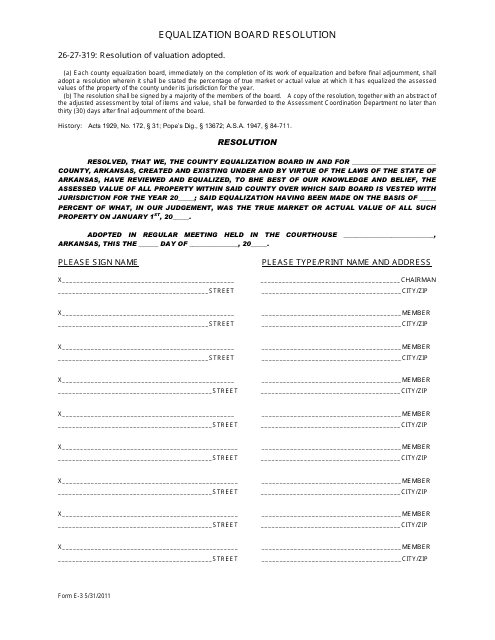

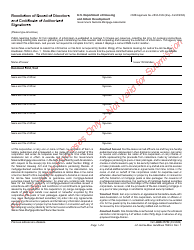

Form E-3 Equalization Board Resolution - Arkansas

What Is Form E-3?

This is a legal form that was released by the Arkansas Assessment Coordination Department - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-3?

A: Form E-3 is a Equalization Board Resolution.

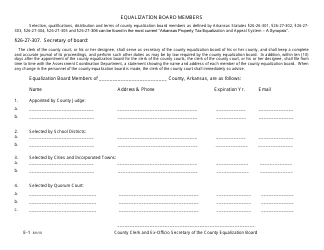

Q: What is an Equalization Board?

A: An Equalization Board is a board responsible for ensuring fair assessments of property for tax purposes.

Q: What is the purpose of Form E-3?

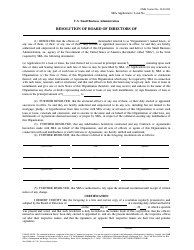

A: The purpose of Form E-3 is to document the decisions made by the Equalization Board regarding property assessments.

Q: Who needs to fill out Form E-3?

A: Form E-3 needs to be filled out by the Equalization Board.

Q: Is Form E-3 specific to Arkansas?

A: Yes, Form E-3 is specific to Arkansas.

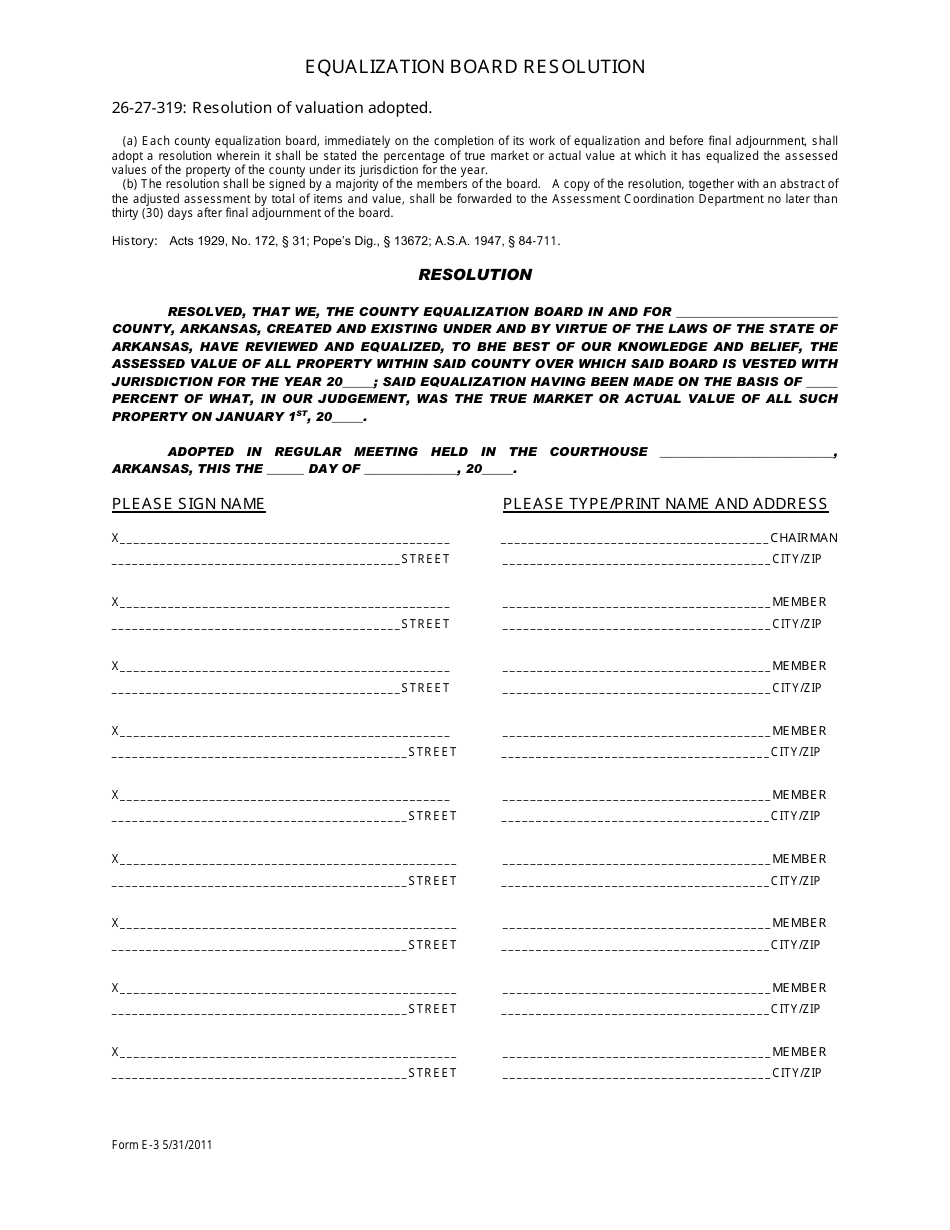

Q: What information is required on Form E-3?

A: Form E-3 requires information about the property being assessed, the decisions made by the Equalization Board, and the signatures of the board members.

Q: When should Form E-3 be filled out?

A: Form E-3 should be filled out after the decisions regarding property assessments have been made by the Equalization Board.

Q: Is there a deadline for submitting Form E-3?

A: Yes, the deadline for submitting Form E-3 is determined by the Arkansas Department of Finance and Administration.

Q: Are there any fees associated with filing Form E-3?

A: There may be fees associated with filing Form E-3, depending on the policies of the Arkansas Department of Finance and Administration.

Form Details:

- Released on May 31, 2011;

- The latest edition provided by the Arkansas Assessment Coordination Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-3 by clicking the link below or browse more documents and templates provided by the Arkansas Assessment Coordination Department.