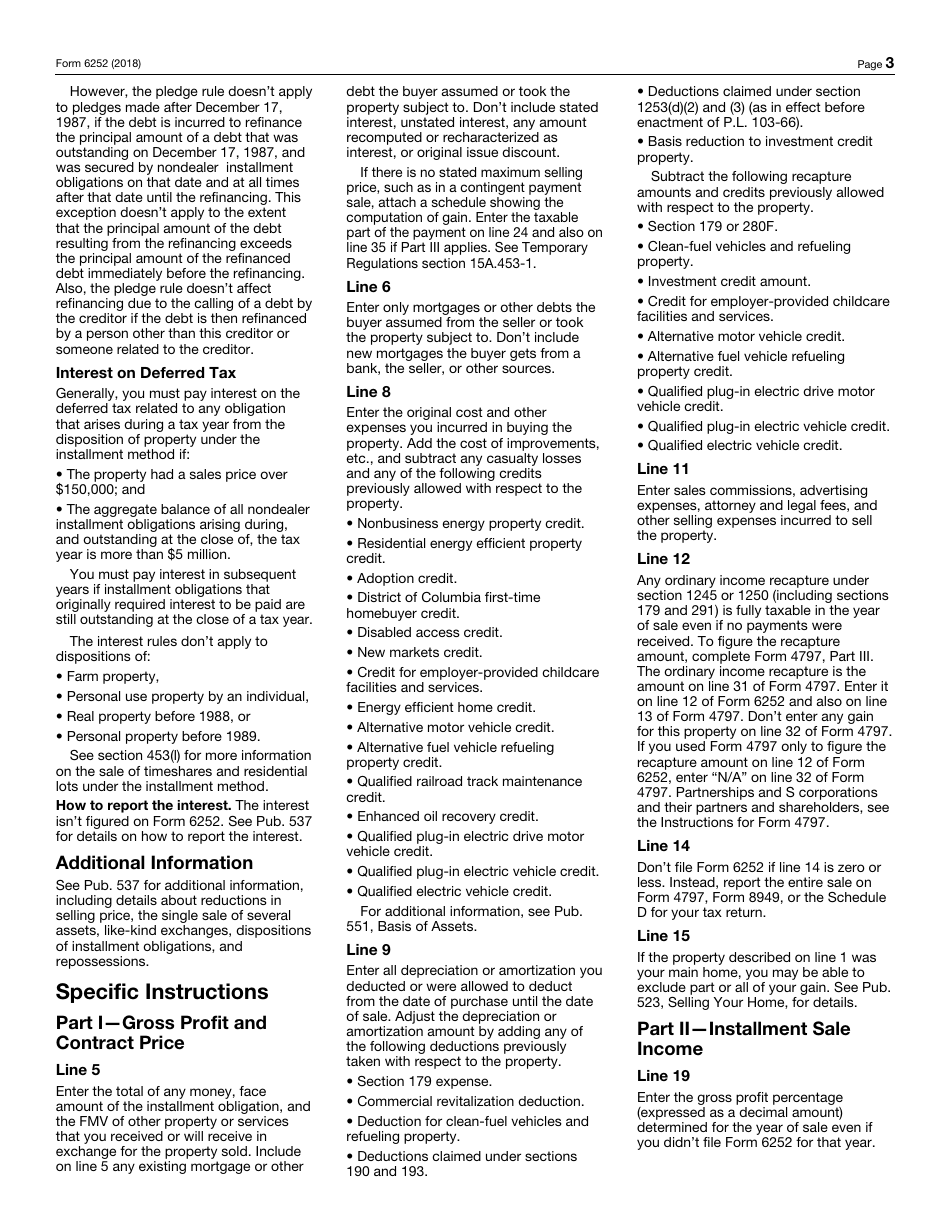

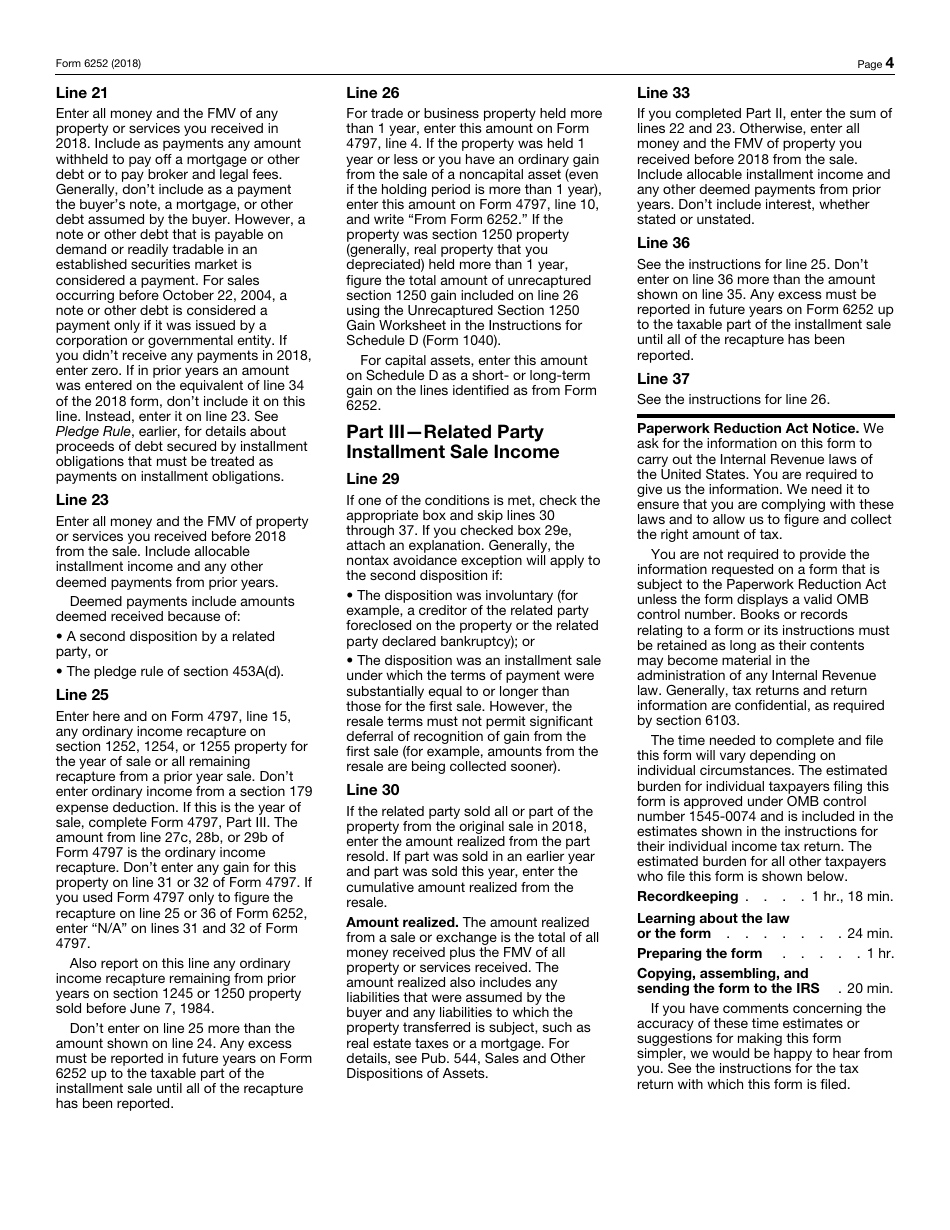

This version of the form is not currently in use and is provided for reference only. Download this version of

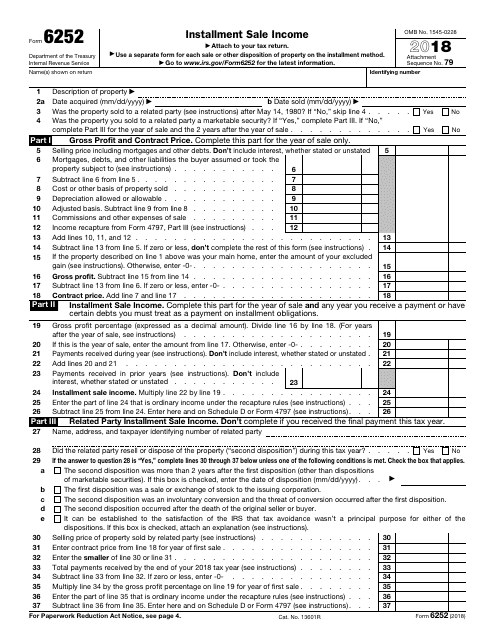

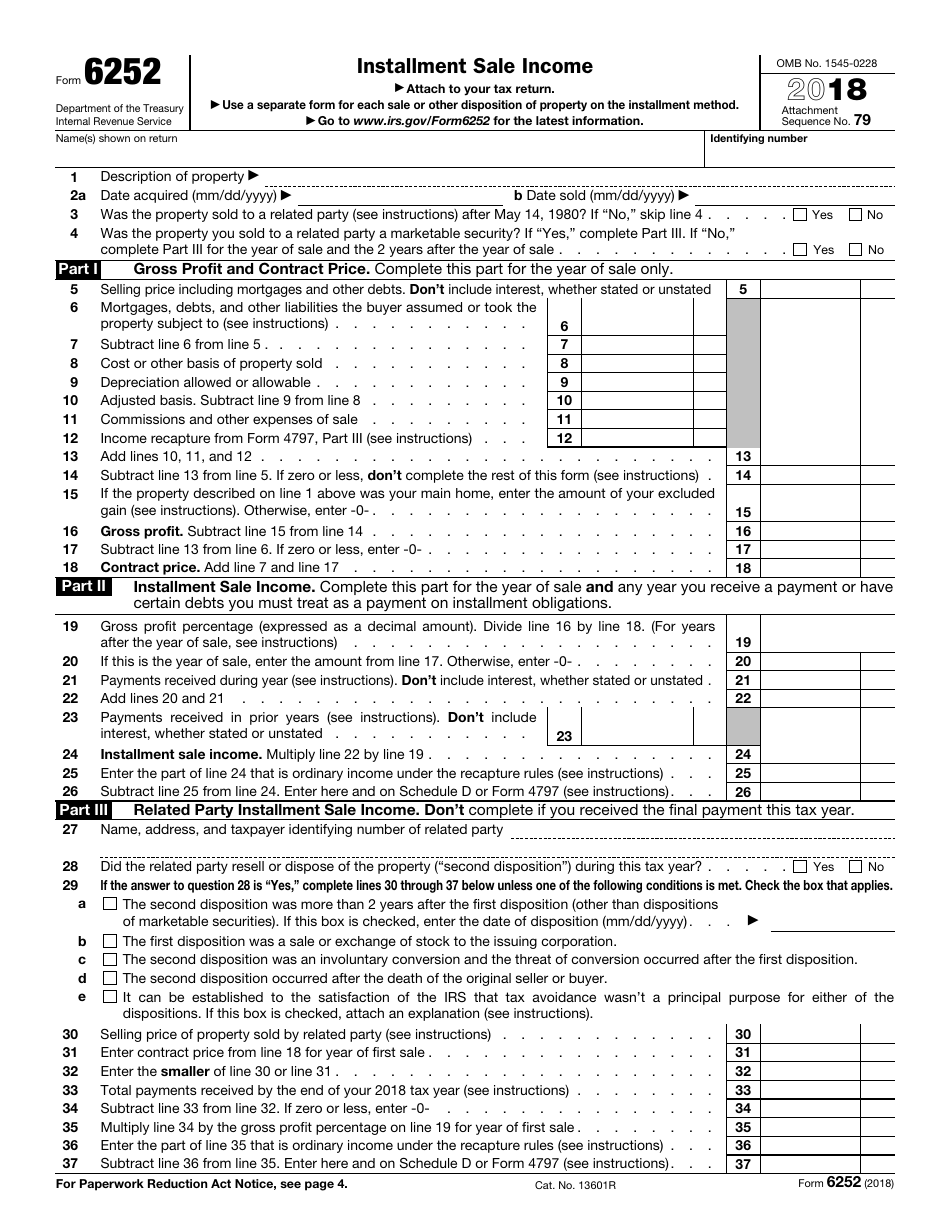

IRS Form 6252

for the current year.

IRS Form 6252 Installment Sale Income

What Is IRS Form 6252?

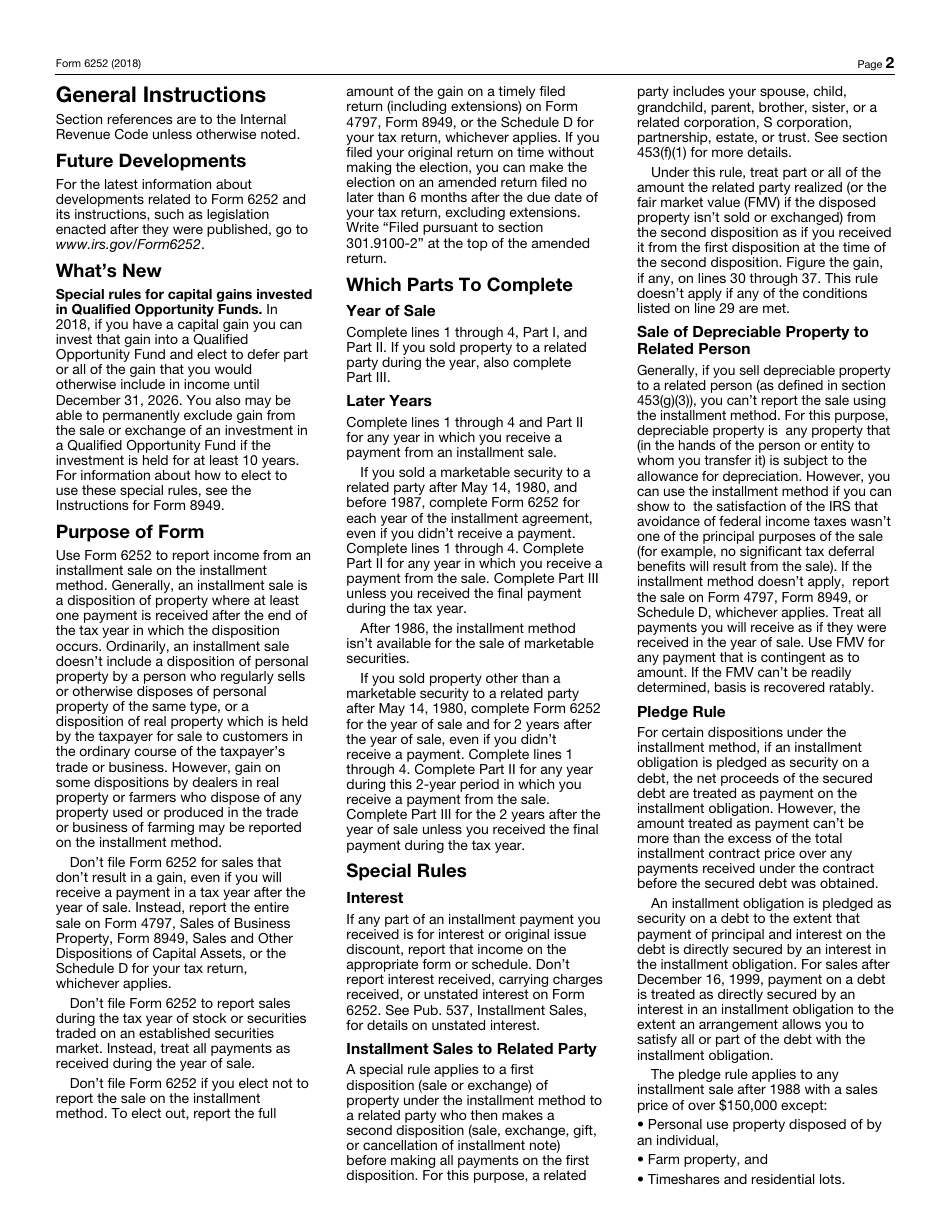

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 6252?

A: IRS Form 6252 is used to report installment sale income.

Q: What is an installment sale?

A: An installment sale is when you sell property and receive at least one payment after the tax year of the sale.

Q: Who uses IRS Form 6252?

A: Anyone who has engaged in an installment sale of property should use IRS Form 6252 to report the income.

Q: Why do I need to report installment sale income?

A: You need to report installment sale income to accurately report your taxable income and ensure compliance with tax laws.

Q: When is the deadline to file IRS Form 6252?

A: The deadline for filing IRS Form 6252 is usually April 15th, unless an extension has been granted.

Q: Are there any penalties for not filing IRS Form 6252?

A: Yes, failing to file IRS Form 6252 or reporting incorrect information may result in penalties and interest.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6252 through the link below or browse more documents in our library of IRS Forms.