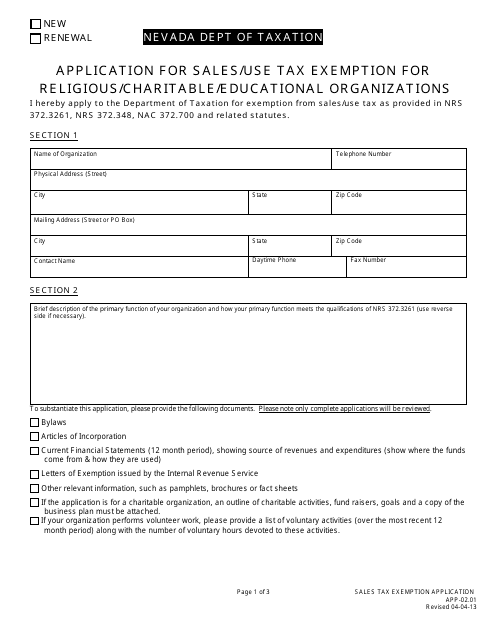

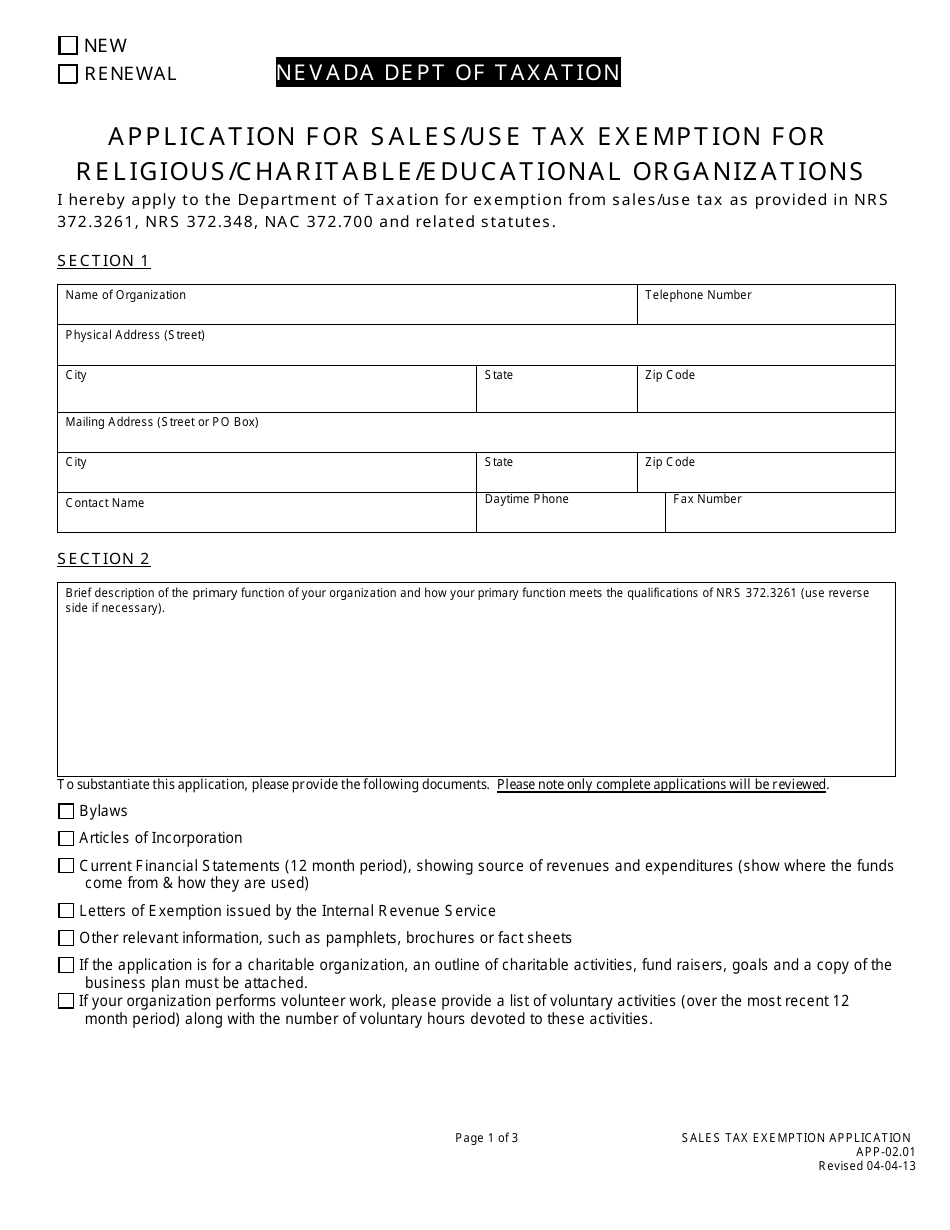

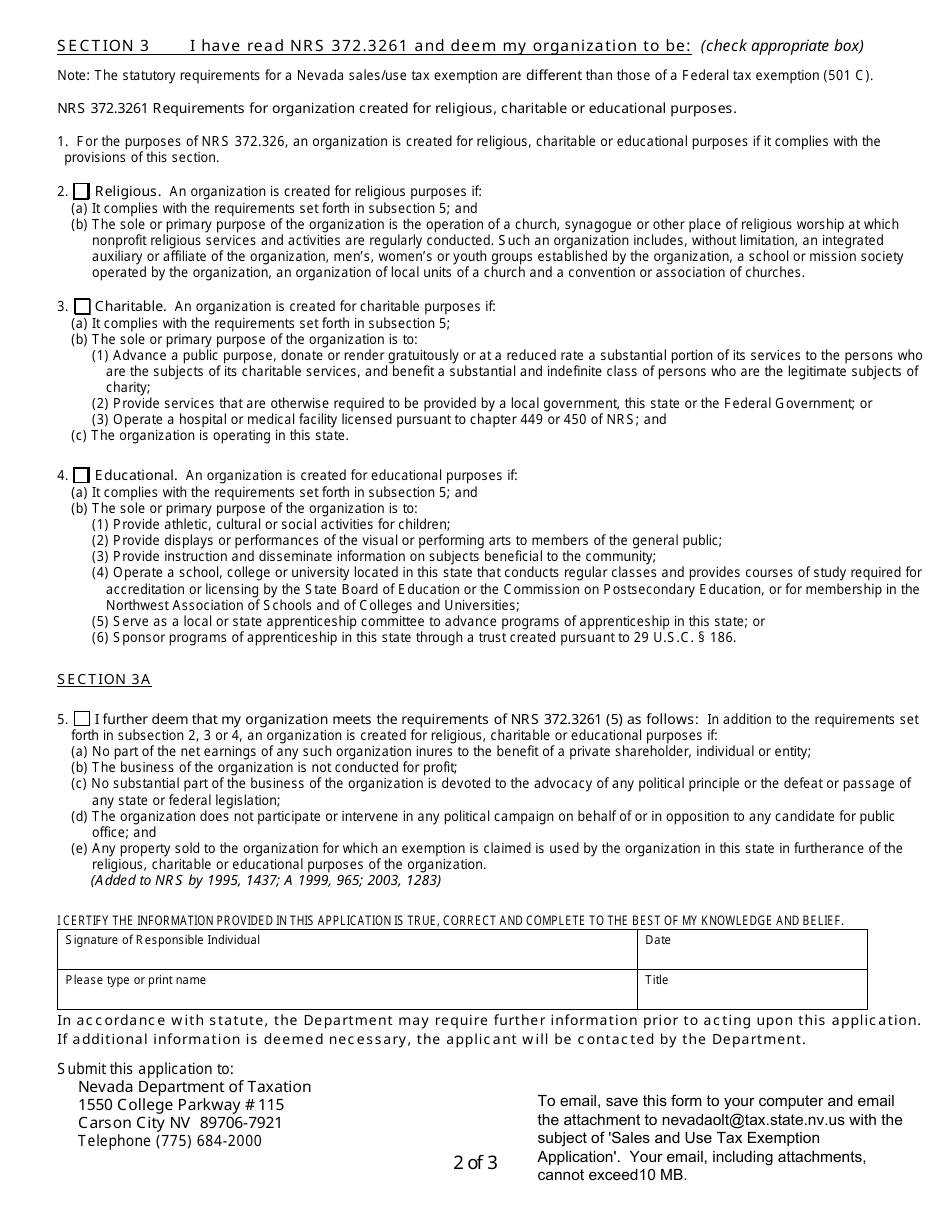

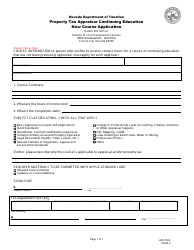

Form APP-02.01 Application for Sales / Use Tax Exemption for Religious / Charitable / Educational Organizations - Nevada

What Is Form APP-02.01?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form APP-02.01?

A: To apply for sales/use tax exemption for religious, charitable, and educational organizations in Nevada.

Q: Who is eligible to use Form APP-02.01?

A: Religious, charitable, and educational organizations in Nevada.

Q: What does the sales/use tax exemption mean?

A: It means that the organization is not required to pay sales or use tax on qualifying purchases.

Q: What information is required on Form APP-02.01?

A: The organization's name, address, tax identification number, and a description of its activities.

Q: Is there a fee to submit Form APP-02.01?

A: No, there is no fee to submit the form.

Q: How long does it take to process the application?

A: Processing times may vary, but it generally takes a few weeks to review and process the application.

Q: Do I need to renew the sales/use tax exemption?

A: Yes, the exemption must be renewed every five years.

Q: Can the sales/use tax exemption be revoked?

A: Yes, the exemption can be revoked if the organization no longer qualifies or fails to comply with the requirements.

Q: Who can I contact for more information?

A: You can contact the Nevada Department of Taxation for more information on Form APP-02.01.

Form Details:

- Released on April 4, 2013;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form APP-02.01 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.