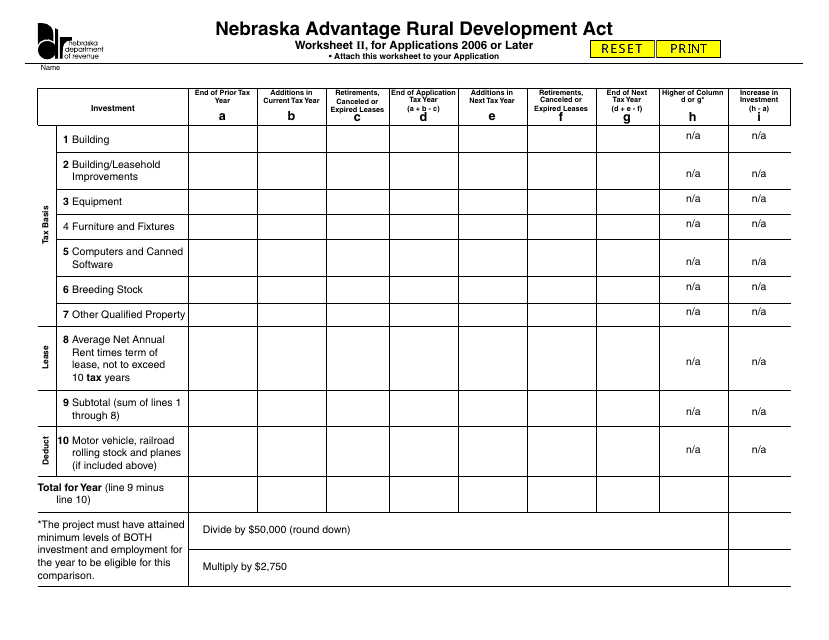

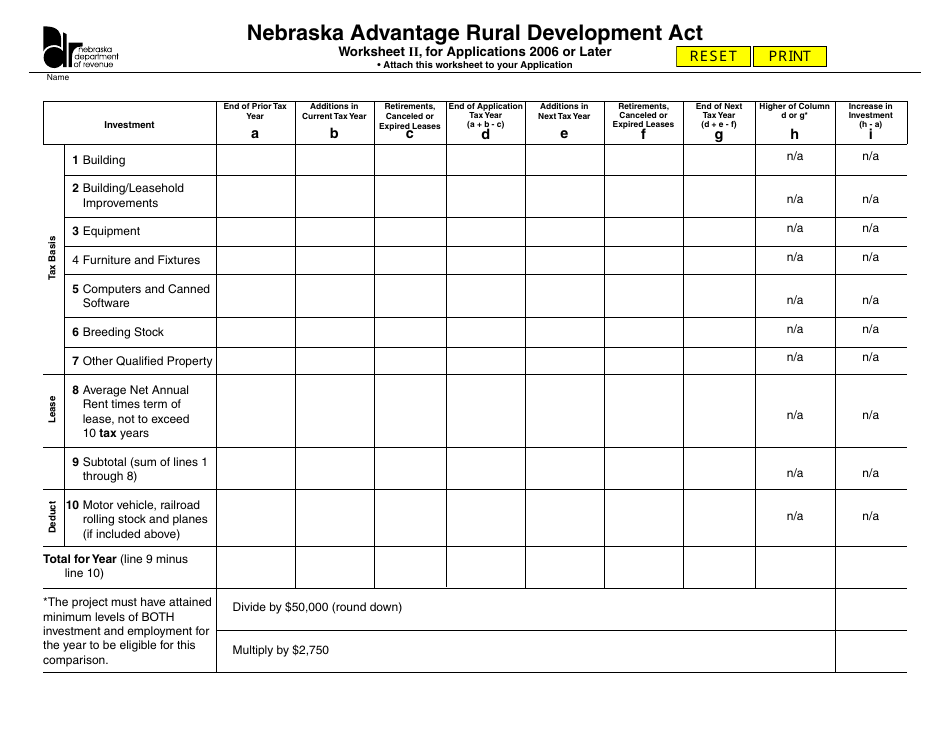

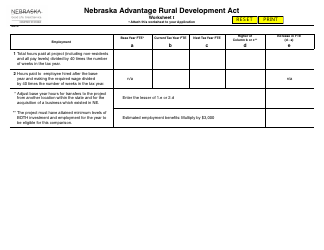

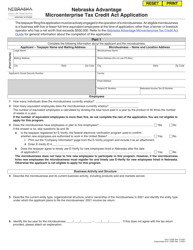

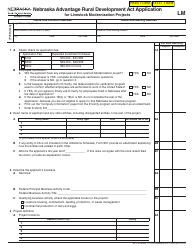

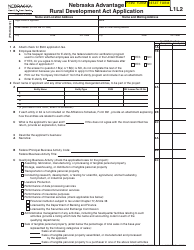

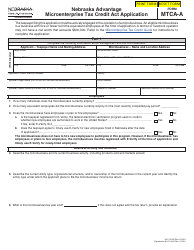

Worksheet II Nebraska Advantage Rural Development Act for Applications 2006 or Later - Nebraska

What Is Worksheet II?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Nebraska Advantage Rural Development Act?

A: The Nebraska Advantage Rural Development Act is a program in Nebraska that promotes economic development in rural areas.

Q: When was the Nebraska Advantage Rural Development Act initiated?

A: The Nebraska Advantage Rural Development Act was initiated in 2006.

Q: What is the purpose of the Nebraska Advantage Rural Development Act?

A: The purpose of the Nebraska Advantage Rural Development Act is to attract and retain businesses in rural areas of Nebraska.

Q: Who is eligible for benefits under the Nebraska Advantage Rural Development Act?

A: Eligible businesses and individuals, such as agricultural processors, manufacturers, and certain services, can apply for benefits under the act.

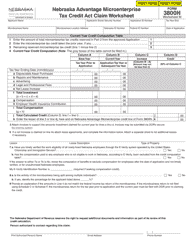

Q: What benefits and incentives are offered under the Nebraska Advantage Rural Development Act?

A: The act provides various benefits and incentives, including tax incentives, credits, exemptions, and grants.

Q: How can businesses or individuals apply for benefits under the Nebraska Advantage Rural Development Act?

A: Businesses or individuals can apply for benefits under the Nebraska Advantage Rural Development Act by submitting an application to the appropriate authorities.

Q: Are there any specific requirements or criteria for receiving benefits under the Nebraska Advantage Rural Development Act?

A: Yes, there are specific requirements and criteria that businesses and individuals must meet to be eligible for benefits under the act.

Q: Is there any deadline for applying for benefits under the Nebraska Advantage Rural Development Act?

A: There may be specific deadlines for applying for benefits under the Nebraska Advantage Rural Development Act, which can vary depending on the program or incentive.

Q: Is the Nebraska Advantage Rural Development Act only applicable to businesses?

A: No, the act is also applicable to individuals who meet the eligibility criteria and are engaged in activities such as agricultural processing or certain services.

Q: Can businesses or individuals receive multiple benefits under the Nebraska Advantage Rural Development Act?

A: Yes, businesses or individuals may be eligible to receive multiple benefits under the act, depending on their specific circumstances and the programs they qualify for.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Worksheet II by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.