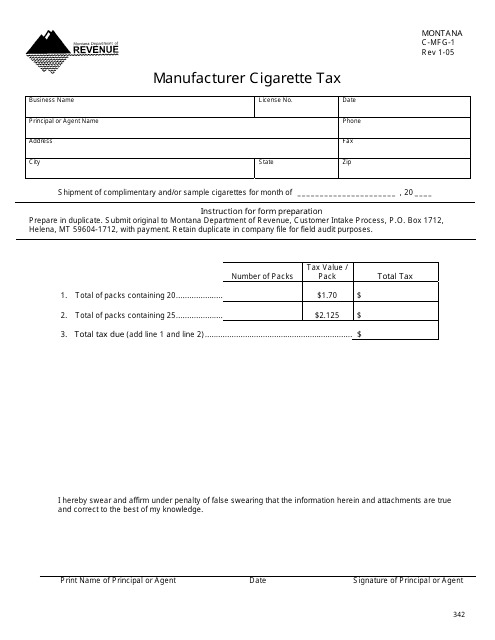

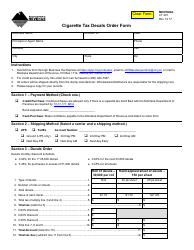

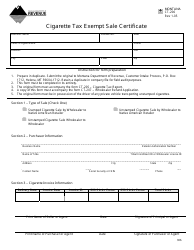

Form C-MFG-1 Manufacturer Cigarette Tax - Montana

What Is Form C-MFG-1?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-MFG-1?

A: Form C-MFG-1 is a form used for reporting and paying cigarette tax by manufacturers in Montana.

Q: Who needs to file Form C-MFG-1?

A: Manufacturers of cigarettes in Montana need to file Form C-MFG-1.

Q: What is the purpose of Form C-MFG-1?

A: The purpose of Form C-MFG-1 is to report and pay the cigarette tax owed by manufacturers in Montana.

Q: What information is required on Form C-MFG-1?

A: Form C-MFG-1 requires information such as the manufacturer's name, address, number of cigarettes manufactured, and the amount of tax due.

Q: When is Form C-MFG-1 due?

A: Form C-MFG-1 is due on a monthly basis, with the tax payment due by the 15th day of the following month.

Q: What happens if I don't file Form C-MFG-1?

A: Failure to file Form C-MFG-1 or pay the cigarette tax can result in penalties and interest being assessed by the Montana Department of Revenue.

Q: Can I file Form C-MFG-1 electronically?

A: Yes, the Montana Department of Revenue allows electronic filing of Form C-MFG-1.

Q: Is there a separate form for cigarette retailers?

A: Yes, there is a separate form for cigarette retailers called Form C-RET-1.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form C-MFG-1 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.