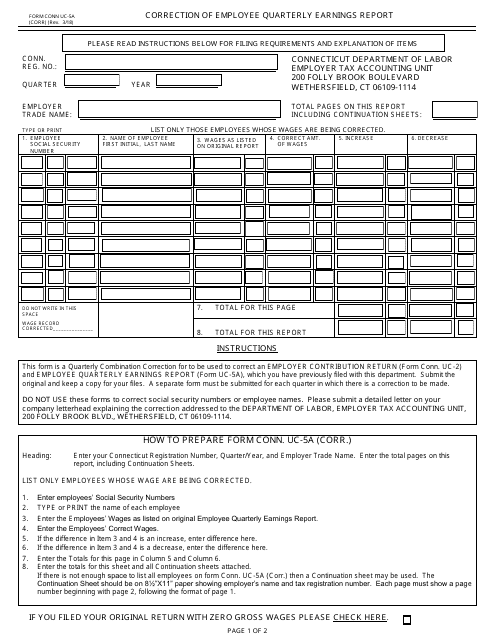

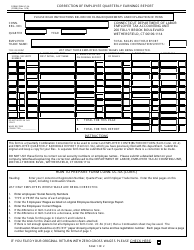

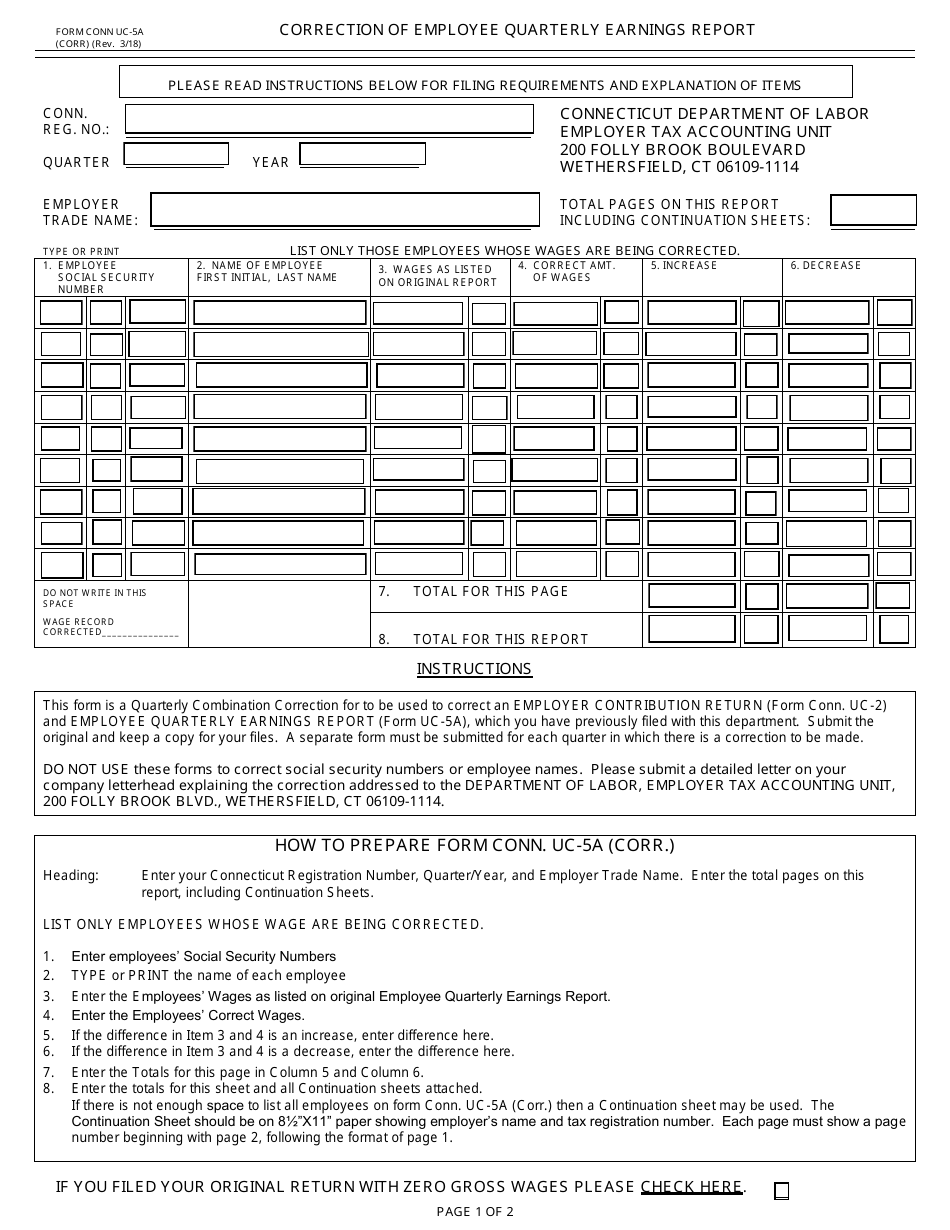

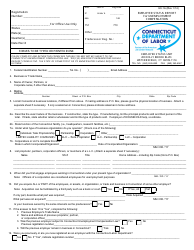

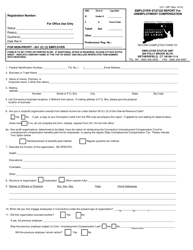

Form CONN.UC-5A Correction of Employee Quarterly Earnings Report - Connecticut

What Is Form CONN.UC-5A?

This is a legal form that was released by the Connecticut Department of Labor - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the form CONN.UC-5A?

A: The form CONN.UC-5A is the Correction of Employee Quarterly Earnings Report specific to Connecticut.

Q: What is the purpose of form CONN.UC-5A?

A: The purpose of form CONN.UC-5A is to correct any errors or omissions in the Employee Quarterly Earnings Report.

Q: Who should use form CONN.UC-5A?

A: Employers in Connecticut should use form CONN.UC-5A to correct errors in their Employee Quarterly Earnings Report.

Q: When should form CONN.UC-5A be filed?

A: Form CONN.UC-5A should be filed as soon as an error or omission is discovered in the Employee Quarterly Earnings Report.

Q: Are there any penalties for not filing form CONN.UC-5A?

A: Failure to file form CONN.UC-5A or filing it late may result in penalties imposed by the Connecticut Department of Labor.

Q: What information is required on form CONN.UC-5A?

A: Form CONN.UC-5A requires information such as the employer's name, address, and federal employer identification number, as well as the corrected wage and employment information for each employee.

Q: Can form CONN.UC-5A be used to report new hires?

A: No, form CONN.UC-5A is specifically for correcting errors in the Employee Quarterly Earnings Report. New hires should be reported using a different form or process.

Q: Is there a deadline for filing form CONN.UC-5A?

A: Form CONN.UC-5A should be filed as soon as possible after an error or omission is discovered, but there is no specific deadline mentioned in the document.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Connecticut Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CONN.UC-5A by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.