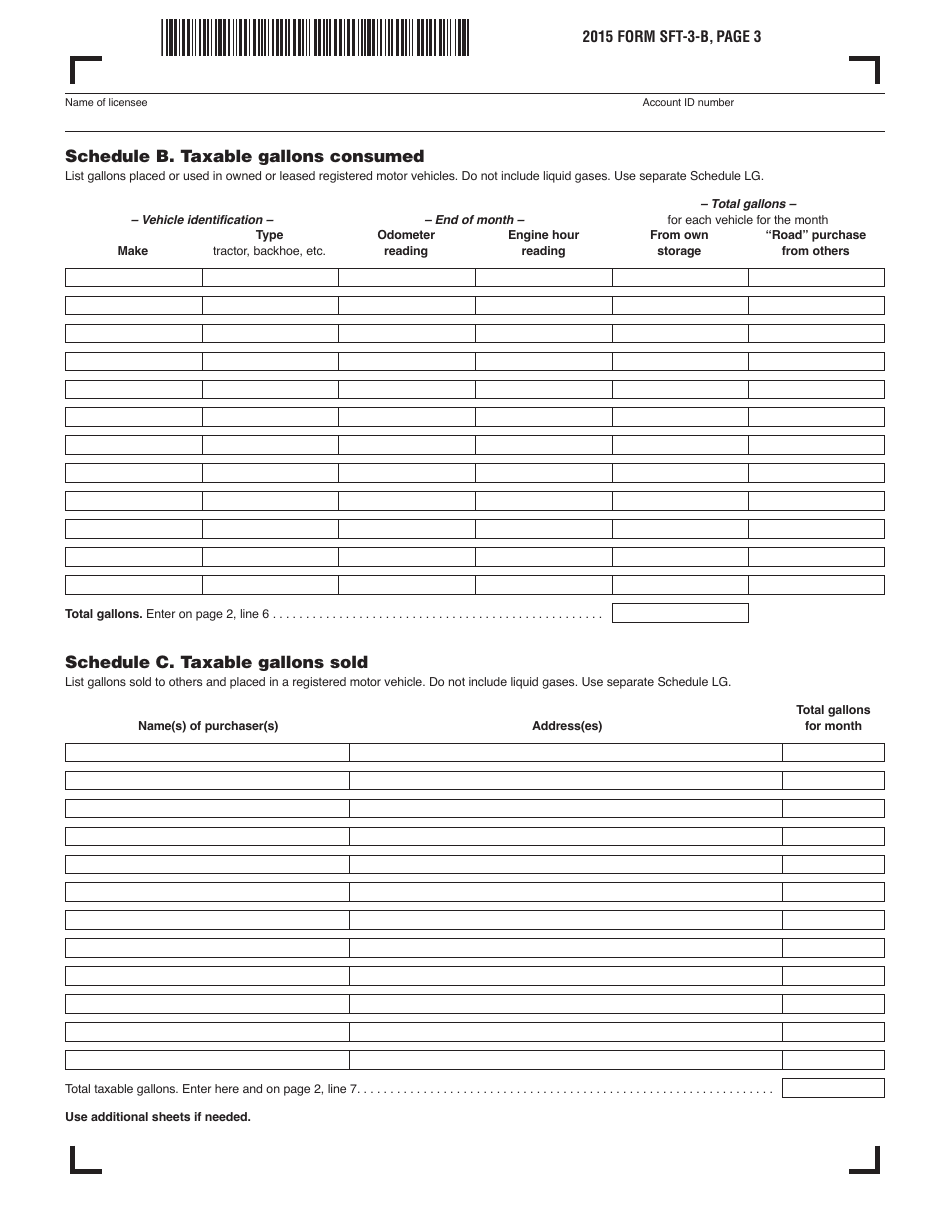

Q: What information is required on Form SFT-3-B?

A: Form SFT-3-B requires information about the amount of special fuels sold, the tax due, and other related information.

Q: When is Form SFT-3-B due?

A: Form SFT-3-B is due on a quarterly basis, with the due dates being April 30th, July 31st, October 31st, and January 31st.

Q: What happens if I don't file Form SFT-3-B?

A: Failure to file Form SFT-3-B or timely payment of the tax due may result in penalties and interest charges.

Q: Are there any exemptions or deductions available?

A: Yes, there are exemptions and deductions available for certain types of special fuels. Details can be found in the instructions for Form SFT-3-B.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFT-3-B by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.