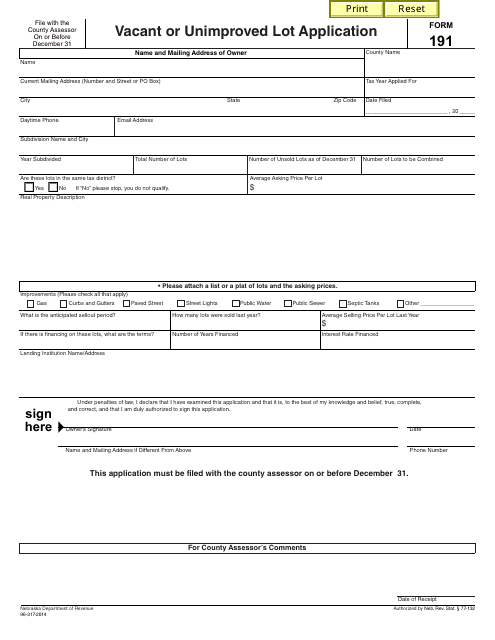

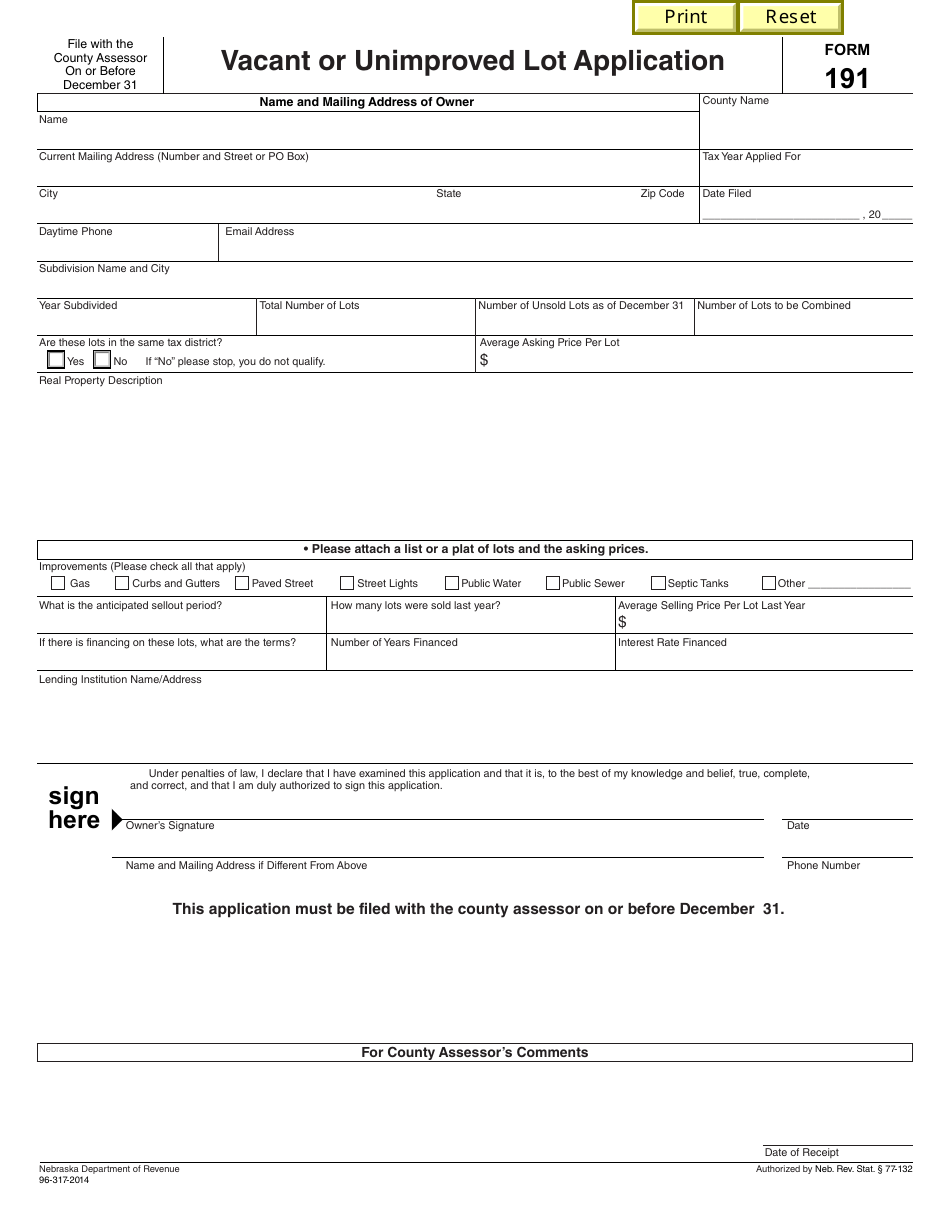

Form 191 Vacant or Unimproved Lot Application - Nebraska

What Is Form 191?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 191?

A: Form 191 is the Vacant or Unimproved Lot Application in Nebraska.

Q: What is the purpose of Form 191?

A: Form 191 is used to apply for a reduced valuation of vacant or unimproved lots in Nebraska.

Q: Who needs to fill out Form 191?

A: Property owners in Nebraska with vacant or unimproved lots are required to fill out Form 191.

Q: What is the benefit of filling out Form 191?

A: Filling out Form 191 may result in a reduced valuation of your vacant or unimproved lot, which can lead to lower property taxes.

Q: Is there a deadline for submitting Form 191?

A: Yes, Form 191 must be submitted to the county assessor by July 1st of each year.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 191 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.