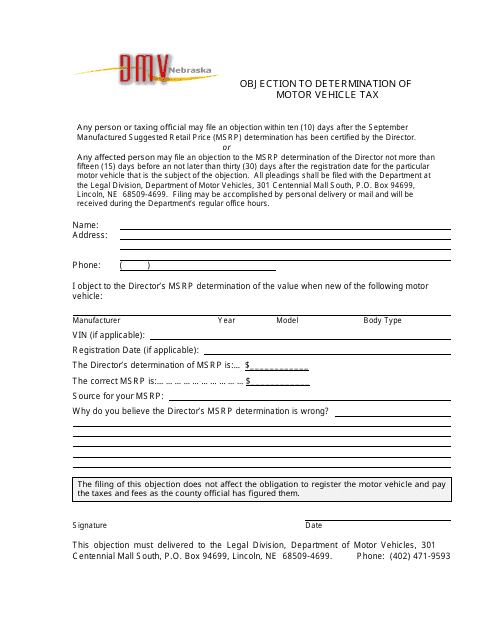

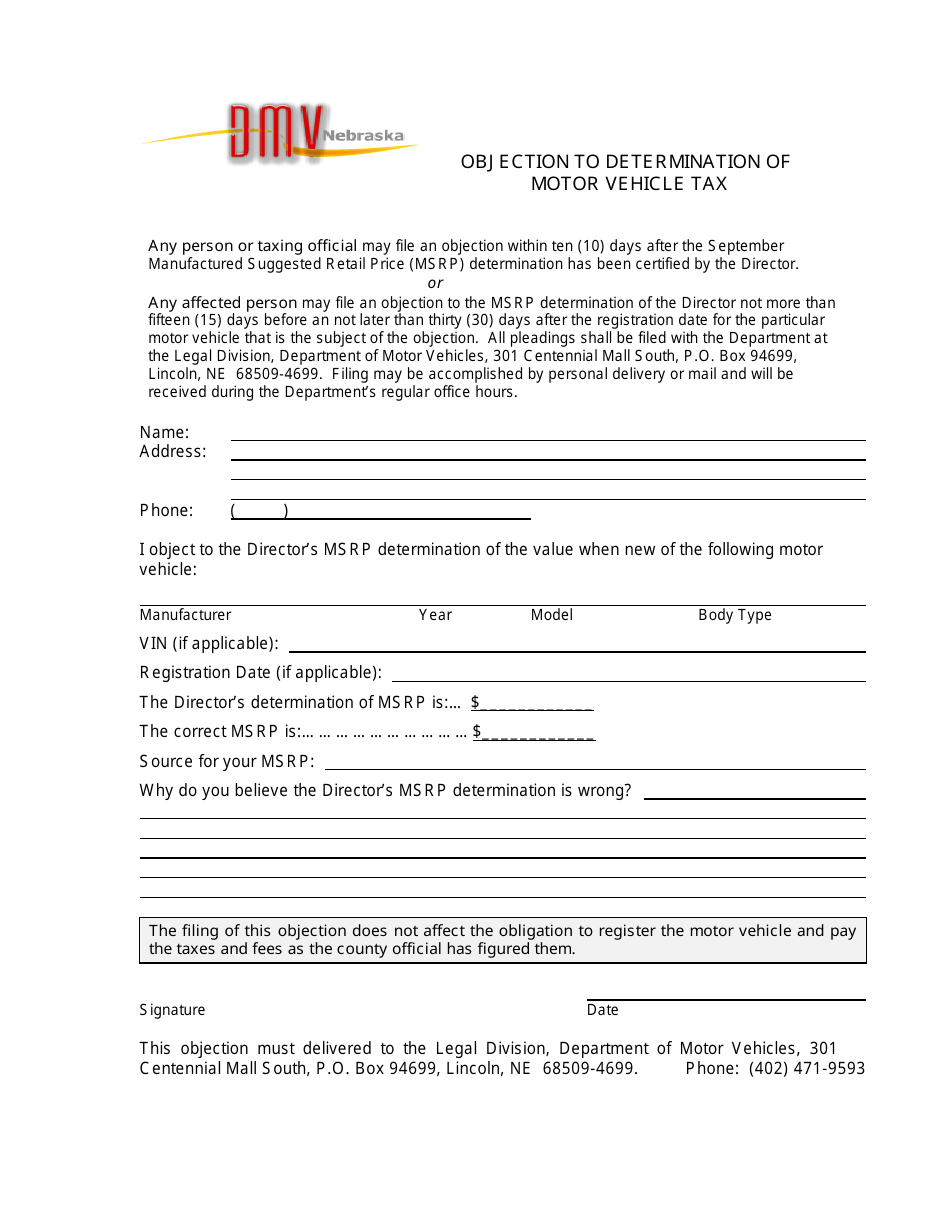

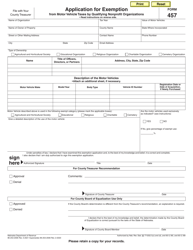

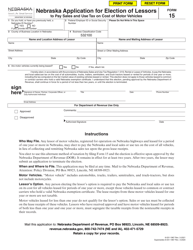

Objection to Determination of Motor Vehicle Tax - Nebraska

Objection to Determination of Motor Vehicle Tax is a legal document that was released by the Nebraska Department of Motor Vehicles - a government authority operating within Nebraska.

FAQ

Q: What is a Determination of Motor Vehicle Tax in Nebraska?

A: A Determination of Motor Vehicle Tax is an assessment made by the Nebraska Department of Motor Vehicles to determine the tax owed for a motor vehicle.

Q: When can I file an objection to the Determination of Motor Vehicle Tax in Nebraska?

A: You can file an objection within 30 days of the date the Determination of Motor Vehicle Tax was mailed to you.

Q: How can I file an objection to the Determination of Motor Vehicle Tax in Nebraska?

A: You can file an objection by completing the Objection to Determination of Motor Vehicle Tax form and submitting it to the Nebraska Department of Motor Vehicles.

Q: What information do I need to include in my objection to the Determination of Motor Vehicle Tax in Nebraska?

A: You will need to include your name, address, vehicle information, and a detailed explanation of why you are objecting to the tax determination.

Q: What happens after I file an objection to the Determination of Motor Vehicle Tax in Nebraska?

A: After you file an objection, the Nebraska Department of Motor Vehicles will review your objection and make a determination.

Q: Can I appeal the decision made after filing an objection to the Determination of Motor Vehicle Tax in Nebraska?

A: Yes, if you are not satisfied with the decision made after filing an objection, you can appeal the decision to the Nebraska Tax Equalization and Review Commission.

Form Details:

- The latest edition currently provided by the Nebraska Department of Motor Vehicles;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Motor Vehicles.