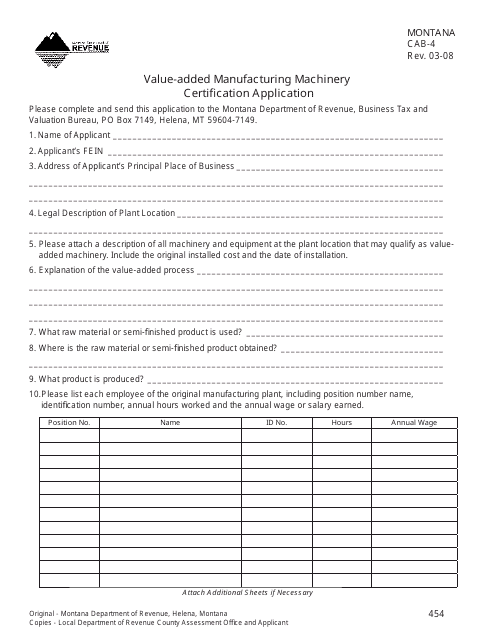

Form CAB-4 Value-Added Manufacturing Machinery Certification Application - Montana

What Is Form CAB-4?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CAB-4 Value-Added Manufacturing Machinery Certification Application?

A: The CAB-4 Value-Added Manufacturing Machinery Certification Application is a form used in Montana for certifying value-added manufacturing machinery.

Q: Who can use the CAB-4 form?

A: The CAB-4 form can be used by individuals or businesses engaged in value-added manufacturing in Montana.

Q: What is value-added manufacturing?

A: Value-added manufacturing refers to the process of transforming raw materials into finished goods with increased value.

Q: What is the purpose of the CAB-4 form?

A: The purpose of the CAB-4 form is to certify that certain machinery used in value-added manufacturing is eligible for property tax exemption.

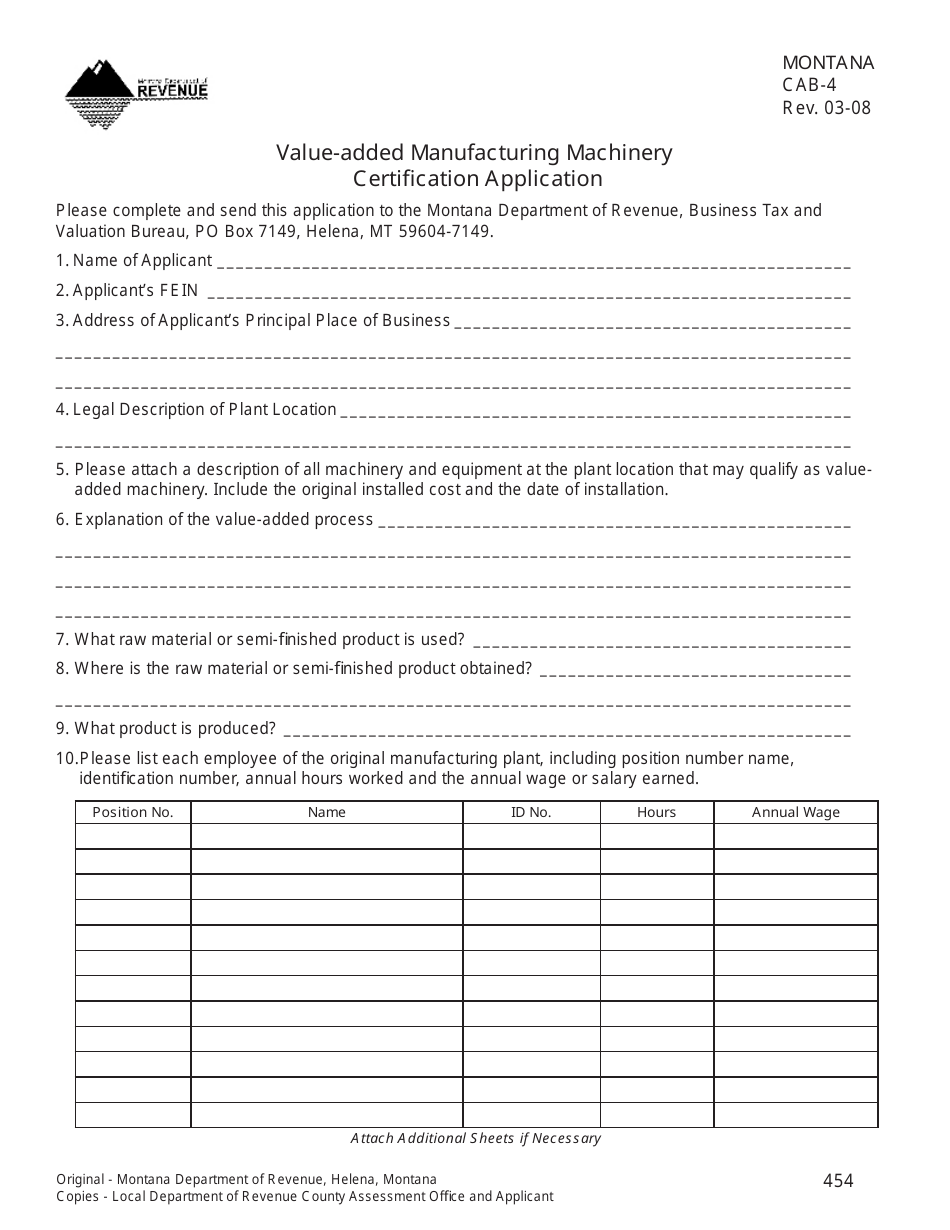

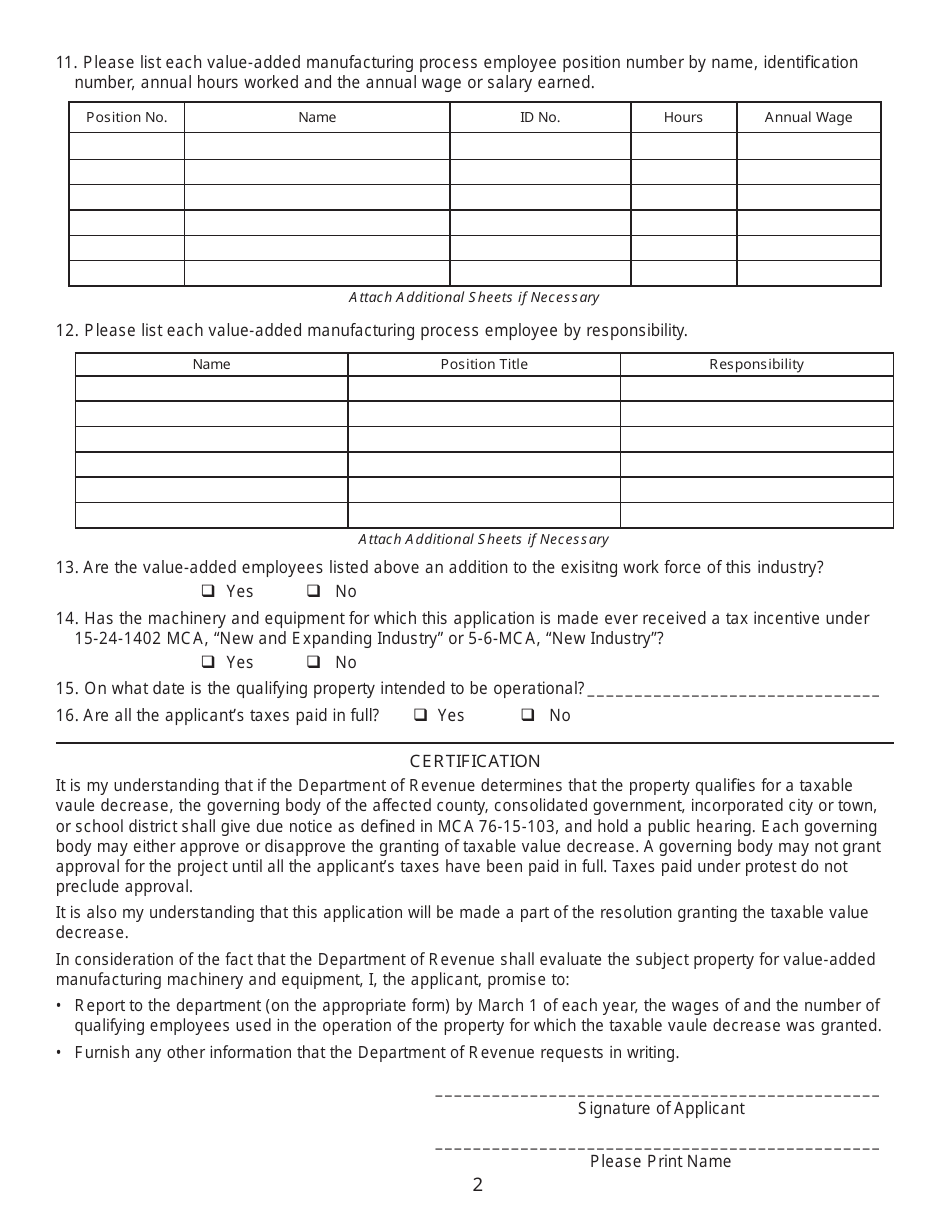

Q: What information is required on the CAB-4 form?

A: The CAB-4 form requires information about the applicant, the machinery being certified, and the value-added manufacturing process.

Q: What is the deadline for submitting the CAB-4 form?

A: The deadline for submitting the CAB-4 form is April 15th of each year.

Q: What happens after I submit the CAB-4 form?

A: After submitting the CAB-4 form, the Montana Department of Revenue will review the application and determine eligibility for the property tax exemption.

Q: How long does it take to receive a decision on the CAB-4 application?

A: The processing time for the CAB-4 application can vary, but it typically takes several weeks to receive a decision.

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-4 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.