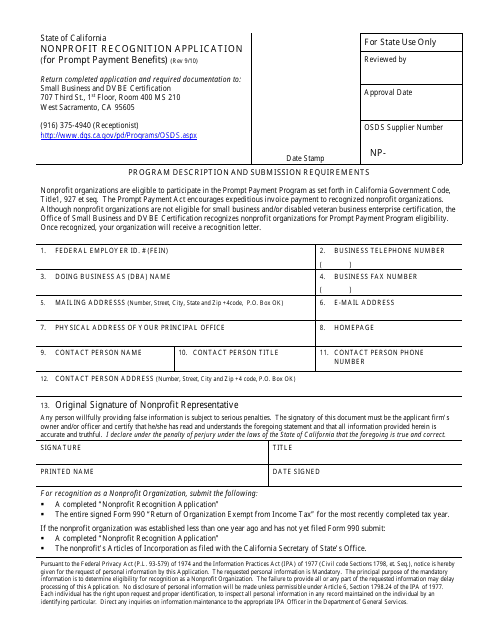

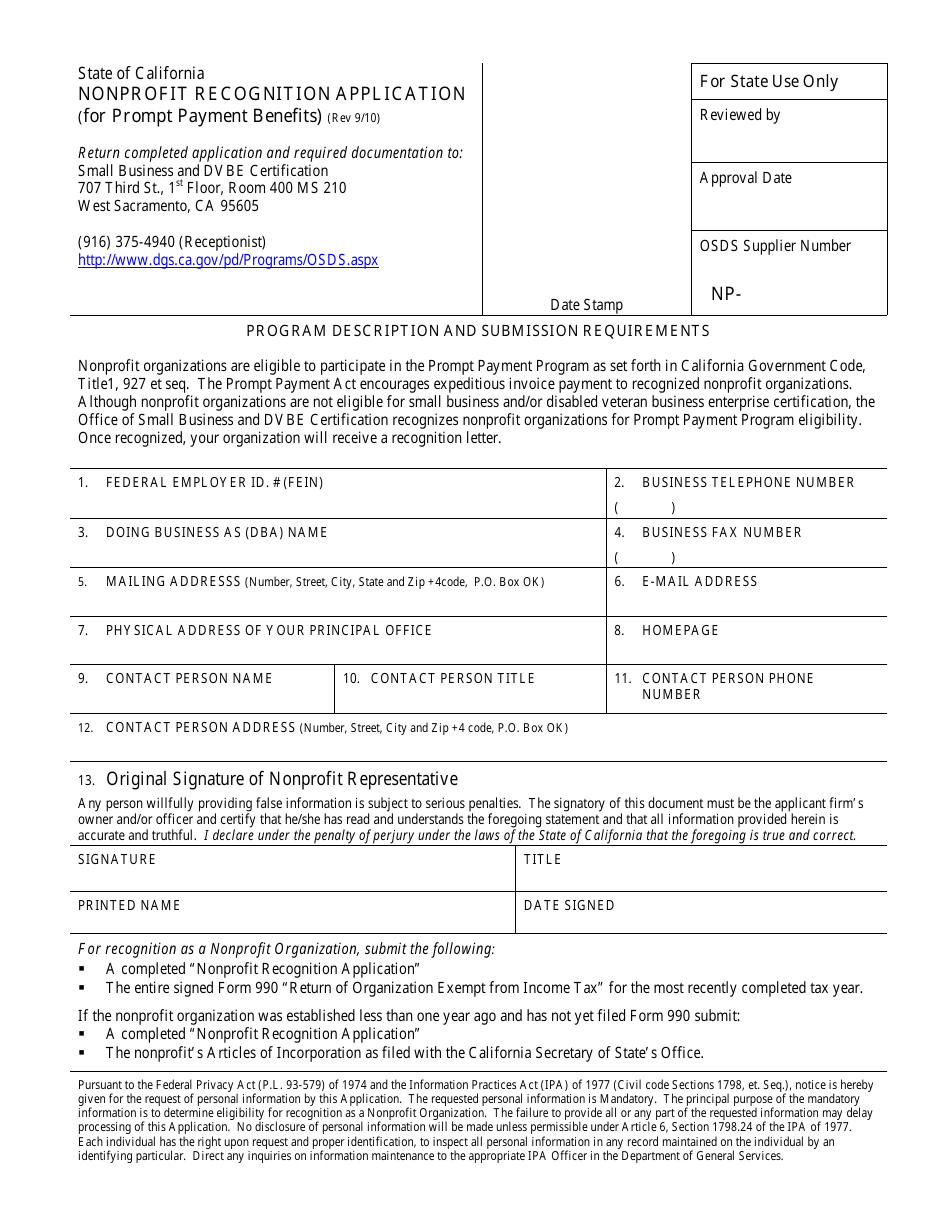

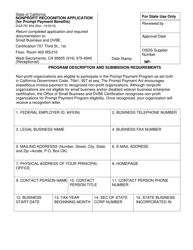

Nonprofit Recognition Application (For Prompt Payment Benefits) - California

Nonprofit Recognition Application (For Prompt Payment Benefits) is a legal document that was released by the California Department of General Services - a government authority operating within California.

FAQ

Q: What is a nonprofit recognition application?

A: A nonprofit recognition application is a form that nonprofit organizations in California need to submit to be recognized as tax-exempt by the state.

Q: Why do nonprofit organizations need to be recognized as tax-exempt?

A: Being recognized as tax-exempt allows nonprofit organizations to be exempt from certain taxes and also makes them eligible for various benefits and incentives.

Q: What are prompt payment benefits?

A: Prompt payment benefits refer to benefits provided to small businesses and nonprofit organizations that ensure they receive timely payments for their goods or services from government agencies.

Q: How do nonprofit organizations in California apply for prompt payment benefits?

A: Nonprofit organizations in California can apply for prompt payment benefits by submitting a nonprofit recognition application to the California state government.

Q: What is the purpose of the nonprofit recognition application for prompt payment benefits?

A: The purpose of the nonprofit recognition application for prompt payment benefits is to establish the eligibility of nonprofit organizations for receiving timely payments from government agencies.

Q: Are all nonprofit organizations in California eligible for prompt payment benefits?

A: Not all nonprofit organizations in California are eligible for prompt payment benefits. They need to submit a nonprofit recognition application and meet certain criteria to be eligible.

Q: Is there a fee for submitting the nonprofit recognition application?

A: Yes, there is usually a fee associated with submitting the nonprofit recognition application in California.

Q: What happens after a nonprofit organization's recognition application is approved?

A: After a nonprofit organization's recognition application is approved, it will be recognized as tax-exempt by the state of California and will be eligible for prompt payment benefits and other tax-exempt benefits.

Q: Can nonprofit organizations in California apply for prompt payment benefits retroactively?

A: No, nonprofit organizations in California cannot apply for prompt payment benefits retroactively. The benefits will start from the date of approval of their recognition application.

Form Details:

- Released on September 1, 2010;

- The latest edition currently provided by the California Department of General Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of General Services.