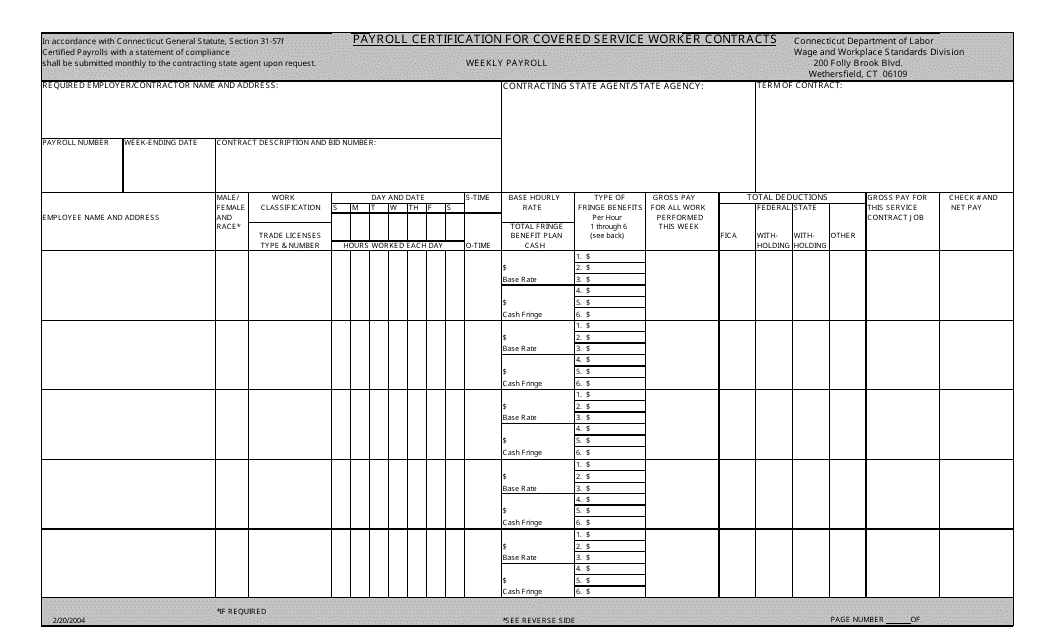

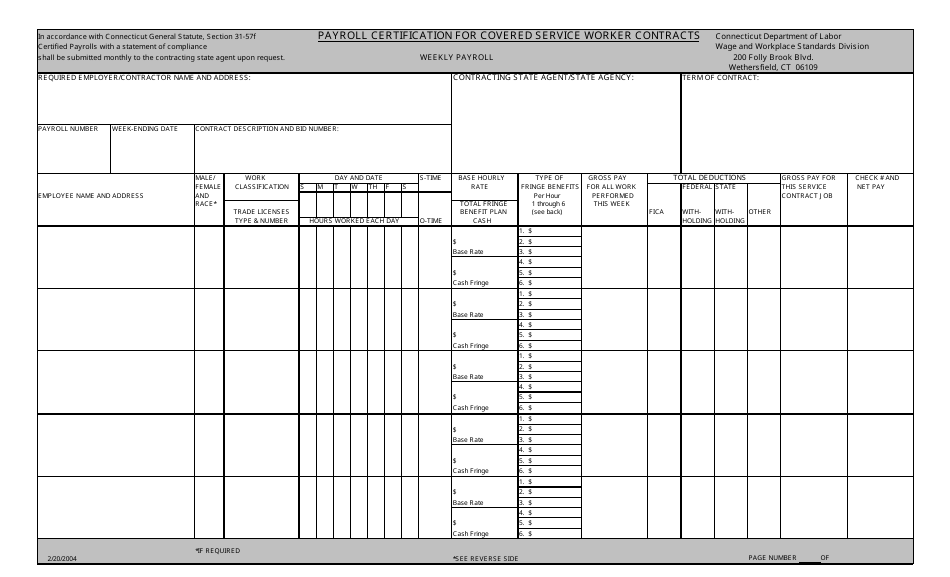

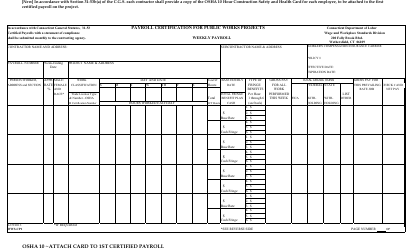

Payroll Certification for Covered Service Worker Contracts - Connecticut

Payroll Certification for Covered Service Worker Contracts is a legal document that was released by the Connecticut Department of Labor - a government authority operating within Connecticut.

FAQ

Q: What is payroll certification for covered service worker contracts?

A: Payroll certification is a process to verify wages, working hours, and employment benefits for covered service workers.

Q: Who are covered service workers in Connecticut?

A: Covered service workers in Connecticut refer to individuals employed by service contractors who provide services to state agencies.

Q: Why is payroll certification necessary?

A: Payroll certification ensures compliance with labor and employment laws, protects workers' rights, and promotes fair wages.

Q: Who is responsible for payroll certification?

A: Service contractors in Connecticut are responsible for payroll certification for their covered service workers.

Q: When should payroll certification be conducted?

A: Payroll certification for covered service worker contracts should be conducted on a monthly basis.

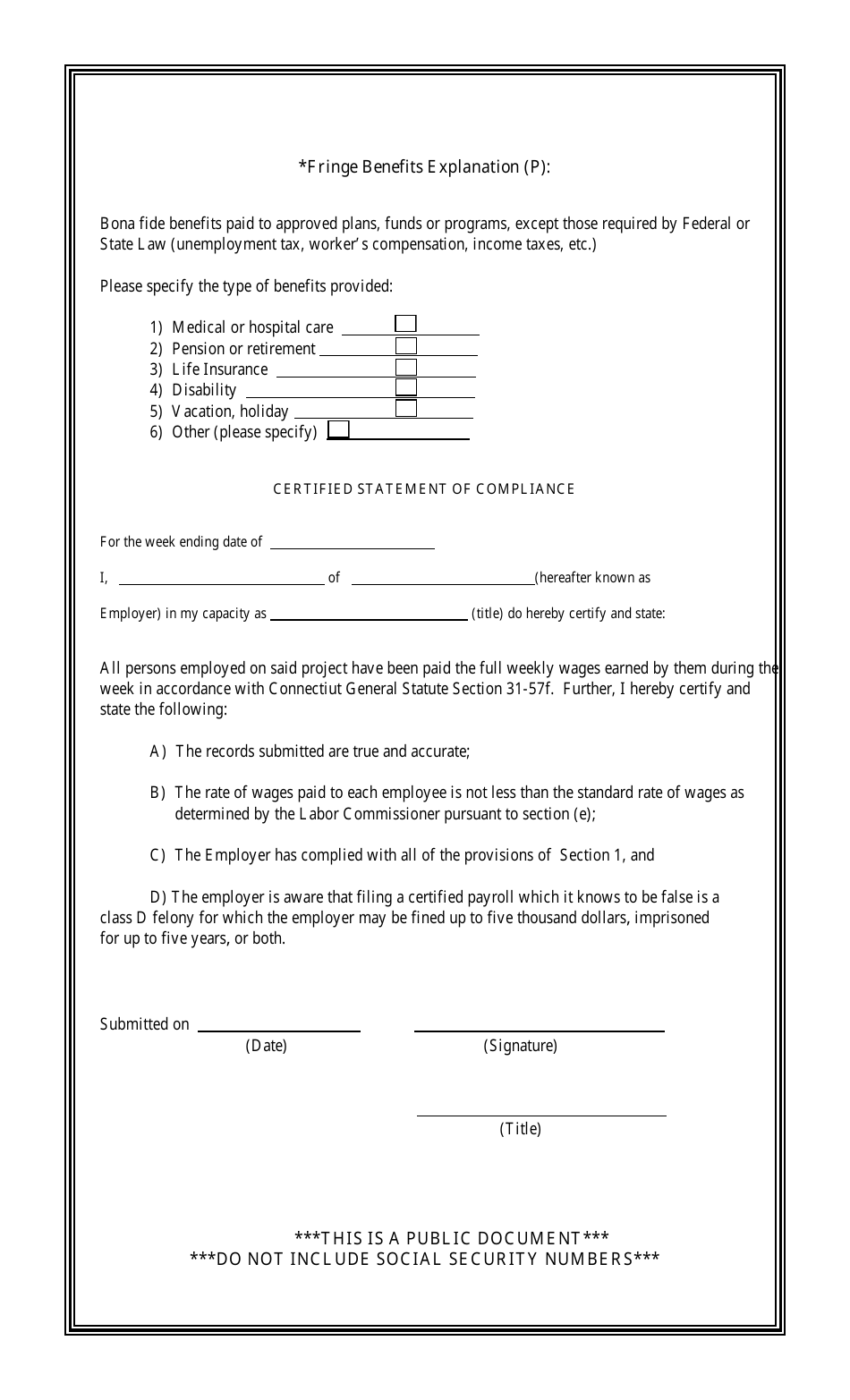

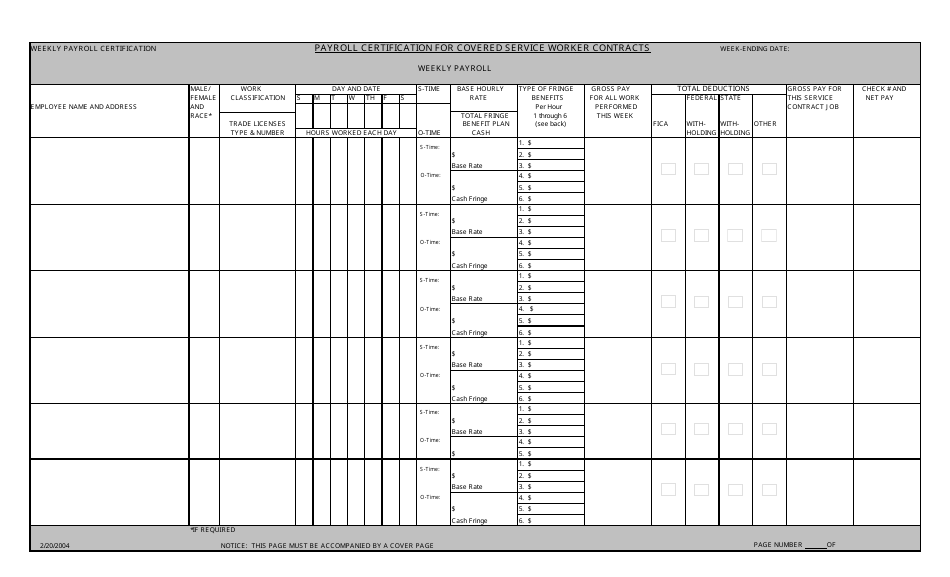

Q: What information is included in a payroll certification?

A: A payroll certification includes employee names, wages, hours worked, and any provided employment benefits.

Q: Are there any penalties for non-compliance with payroll certification?

A: Yes, service contractors may face penalties for non-compliance with payroll certification requirements, including contract termination and debarment.

Form Details:

- Released on February 20, 2004;

- The latest edition currently provided by the Connecticut Department of Labor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.