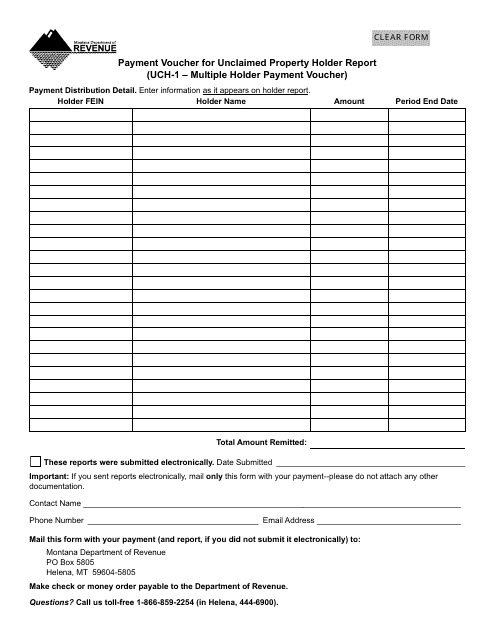

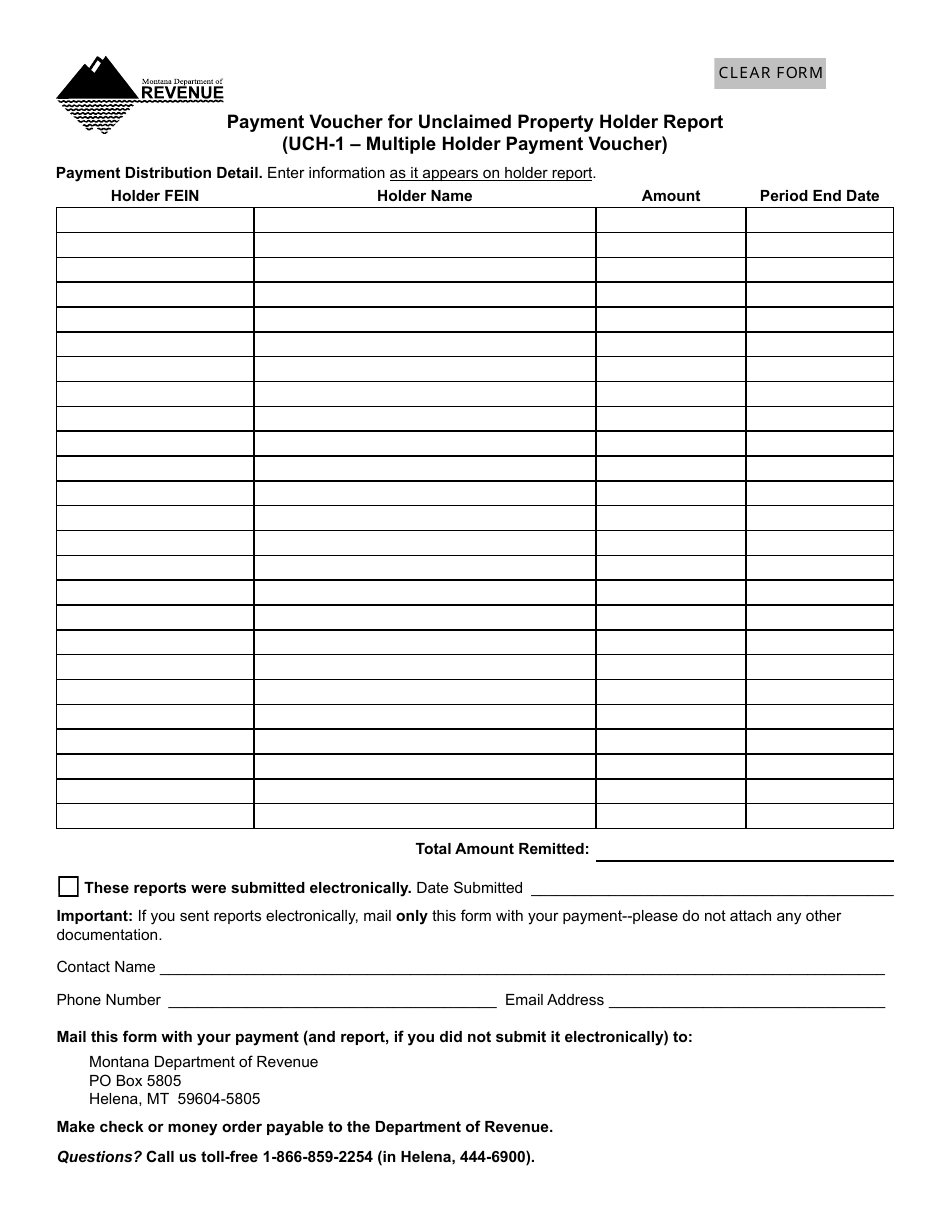

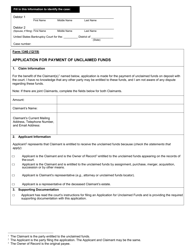

Form UCH-1 Payment Voucher for Unclaimed Property Multiple Holder Report - Montana

What Is Form UCH-1?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UCH-1?

A: Form UCH-1 is a Payment Voucher for Unclaimed Property Multiple Holder Report in Montana.

Q: What is Unclaimed Property?

A: Unclaimed property refers to financial assets that have been abandoned by their rightful owners. Examples include uncashed checks, dormant bank accounts, and unclaimed insurance benefits.

Q: Who needs to file Form UCH-1 in Montana?

A: Any business or organization that holds unclaimed property owed to multiple owners must file Form UCH-1 in Montana.

Q: What is the purpose of Form UCH-1?

A: Form UCH-1 is used to report and remit unclaimed property held by businesses or organizations in Montana.

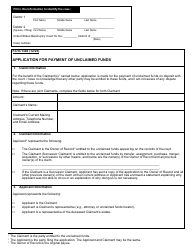

Q: Is there a deadline for filing Form UCH-1?

A: Yes, Form UCH-1 must be filed annually by November 1st.

Q: Are there any penalties for not filing Form UCH-1?

A: Yes, failure to file Form UCH-1 or reporting false information can result in penalties and interest charges.

Q: Is there any fee for filing Form UCH-1?

A: No, there is no fee for filing Form UCH-1 in Montana.

Q: Is it necessary to include payment with Form UCH-1?

A: Yes, you must include payment for the reported unclaimed property along with Form UCH-1.

Form Details:

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCH-1 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.