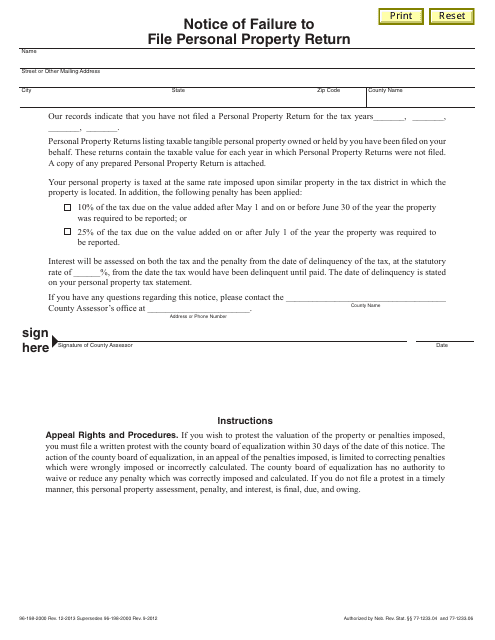

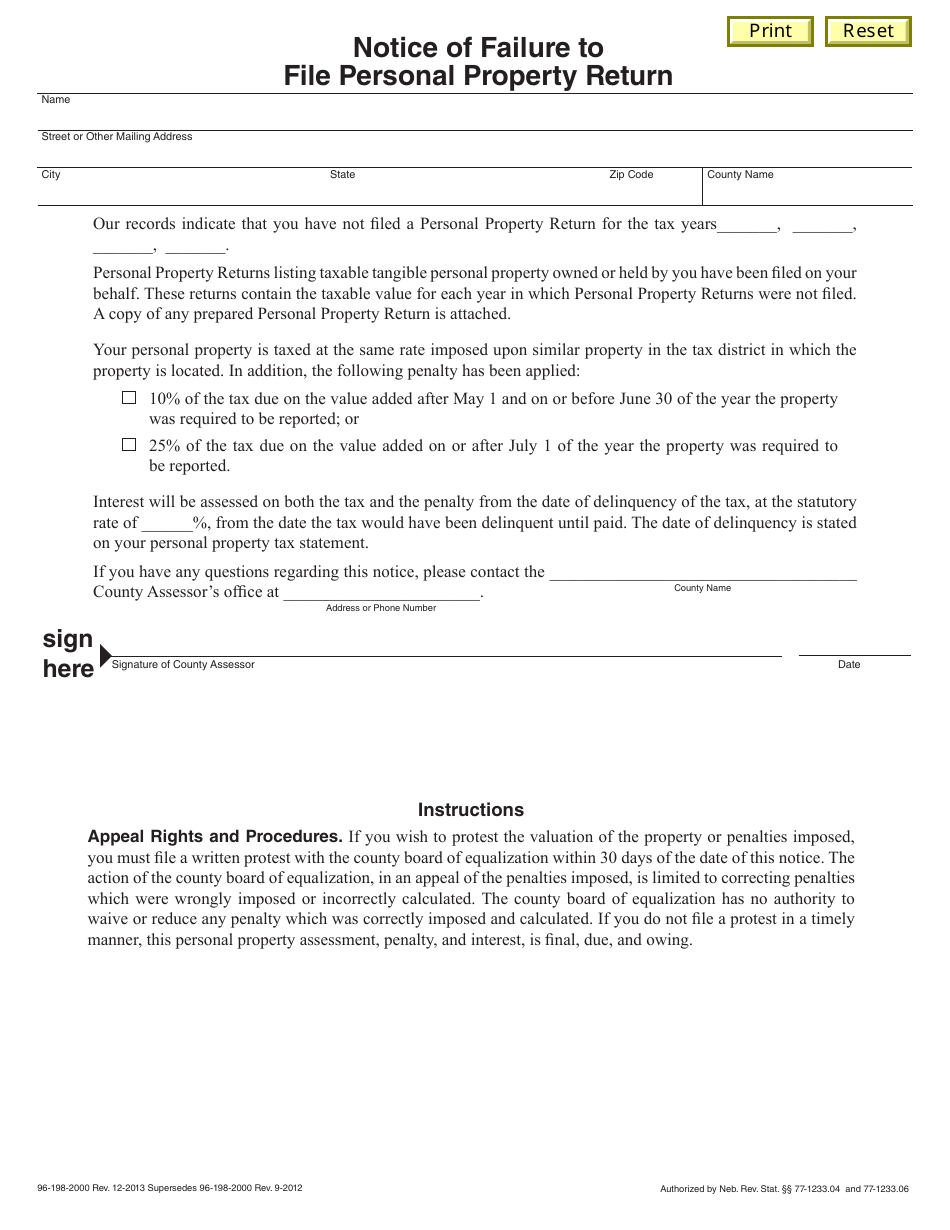

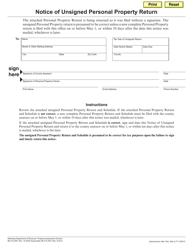

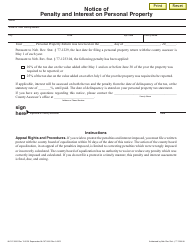

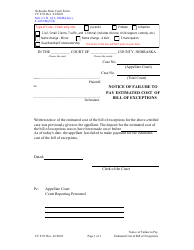

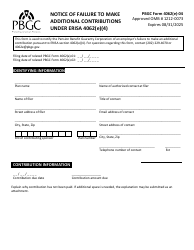

Notice of Failure to File Personal Property Return - Nebraska

Notice of Failure to File Personal Property Return is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

Q: What is a Notice of Failure to File Personal Property Return?

A: A Notice of Failure to File Personal Property Return is a notification sent to individuals or businesses in Nebraska who have failed to submit their personal property return to the county assessor by the specified deadline.

Q: Who receives a Notice of Failure to File Personal Property Return in Nebraska?

A: Individuals or businesses in Nebraska who have failed to submit their personal property return to the county assessor by the specified deadline receive a Notice of Failure to File Personal Property Return.

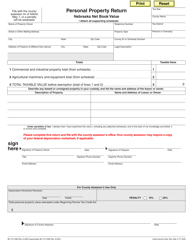

Q: What is a personal property return?

A: A personal property return is a form used to report personal property, such as business equipment, machinery, and vehicles, to the county assessor for tax assessment purposes.

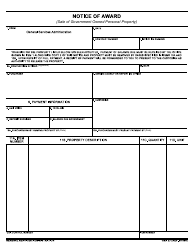

Q: What should I do if I receive a Notice of Failure to File Personal Property Return?

A: If you receive a Notice of Failure to File Personal Property Return, you should promptly file your personal property return with the county assessor and ensure that it is received by the specified deadline.

Q: What are the consequences of failing to file a personal property return in Nebraska?

A: Failure to file a personal property return in Nebraska may result in penalties, including late filing fees and increased property tax assessments.

Q: What information do I need to include in a personal property return?

A: When filling out a personal property return, you will typically need to provide details of your personal property, such as a description, quantity, and value. The exact information required may vary depending on the county assessor's guidelines.

Q: Is there a deadline for filing a personal property return in Nebraska?

A: Yes, there is a deadline for filing a personal property return in Nebraska. The specific deadline varies by county, but it is typically in early May.

Q: Can I request an extension for filing a personal property return in Nebraska?

A: In some cases, you may be able to request an extension for filing a personal property return in Nebraska. Contact the county assessor's office for more information and to inquire about the possibility of an extension.

Q: What if I no longer own the personal property listed on the return?

A: If you no longer own the personal property listed on the return, you should still file the return and indicate that you no longer own the property. This will ensure accurate tax assessments and prevent future notices or penalties.

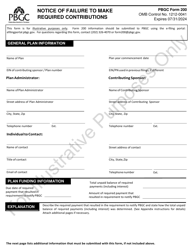

Form Details:

- Released on December 1, 2013;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.