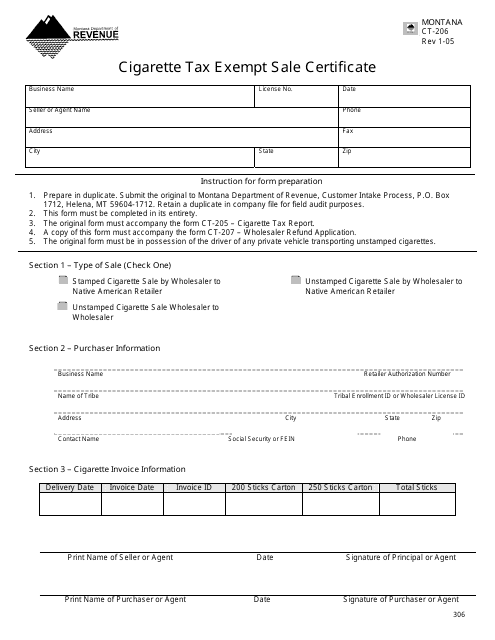

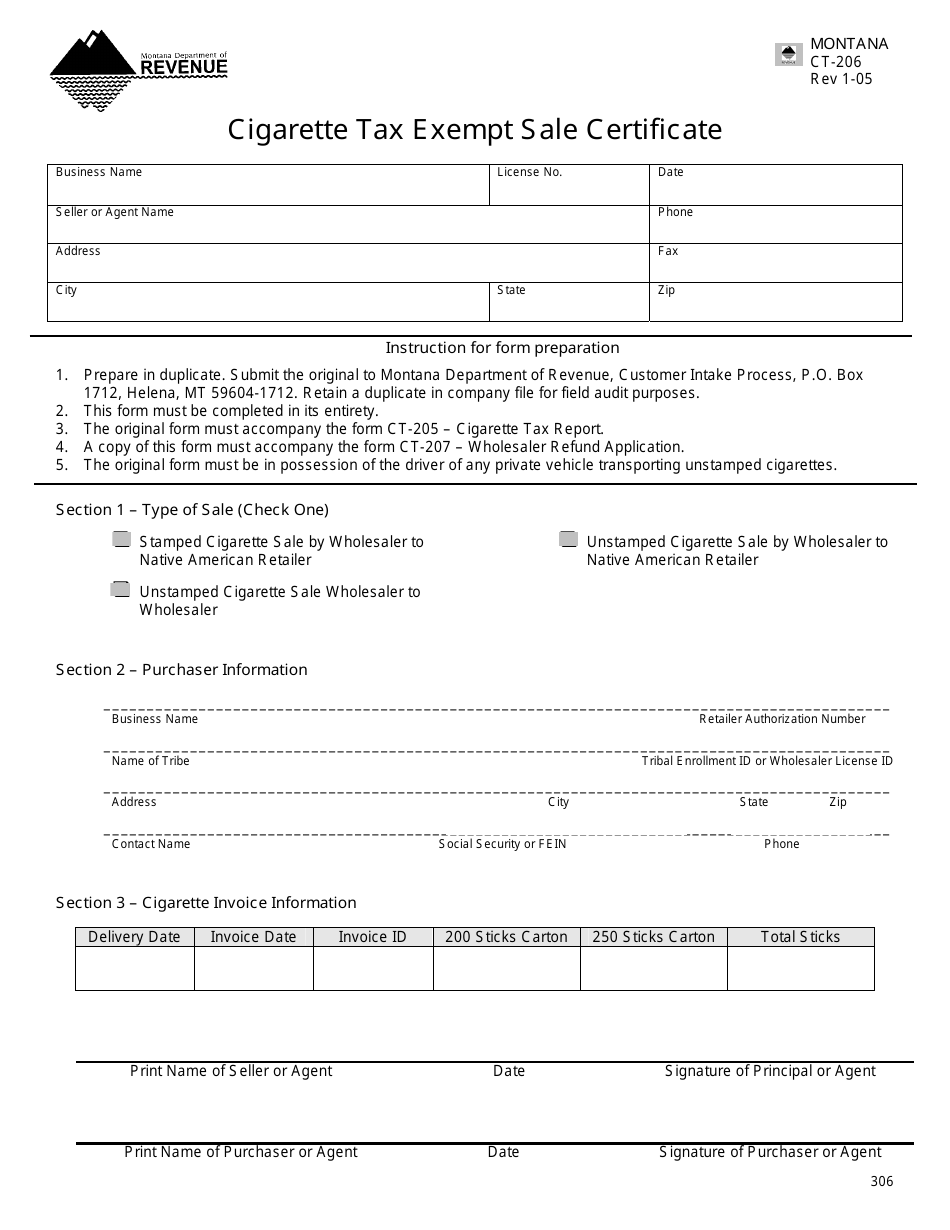

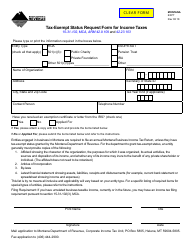

Form CT-206 Cigarette Tax Exempt Sale Certificate - Montana

What Is Form CT-206?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-206?

A: Form CT-206 is the Cigarette Tax Exempt Sale Certificate for Montana.

Q: What is the purpose of Form CT-206?

A: The purpose of Form CT-206 is to certify that a sale of cigarettes is exempt from Montana cigarette tax.

Q: Who needs to fill out Form CT-206?

A: Retailers who are selling cigarettes exempt from Montana cigarette tax need to fill out Form CT-206.

Q: What information is required on Form CT-206?

A: Form CT-206 requires information about the retailer, purchaser, and details of the exempt sale.

Q: Are there any fees or taxes associated with Form CT-206?

A: No, there are no fees or taxes associated with Form CT-206 itself.

Q: What should I do if there are changes to the information on the Form CT-206?

A: If there are changes to the information on the Form CT-206, a new form should be completed and submitted to the Montana Department of Revenue.

Q: Is Form CT-206 specific to Montana?

A: Yes, Form CT-206 is specific to Montana and is used for certifying cigarette sales exempt from Montana cigarette tax.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-206 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.