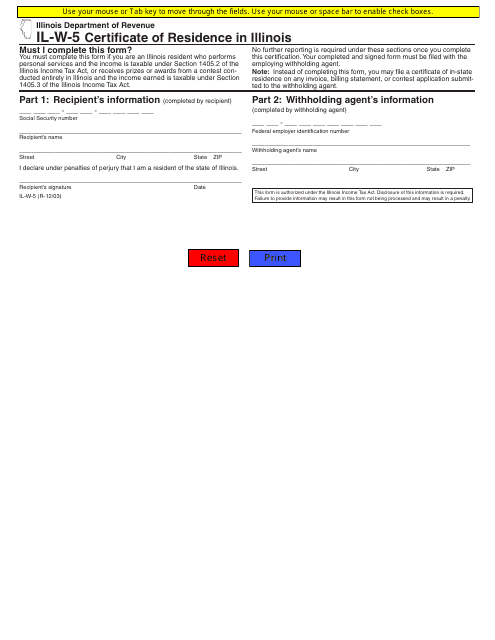

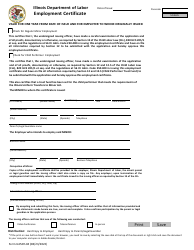

Form IL-W-5 Certificate of Residence in Illinois - Illinois

What Is Form IL-W-5?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-W-5?

A: Form IL-W-5 is the Certificate of Residence in Illinois.

Q: Who needs to fill out Form IL-W-5?

A: Individuals who are claiming exemption from Illinois withholding tax because they are residents of states other than Illinois.

Q: Why would someone need a Certificate of Residence in Illinois?

A: To establish that they are a resident of a state other than Illinois and are therefore exempt from Illinois withholding tax.

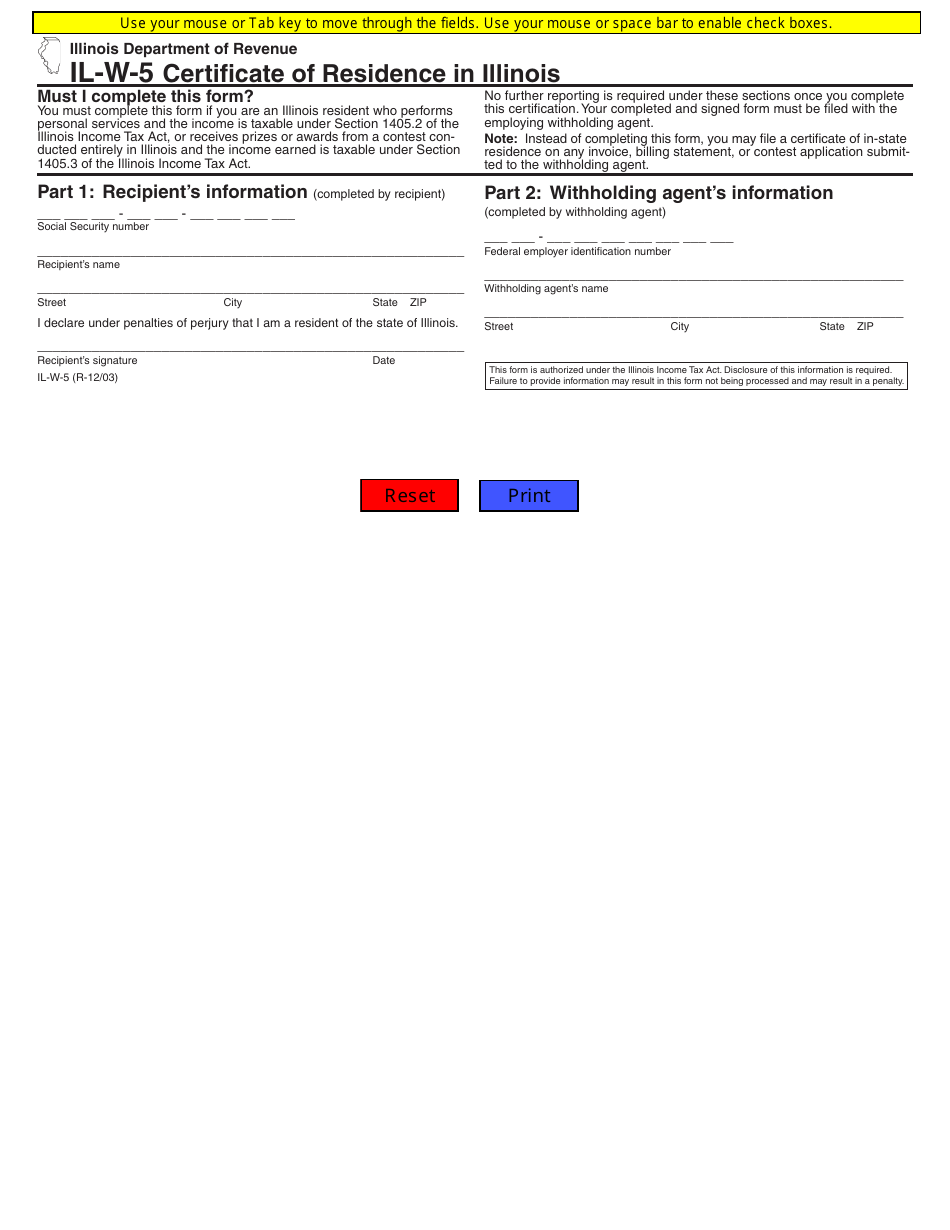

Q: How do I fill out Form IL-W-5?

A: You will need to provide your name, social security number, address, and certify that you are a resident of a state other than Illinois.

Q: When do I need to submit Form IL-W-5?

A: You should submit Form IL-W-5 to your employer before the first payment of income subject to withholding.

Q: Can I electronically submit Form IL-W-5?

A: Yes, you can submit Form IL-W-5 electronically if your employer has an electronic filing system.

Q: What happens if I don't submit Form IL-W-5?

A: If you don't submit Form IL-W-5, your employer may withhold Illinois income tax from your wages.

Q: Is Form IL-W-5 only for non-residents of Illinois?

A: Yes, Form IL-W-5 is only for individuals who are residents of states other than Illinois.

Q: What is the purpose of Form IL-W-5?

A: The purpose of Form IL-W-5 is to certify that you are a resident of a state other than Illinois and are exempt from Illinois withholding tax.

Form Details:

- Released on December 1, 2003;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-W-5 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.