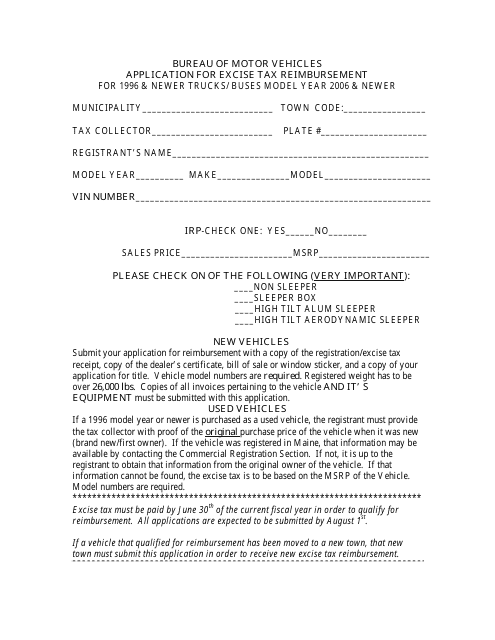

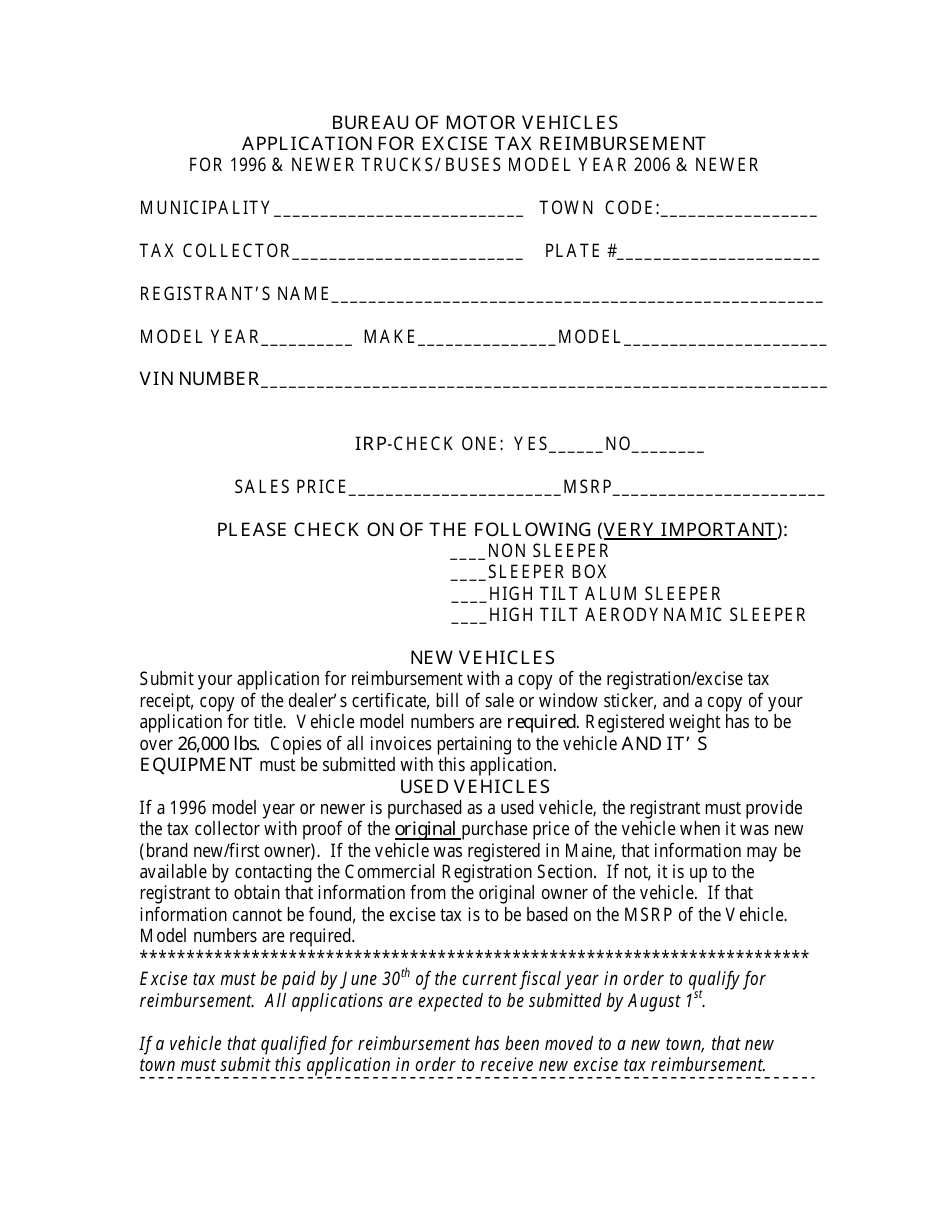

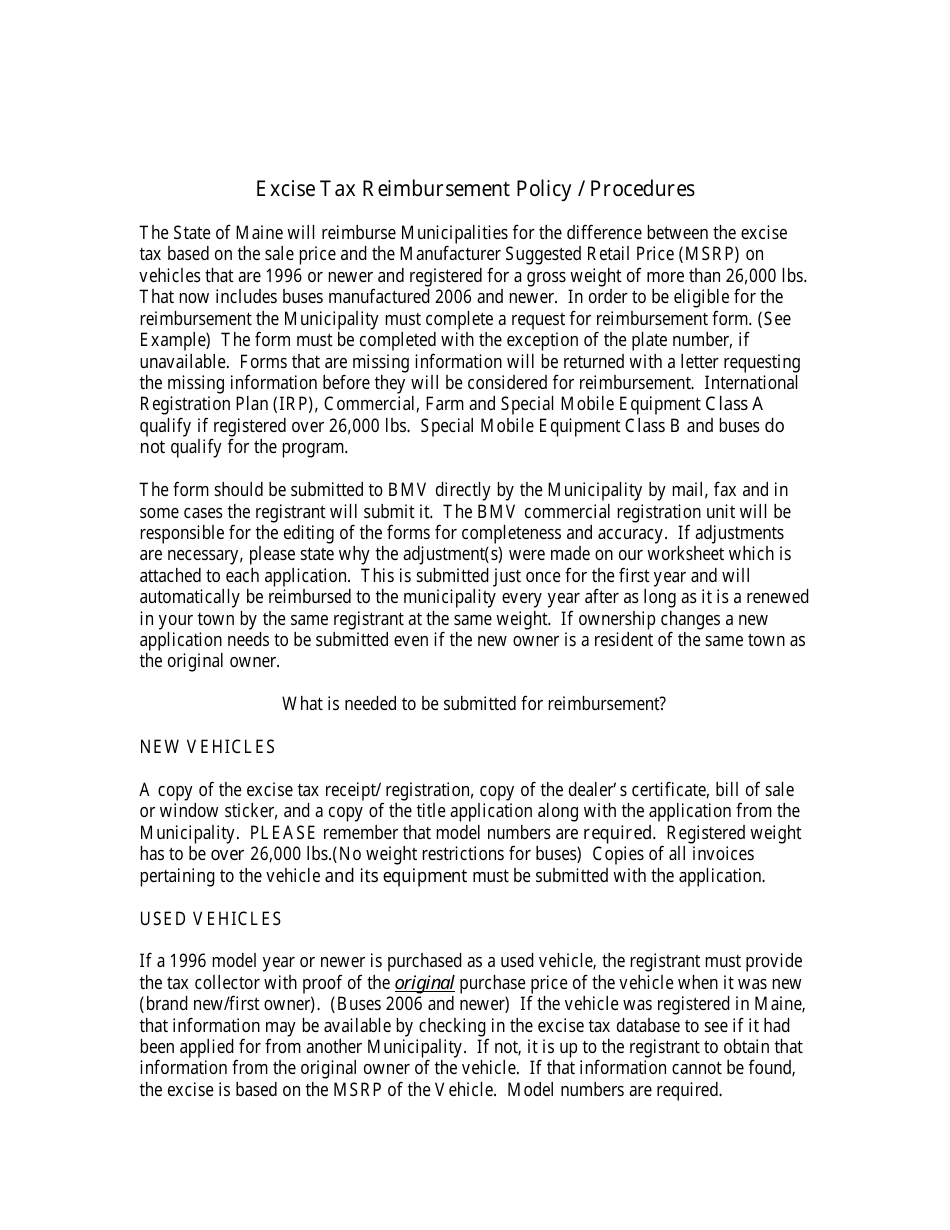

Application for Excise Tax Reimbursement - Maine

Application for Excise Tax Reimbursement is a legal document that was released by the Maine Department of the Secretary of State - a government authority operating within Maine.

FAQ

Q: What is an Excise Tax Reimbursement?

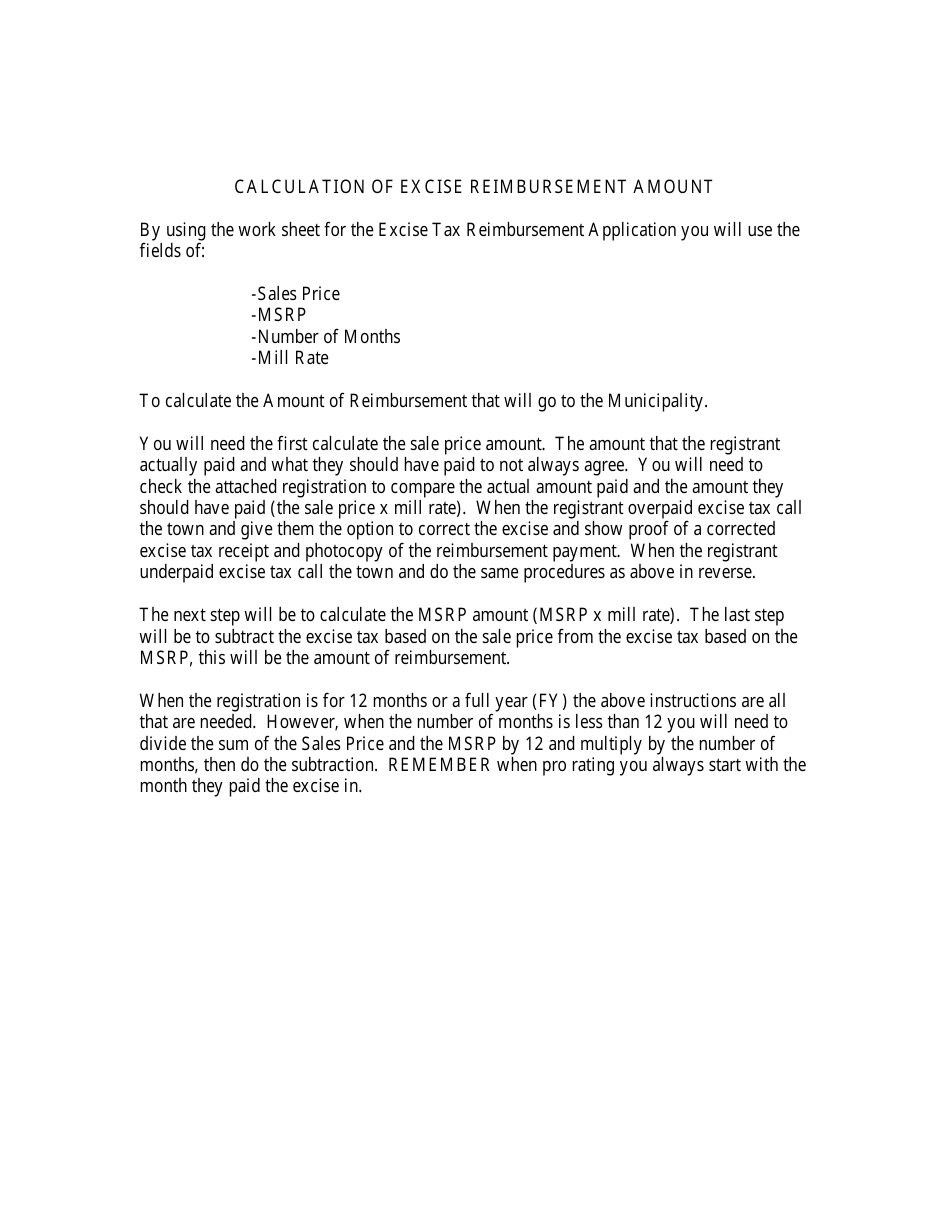

A: Excise Tax Reimbursement is a process through which individuals can request a refund for certain taxes they paid on items such as fuel, vehicles, or specific goods.

Q: Who is eligible for Excise Tax Reimbursement in Maine?

A: Eligibility for Excise Tax Reimbursement in Maine depends on the specific program or tax exemption for which you are applying. Generally, residents who meet certain criteria, such as low income or specific occupations, may be eligible.

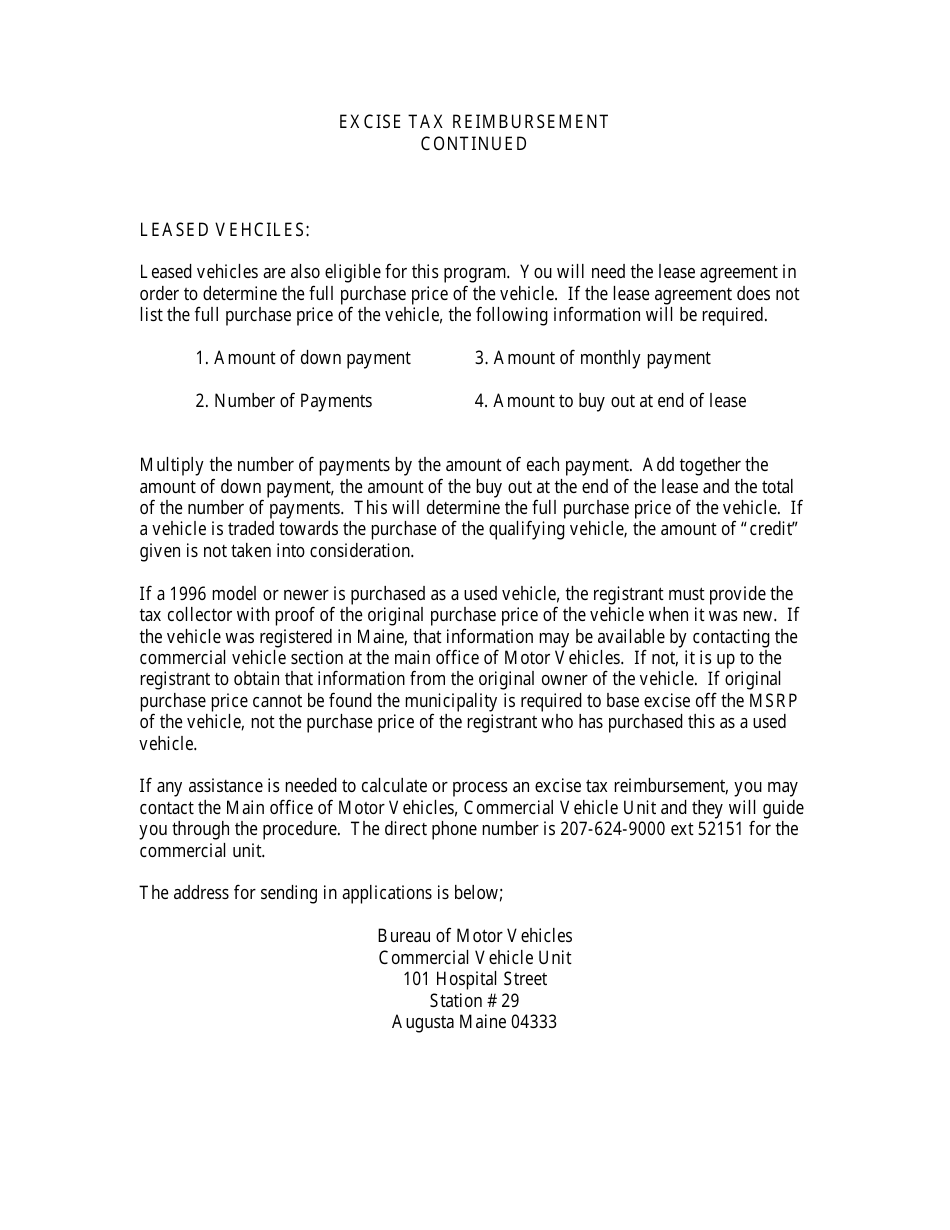

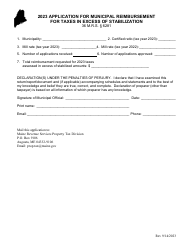

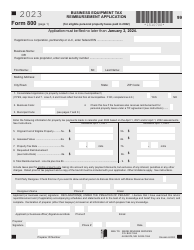

Q: How can I apply for Excise Tax Reimbursement in Maine?

A: To apply for Excise Tax Reimbursement in Maine, you need to fill out an application form provided by the state government. This form typically requires information about your income, expenses, and the specific tax you are seeking reimbursement for.

Q: What types of taxes can I seek reimbursement for in Maine?

A: In Maine, you may be able to seek reimbursement for excise taxes paid on items such as fuel, motor vehicles, recreational vehicles, and certain goods that are subject to excise tax.

Q: Are there any deadlines for applying for Excise Tax Reimbursement in Maine?

A: Yes, there are usually deadlines for applying for Excise Tax Reimbursement in Maine. These deadlines vary depending on the specific reimbursement program or tax exemption you are seeking. It is important to check the specific requirements and deadlines for the program you are applying for.

Form Details:

- The latest edition currently provided by the Maine Department of the Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of the Secretary of State.