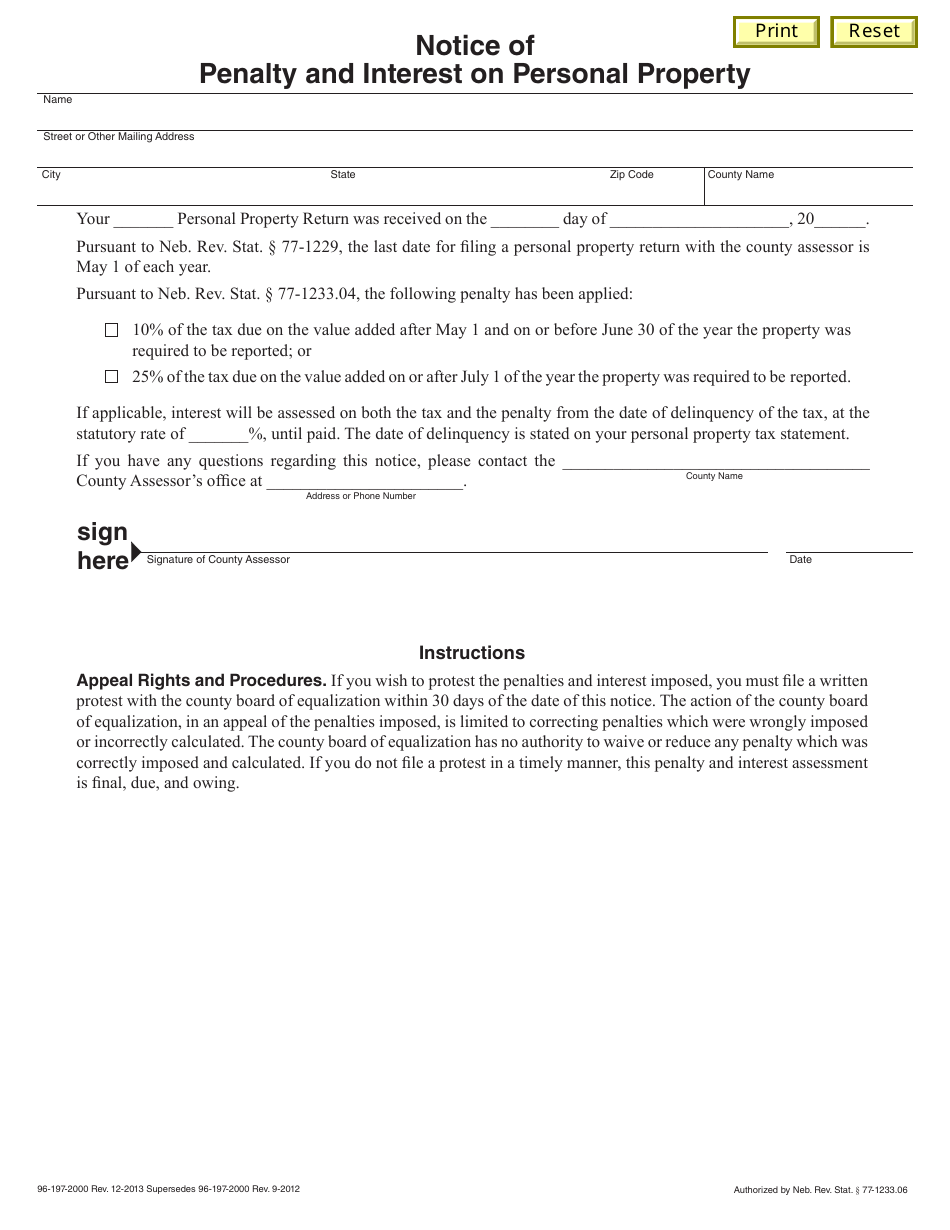

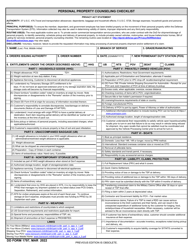

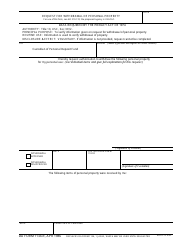

Notice of Penalty and Interest on Personal Property - Nebraska

Notice of Penalty and Interest on Personal Property is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

Q: What is a Notice of Penalty and Interest on Personal Property?

A: A Notice of Penalty and Interest on Personal Property is a notice sent by the state of Nebraska to inform individuals that they owe penalties and interest on their personal property taxes.

Q: Why am I receiving this notice?

A: You are receiving this notice because you have unpaid personal property taxes, and penalties and interest have been added to the amount owed.

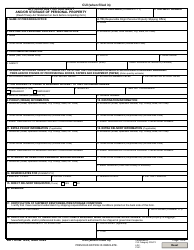

Q: What is personal property?

A: Personal property refers to any movable property that is not real estate, such as vehicles, boats, furniture, and business equipment.

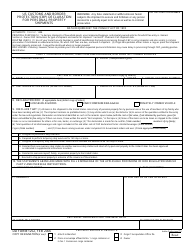

Q: How are penalties and interest calculated?

A: Penalties and interest are typically calculated based on the amount of unpaid taxes and the length of time they have been delinquent.

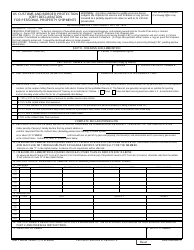

Q: What should I do if I receive a Notice of Penalty and Interest on Personal Property?

A: If you receive this notice, you should review the information and make arrangements to pay the outstanding amount as soon as possible to avoid further penalties and interest.

Q: What happens if I don't pay the amount owed?

A: If you do not pay the amount owed, the state of Nebraska may take further collection actions, such as placing a lien on your property or garnishing your wages.

Q: How can I resolve the issue?

A: To resolve the issue, you can contact the Nebraska Department of Revenue or the county treasurer's office to discuss payment options and potential payment plans.

Q: Can I dispute the penalties and interest?

A: You may be able to dispute the penalties and interest if you believe they have been incorrectly applied. Contact the Nebraska Department of Revenue or the county treasurer's office for more information on the dispute process.

Q: Is there a deadline to pay the amount owed?

A: There may be a deadline to pay the amount owed to avoid further collection actions. It is important to contact the Nebraska Department of Revenue or the county treasurer's office to determine the deadline.

Q: Can I set up a payment plan?

A: You may be able to set up a payment plan to pay the amount owed over time. Contact the Nebraska Department of Revenue or the county treasurer's office to discuss payment plan options.

Form Details:

- Released on December 1, 2013;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.