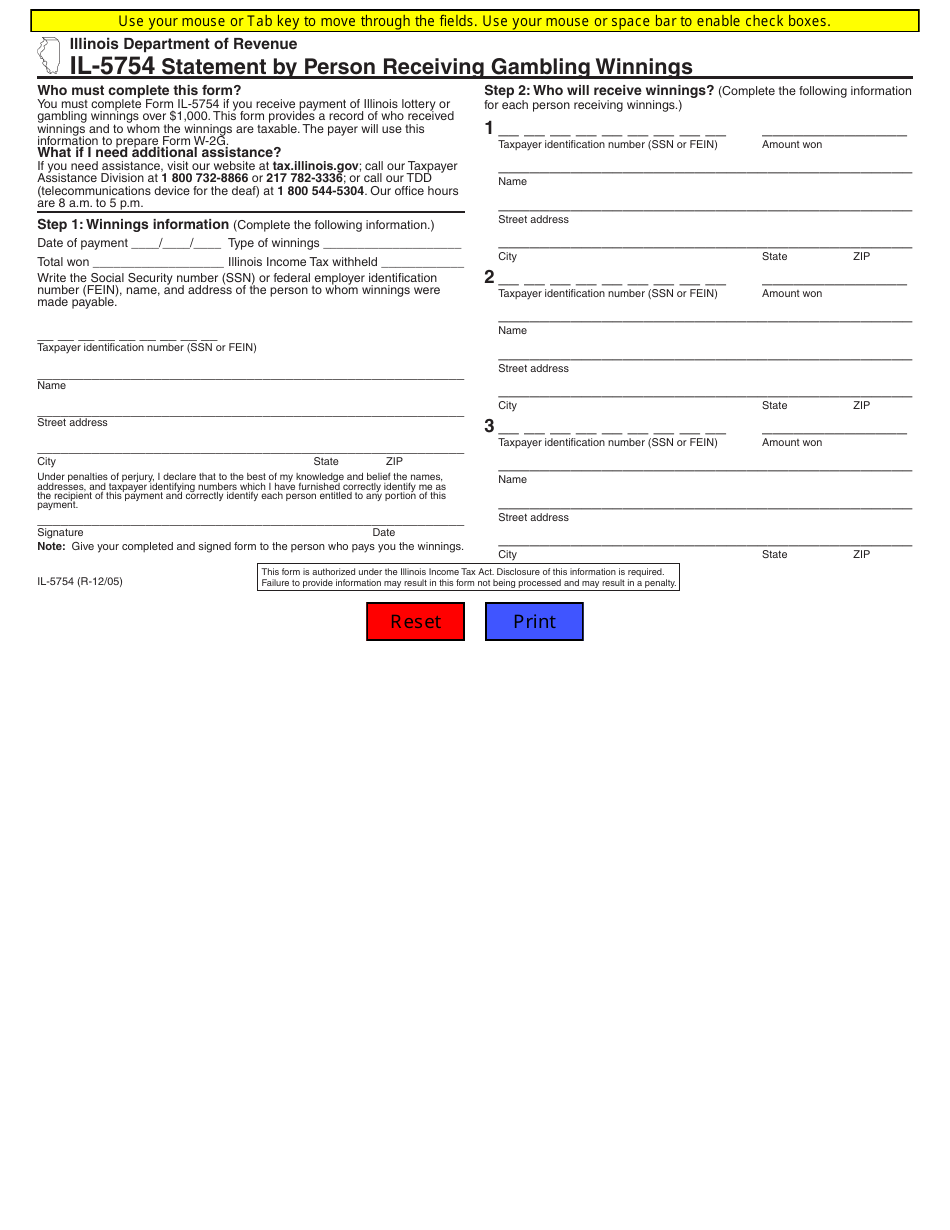

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IL-5754

for the current year.

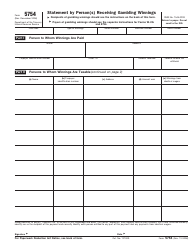

Form IL-5754 Statement by Person Receiving Gambling Winnings - Illinois

What Is Form IL-5754?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-5754?

A: Form IL-5754 is a statement used by a person who received gambling winnings in Illinois.

Q: Who needs to file Form IL-5754?

A: Any individual who received gambling winnings in Illinois and is subject to federal incometax withholding.

Q: Why is Form IL-5754 filed?

A: Form IL-5754 is filed to notify the Illinois Department of Revenue about the gambling winnings received and the amount withheld for federal income tax purposes.

Q: When is the deadline to file Form IL-5754?

A: Form IL-5754 must be filed within three days of receiving the gambling winnings.

Q: Do I need to attach Form IL-5754 to my tax return?

A: No, Form IL-5754 is not attached to your tax return. It is provided to the Illinois Department of Revenue for informational purposes only.

Form Details:

- Released on December 1, 2005;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-5754 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.