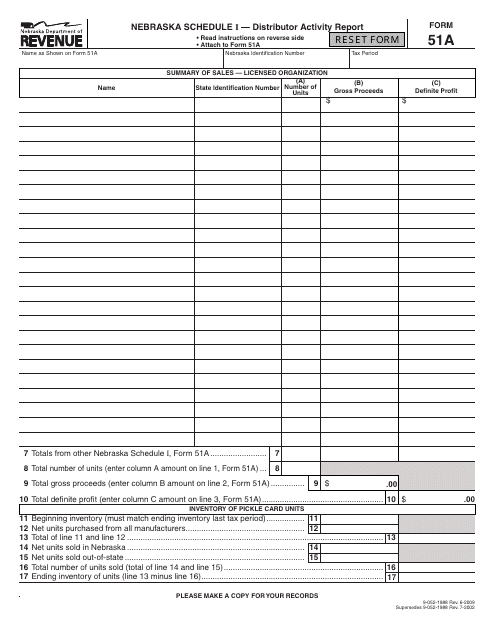

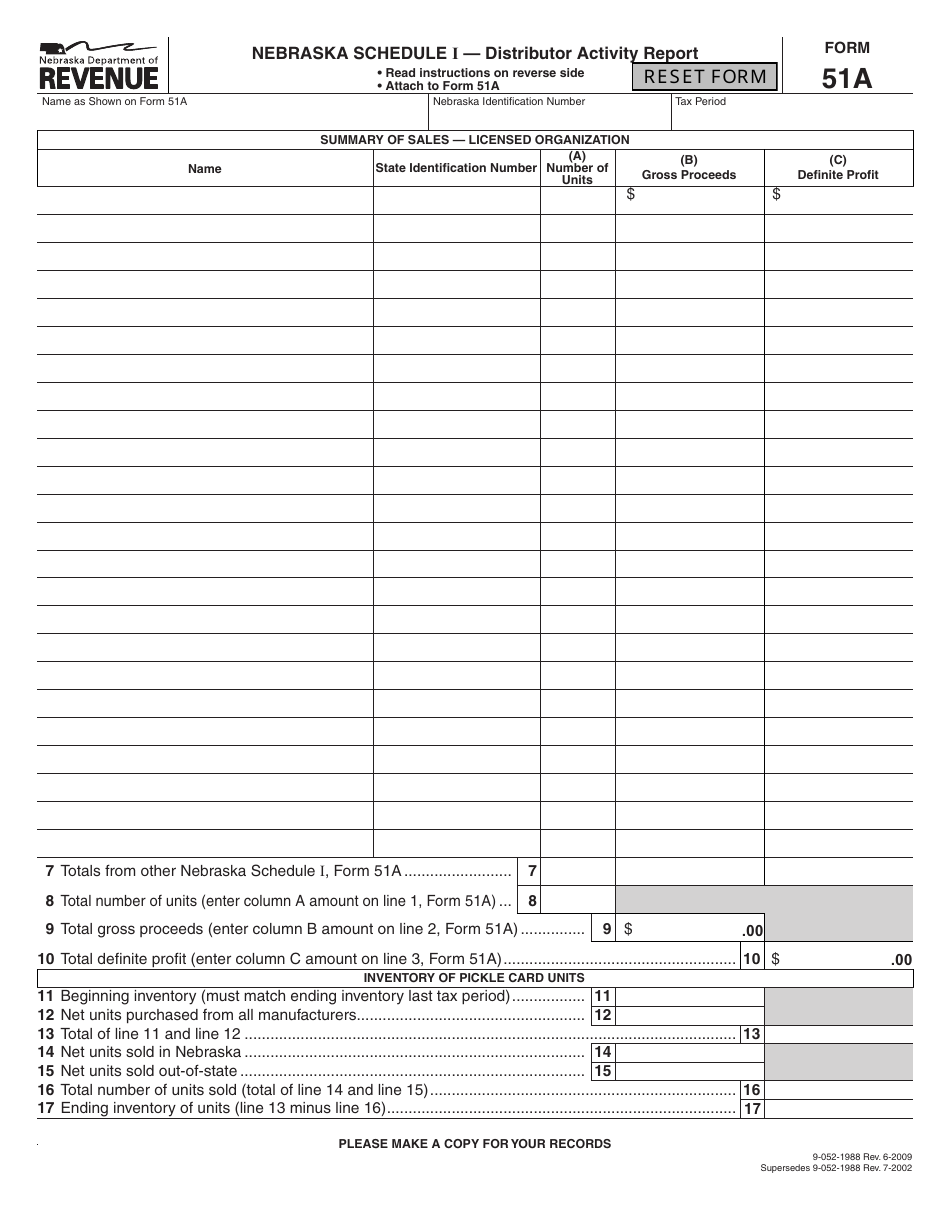

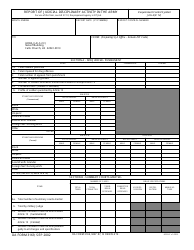

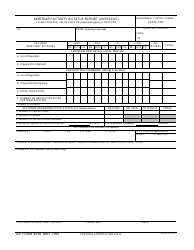

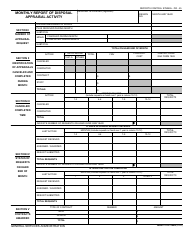

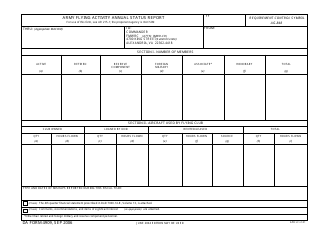

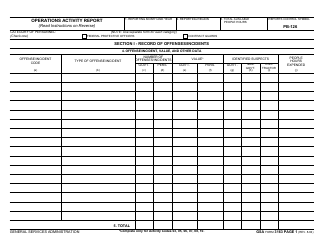

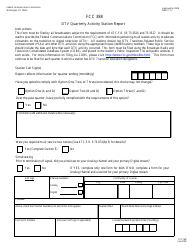

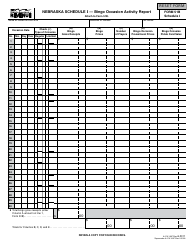

Form 51A Schedule I Distributor Activity Report - Nebraska

What Is Form 51A Schedule I?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 51A, Nebraska Distributor of Pickle Cards Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A Schedule I?

A: Form 51A Schedule I is a Distributor Activity Report used in Nebraska.

Q: Who needs to file Form 51A Schedule I?

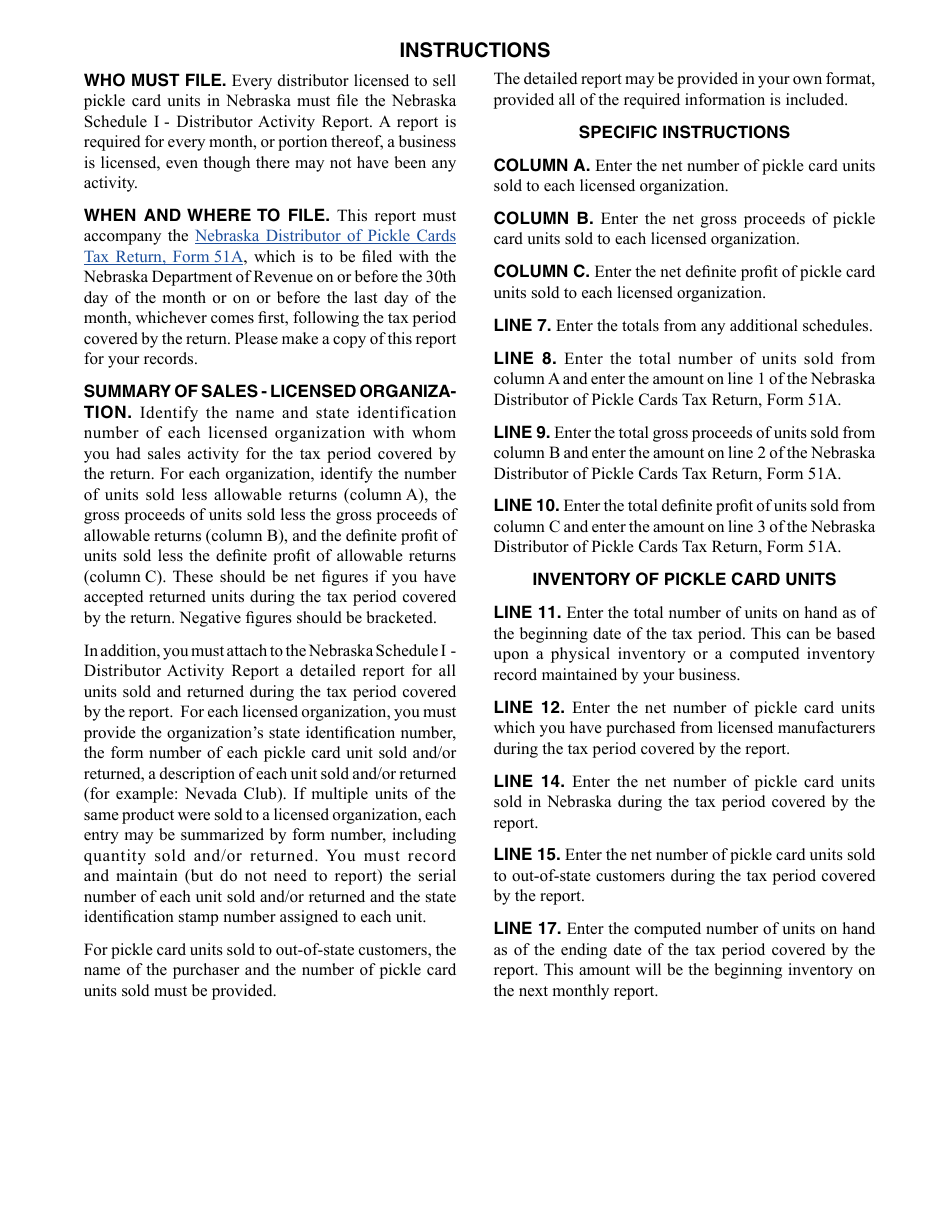

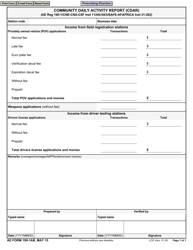

A: Distributors in Nebraska who engage in certain activities need to file Form 51A Schedule I.

Q: What activities does Form 51A Schedule I cover?

A: Form 51A Schedule I covers activities such as wholesale distribution of tobacco products and vapor products.

Q: When is the due date for filing Form 51A Schedule I?

A: The due date for filing Form 51A Schedule I varies depending on the reporting period. Check the instructions for specific due dates.

Q: Are there any penalties for not filing Form 51A Schedule I?

A: Yes, failure to file Form 51A Schedule I or filing it late may result in penalties and interest.

Q: Can I file Form 51A Schedule I electronically?

A: Yes, Nebraska Department of Revenue allows electronic filing of Form 51A Schedule I.

Form Details:

- Released on June 1, 2009;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 51A Schedule I by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.