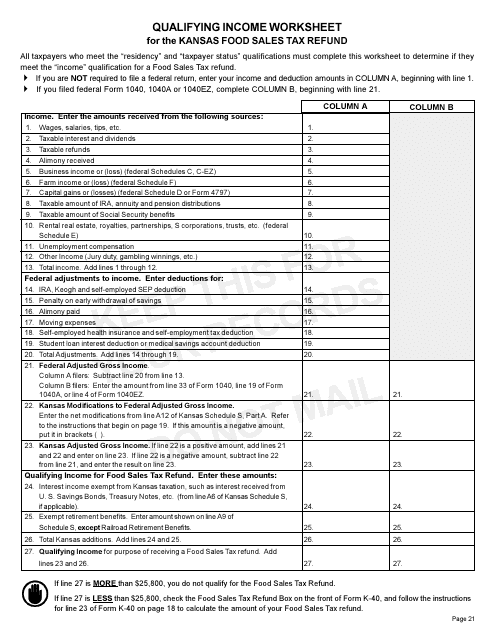

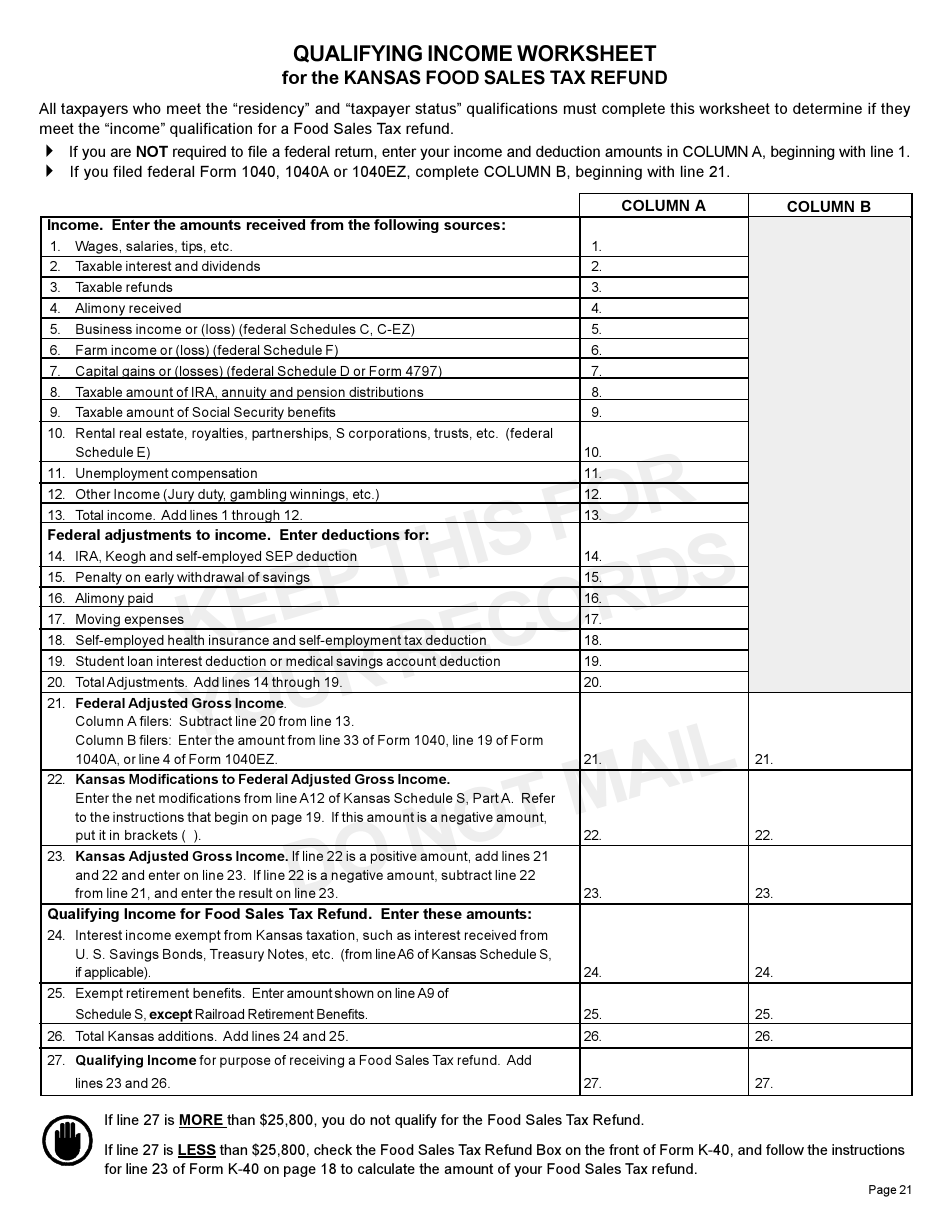

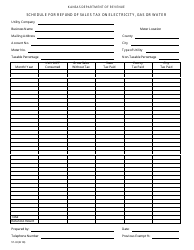

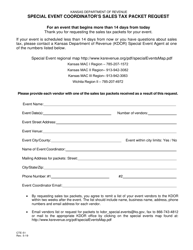

Qualifying Income Worksheet for the Kansas Food Sales Tax Refund - Kansas

Qualifying Income Worksheet for the Kansas Food Sales Tax Refund is a legal document that was released by the Kansas Department of Revenue - a government authority operating within Kansas.

FAQ

Q: What is the Qualifying Income Worksheet for the Kansas Food Sales Tax Refund?

A: The Qualifying Income Worksheet is a form used to determine eligibility for the Kansas Food Sales Tax Refund.

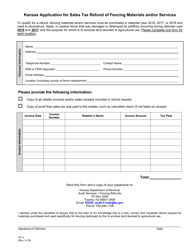

Q: What is the purpose of the Kansas Food Sales Tax Refund?

A: The purpose of the Kansas Food Sales Tax Refund is to provide financial assistance to low-income individuals and families in Kansas by refunding a portion of the sales tax paid on food purchases.

Q: Who is eligible for the Kansas Food Sales Tax Refund?

A: Eligibility for the Kansas Food Sales Tax Refund is based on income and household size. Individuals and families with lower incomes are more likely to qualify.

Q: How do I calculate my qualifying income for the Kansas Food Sales Tax Refund?

A: You can calculate your qualifying income by filling out the Qualifying Income Worksheet, which takes into account factors such as household size and total income.

Q: What documents do I need to provide to apply for the Kansas Food Sales Tax Refund?

A: You will need to provide documents such as pay stubs, tax returns, and proof of residency to apply for the Kansas Food Sales Tax Refund.

Q: How much money can I receive from the Kansas Food Sales Tax Refund?

A: The amount of money you can receive from the Kansas Food Sales Tax Refund depends on your income and household size. The refund is calculated based on a percentage of the sales tax paid on food purchases.

Form Details:

- The latest edition currently provided by the Kansas Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.