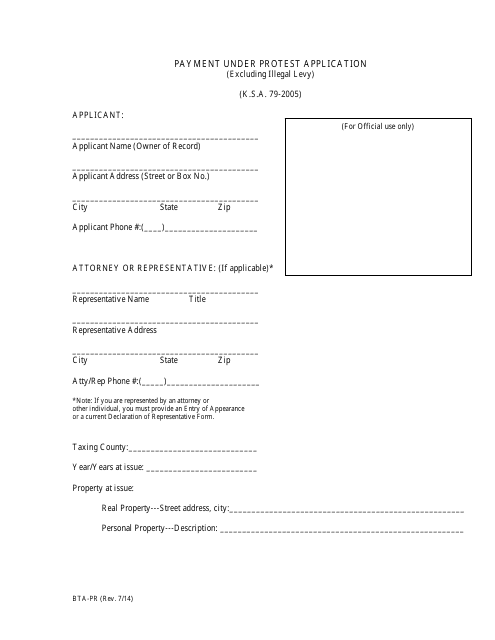

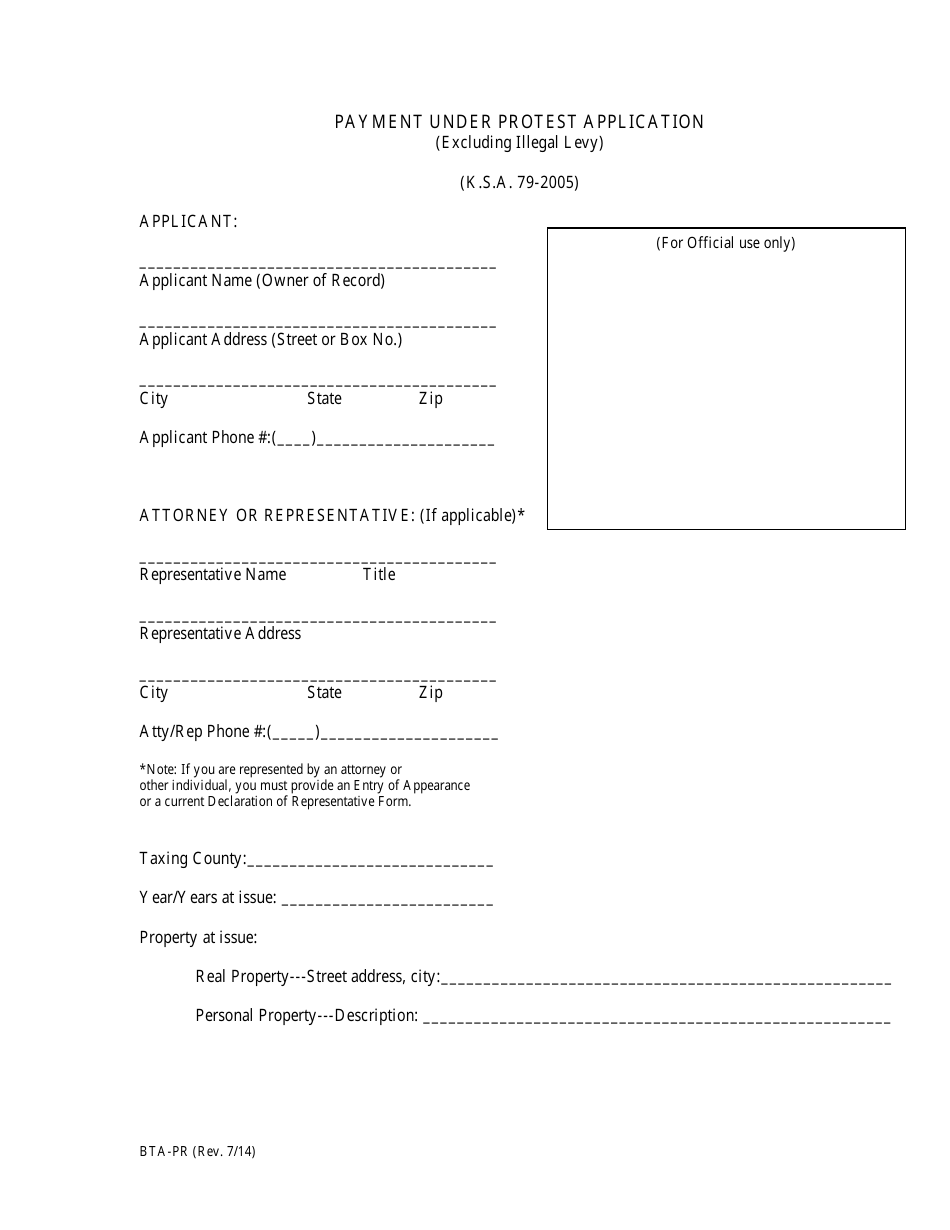

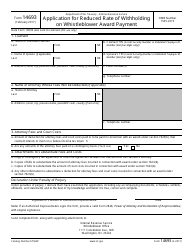

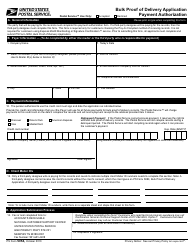

Form BTA-PR Payment Under Protest Application - Kansas

What Is Form BTA-PR?

This is a legal form that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BTA-PR?

A: BTA-PR stands for Board of Tax Appeals - Payment Under Protest.

Q: What is the purpose of the Payment Under Protest application?

A: The purpose of the Payment Under Protest application is to request a refund of taxes paid to the state of Kansas.

Q: Who can file a Payment Under Protest application?

A: Any taxpayer who has paid taxes to the state of Kansas and believes the taxes were paid in error can file a Payment Under Protest application.

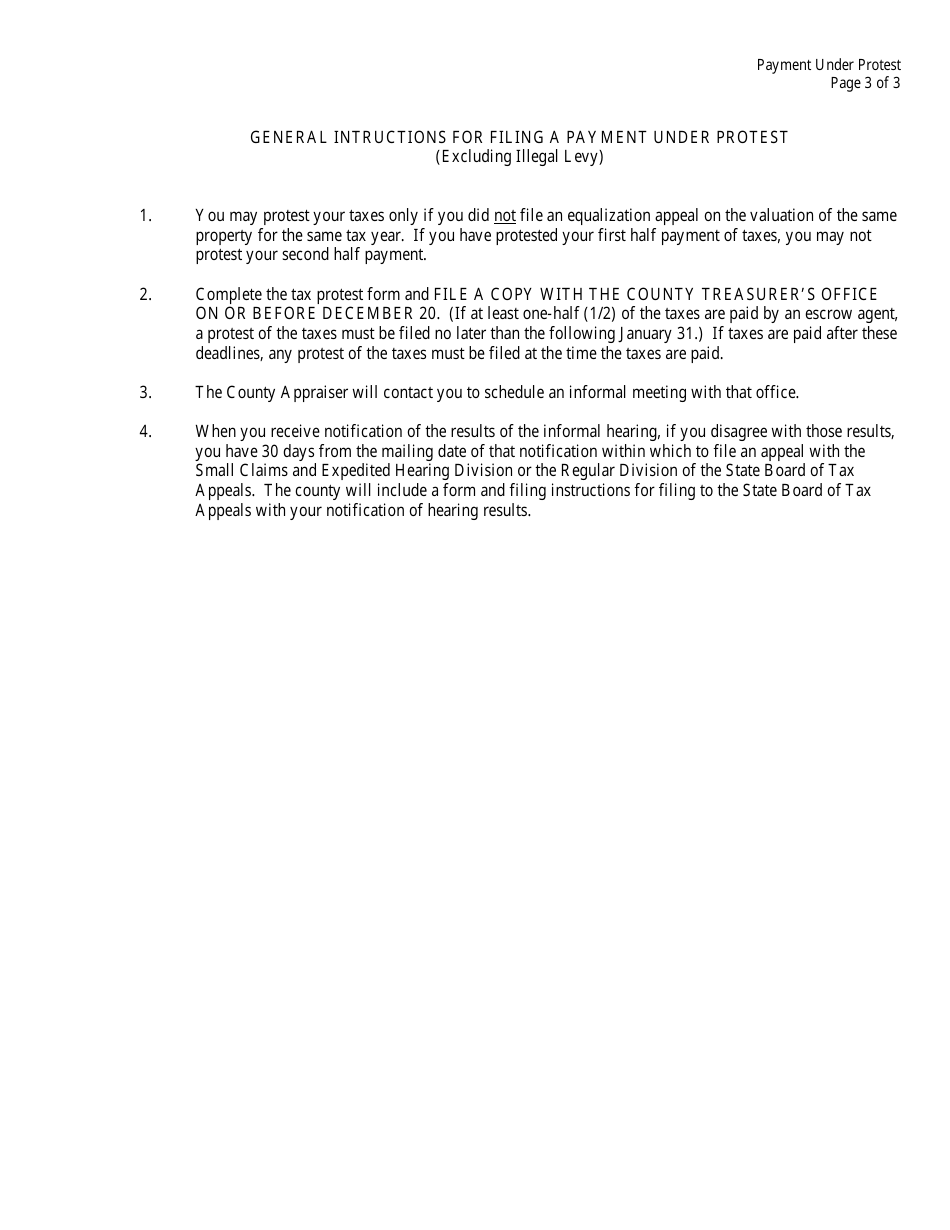

Q: How can I file a Payment Under Protest application?

A: To file a Payment Under Protest application, you need to complete Form BTA-PR and submit it to the Kansas Board of Tax Appeals.

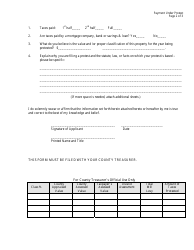

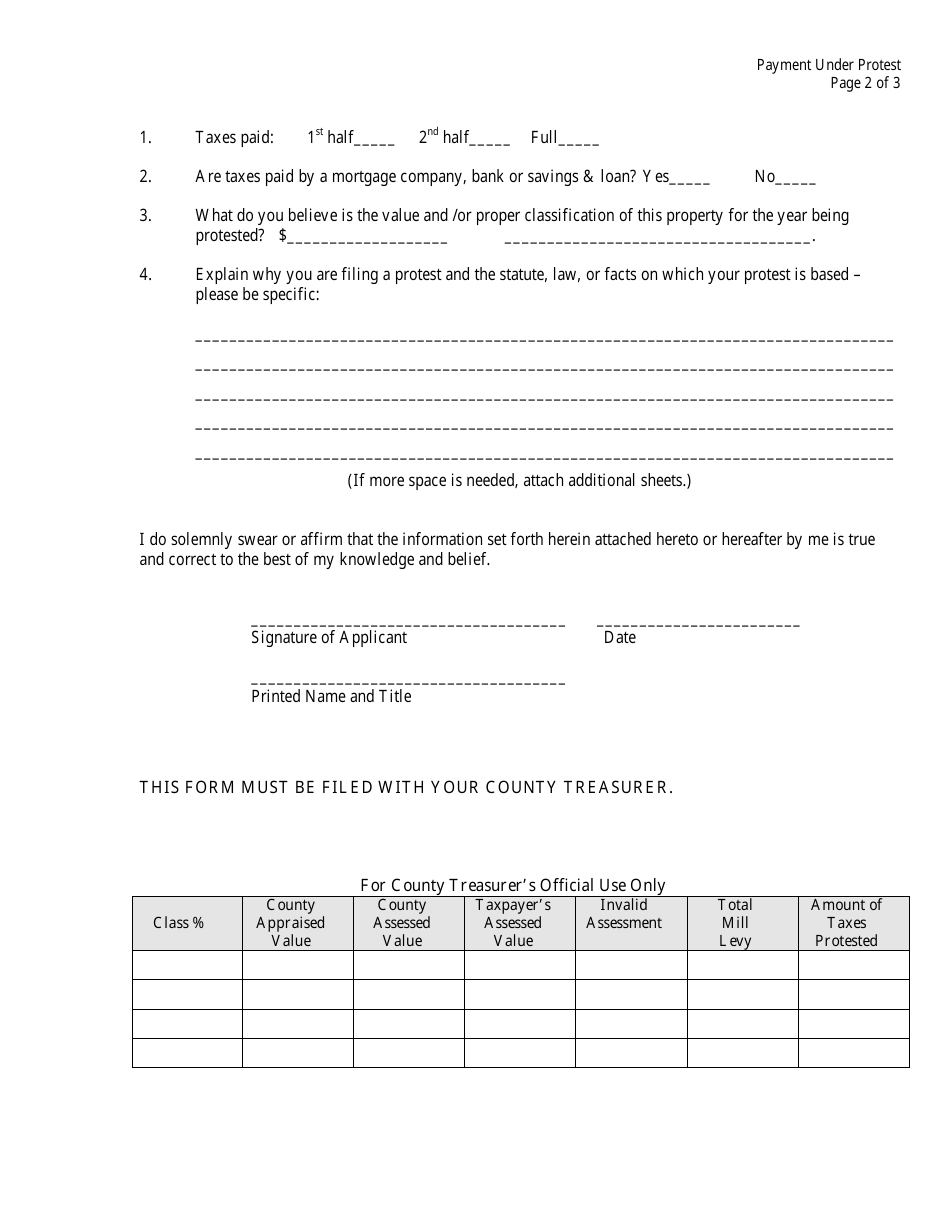

Q: What information do I need to provide in the Payment Under Protest application?

A: In the Payment Under Protest application, you need to provide details about the taxes paid, the grounds for the protest, and any supporting documents.

Q: Is there a deadline to file the Payment Under Protest application?

A: Yes, the Payment Under Protest application must be filed within 30 days from the date of payment of the taxes.

Q: What happens after I file the Payment Under Protest application?

A: After filing the Payment Under Protest application, the Kansas Board of Tax Appeals will review the application and make a determination.

Q: Can I get a refund if my Payment Under Protest application is approved?

A: Yes, if the Kansas Board of Tax Appeals determines that the taxes were paid in error, you may be eligible for a refund.

Q: What if my Payment Under Protest application is denied?

A: If your Payment Under Protest application is denied, you may have the option to appeal the decision to a higher court.

Q: Can I seek legal representation for my Payment Under Protest application?

A: Yes, you have the right to seek legal representation for your Payment Under Protest application if you choose to do so.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Kansas Board of Tax Appeals;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BTA-PR by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.