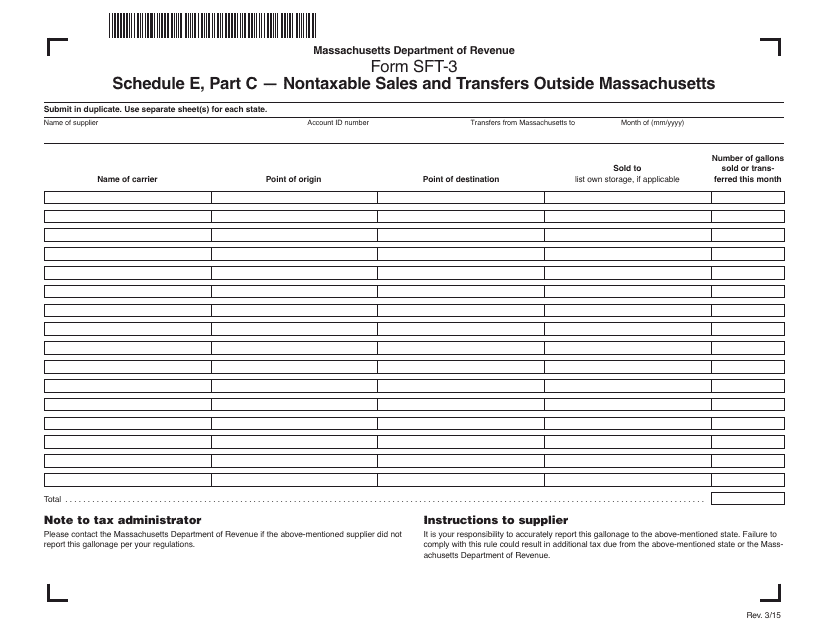

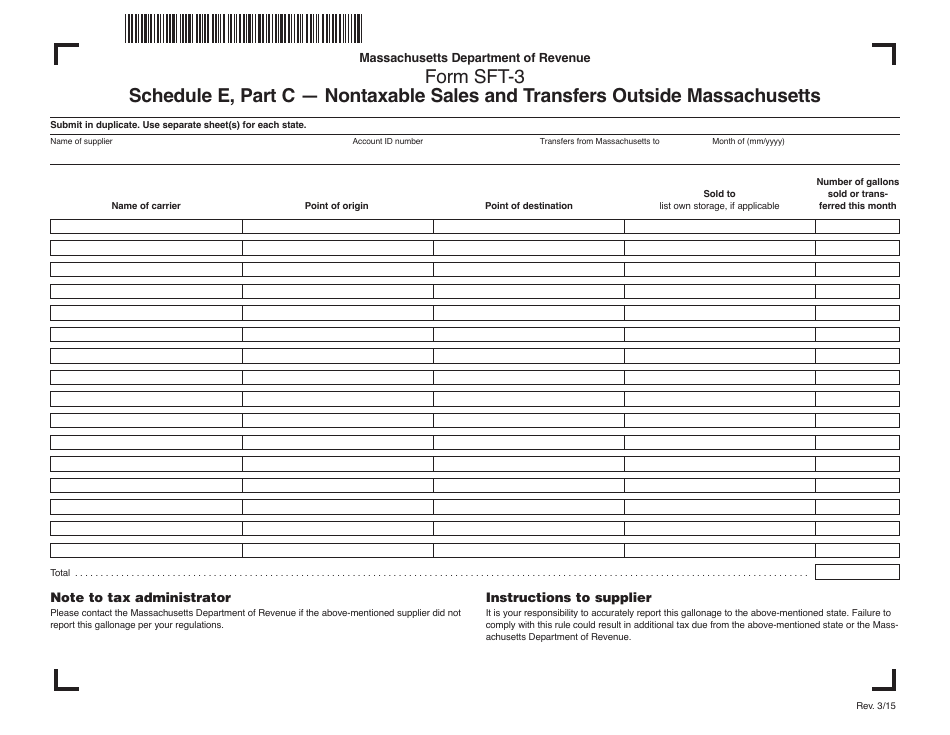

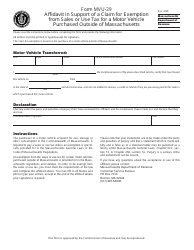

Form SFT-3 Schedule E Nontaxable Sales and Transfers Outside Massachusetts - Massachusetts

What Is Form SFT-3 Schedule E?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFT-3?

A: Form SFT-3 is a tax form used in Massachusetts.

Q: What is Schedule E?

A: Schedule E is a section of Form SFT-3.

Q: What are nontaxable sales and transfers?

A: Nontaxable sales and transfers refer to transactions that are not subject to sales tax.

Q: What does 'outside Massachusetts' mean in Schedule E?

A: 'Outside Massachusetts' refers to sales and transfers that occur outside the state of Massachusetts.

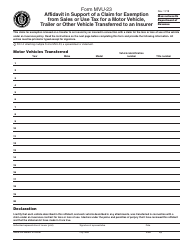

Q: What information is required in Schedule E?

A: Schedule E requires details about nontaxable sales and transfers outside Massachusetts, including the date, description, and amount of each transaction.

Q: Who needs to fill out Form SFT-3 Schedule E?

A: Individuals or businesses engaged in nontaxable sales and transfers outside Massachusetts need to fill out Form SFT-3 Schedule E.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFT-3 Schedule E by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.