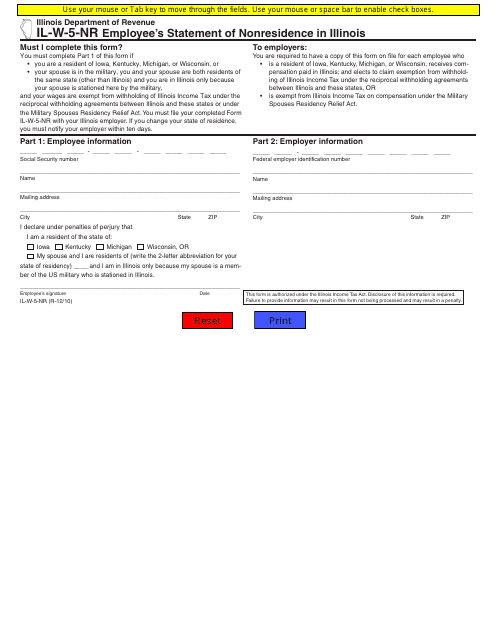

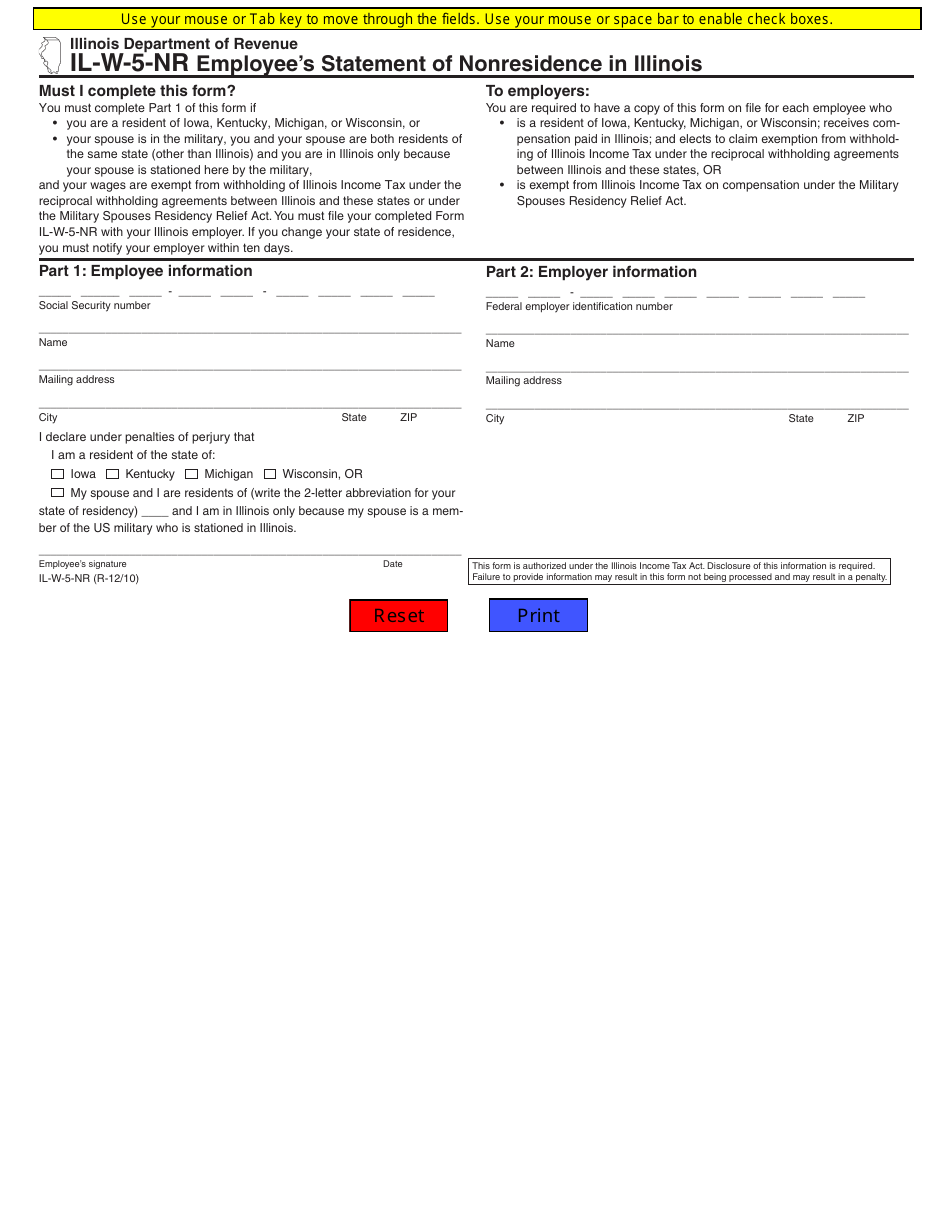

Form IL-W-5-NR Employee's Statement of Nonresidence in Illinois - Illinois

What Is Form IL-W-5-NR?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-W-5-NR?

A: Form IL-W-5-NR is an employee's statement of nonresidence in Illinois.

Q: Who needs to file Form IL-W-5-NR?

A: Form IL-W-5-NR needs to be filed by employees who are claiming nonresidency in Illinois for income tax purposes.

Q: When is Form IL-W-5-NR due?

A: Form IL-W-5-NR is usually due by the same date as your federal income tax return, which is April 15th.

Q: What information do I need to complete Form IL-W-5-NR?

A: You will need to provide your personal information, including your name, address, and Social Security number, as well as details about your nonresidency status.

Q: Do I need to attach any documents to Form IL-W-5-NR?

A: No, you do not need to attach any documents to Form IL-W-5-NR. However, you should keep any supporting documents for your records.

Q: What happens if I don't file Form IL-W-5-NR?

A: If you are required to file Form IL-W-5-NR and you fail to do so, you may be subject to penalties and interest charges.

Q: Can I e-file Form IL-W-5-NR?

A: No, Form IL-W-5-NR cannot be e-filed. It must be filed by mail or in person.

Q: Can I claim a refund if I file Form IL-W-5-NR?

A: If you had Illinois withholding tax withheld from your wages and you file Form IL-W-5-NR, you may be eligible for a refund of the amount withheld.

Q: Is Form IL-W-5-NR only for nonresidents of Illinois?

A: Yes, Form IL-W-5-NR is specifically for individuals who do not reside in Illinois for income tax purposes.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-W-5-NR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.