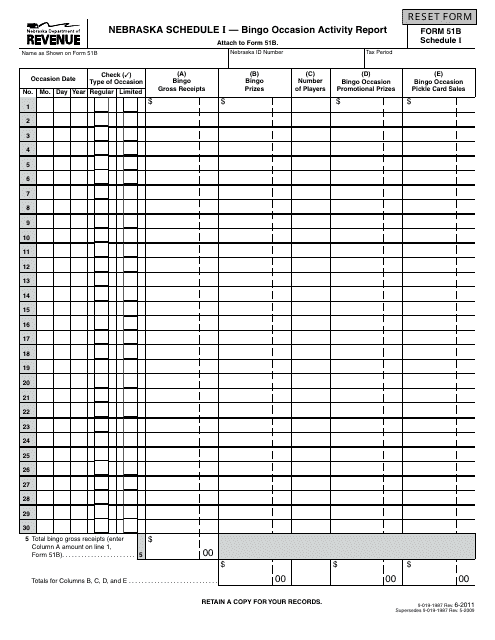

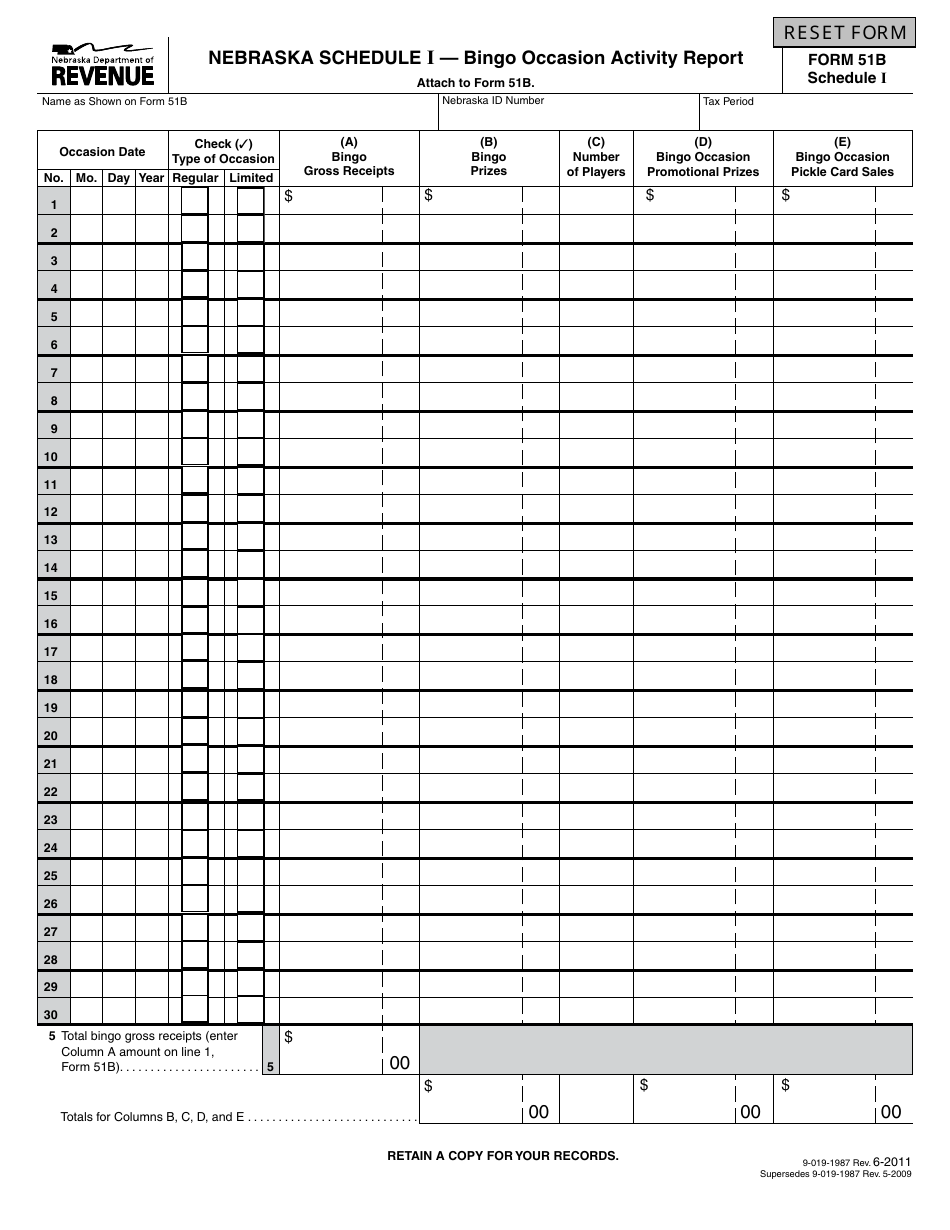

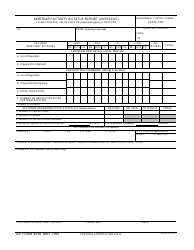

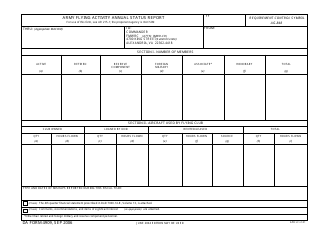

Form 51B Schedule I Bingo Occasion Activity Report - Nebraska

What Is Form 51B Schedule I?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 51B, Nebraska Bingo Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51B Schedule I?

A: Form 51B Schedule I is a report used in Nebraska to document bingo occasion activity.

Q: What is a bingo occasion activity?

A: A bingo occasion activity refers to any event or session where bingo games are played.

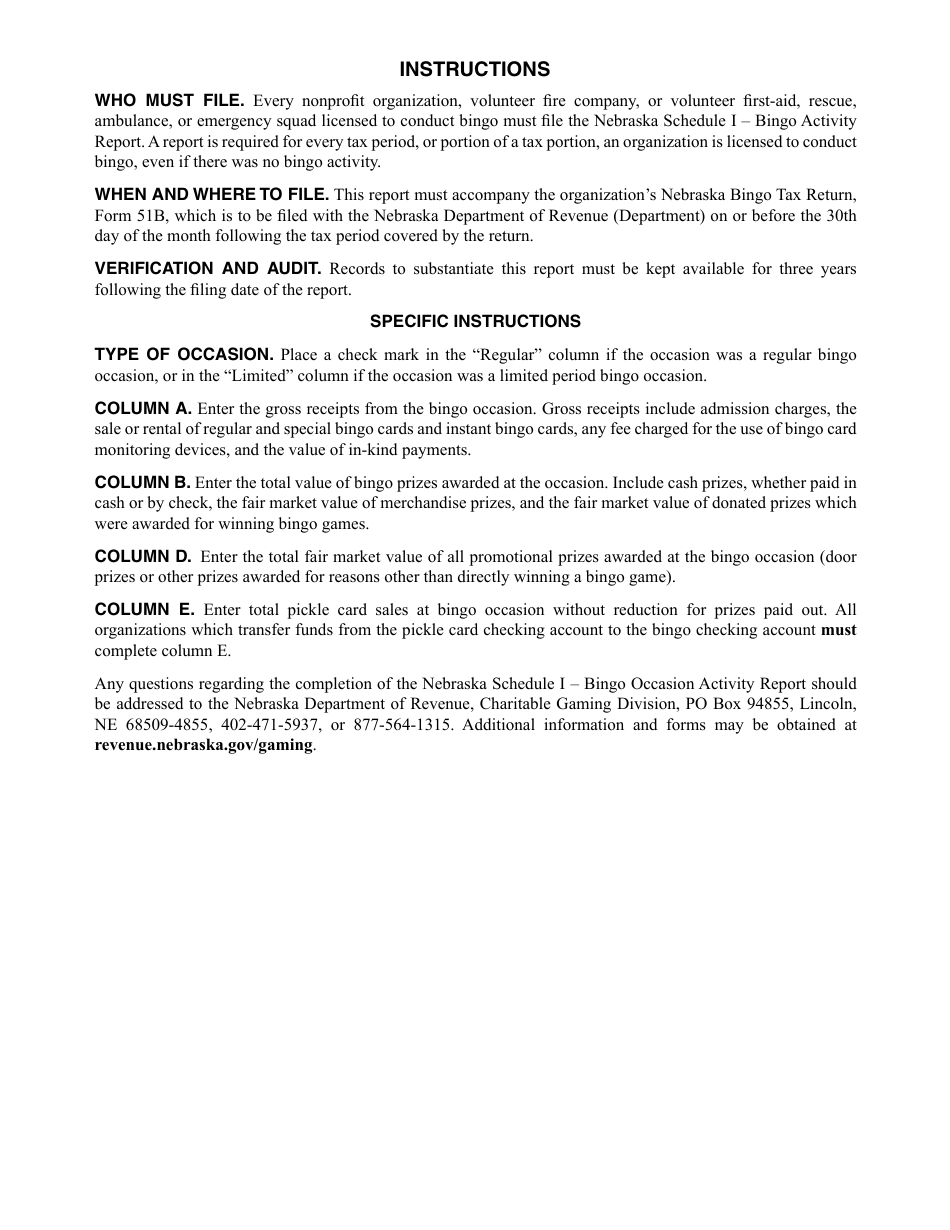

Q: Who needs to file Form 51B Schedule I?

A: Any organization or entity that conducts bingo games in Nebraska is required to file this form.

Q: What information is required on Form 51B Schedule I?

A: The form requires details about the bingo occasion, including the date, location, number of games played, and total receipts.

Q: Is there a deadline for filing Form 51B Schedule I?

A: Yes, the form must be filed within 10 days after the end of the month in which the bingo occasion occurred.

Q: What happens if I don't file Form 51B Schedule I?

A: Failure to file the form or providing false information may result in penalties or legal consequences.

Q: Are there any fees associated with filing Form 51B Schedule I?

A: There are no fees associated with filing this form.

Q: Who can I contact for more information about Form 51B Schedule I?

A: For more information or assistance, you can contact the Nebraska Department of Revenue.

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 51B Schedule I by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.