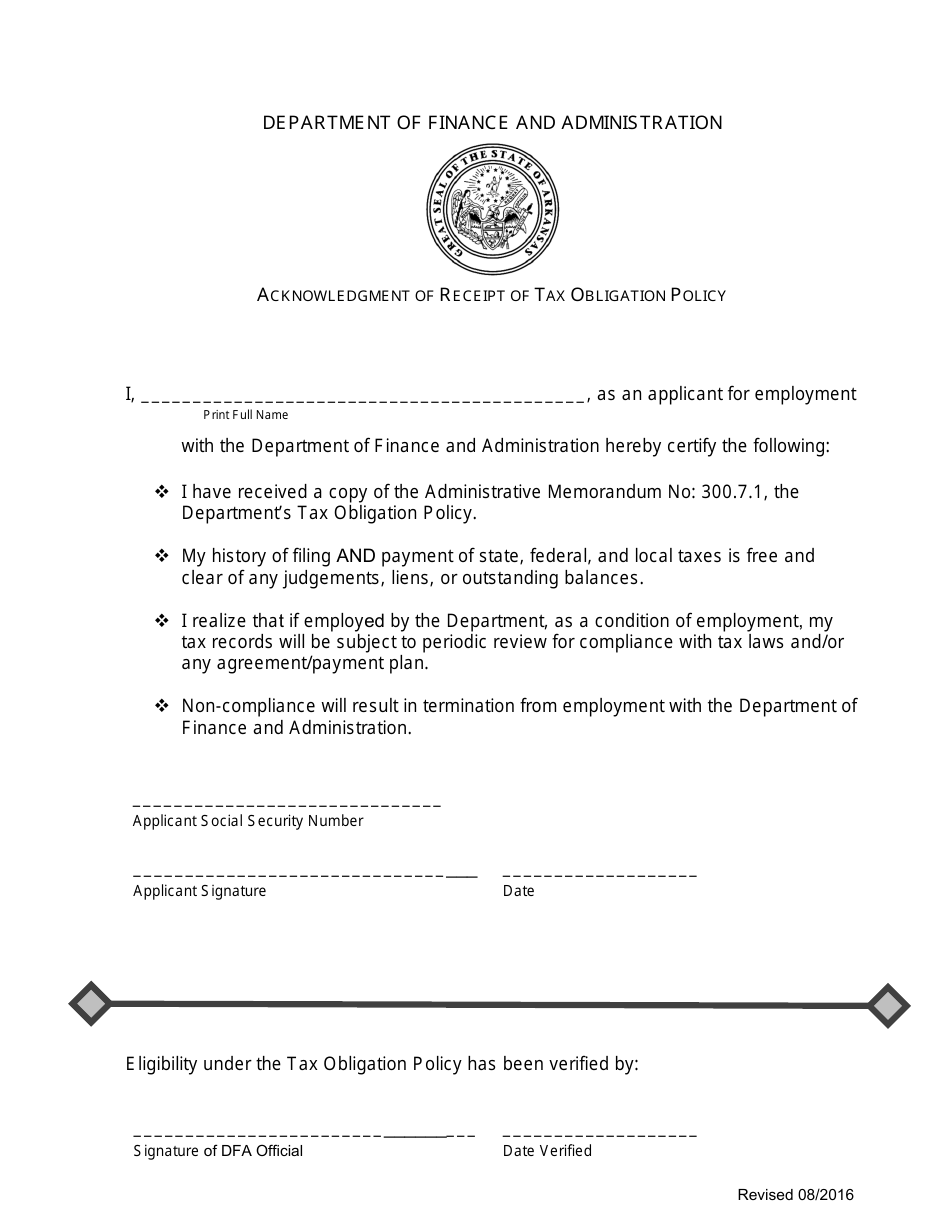

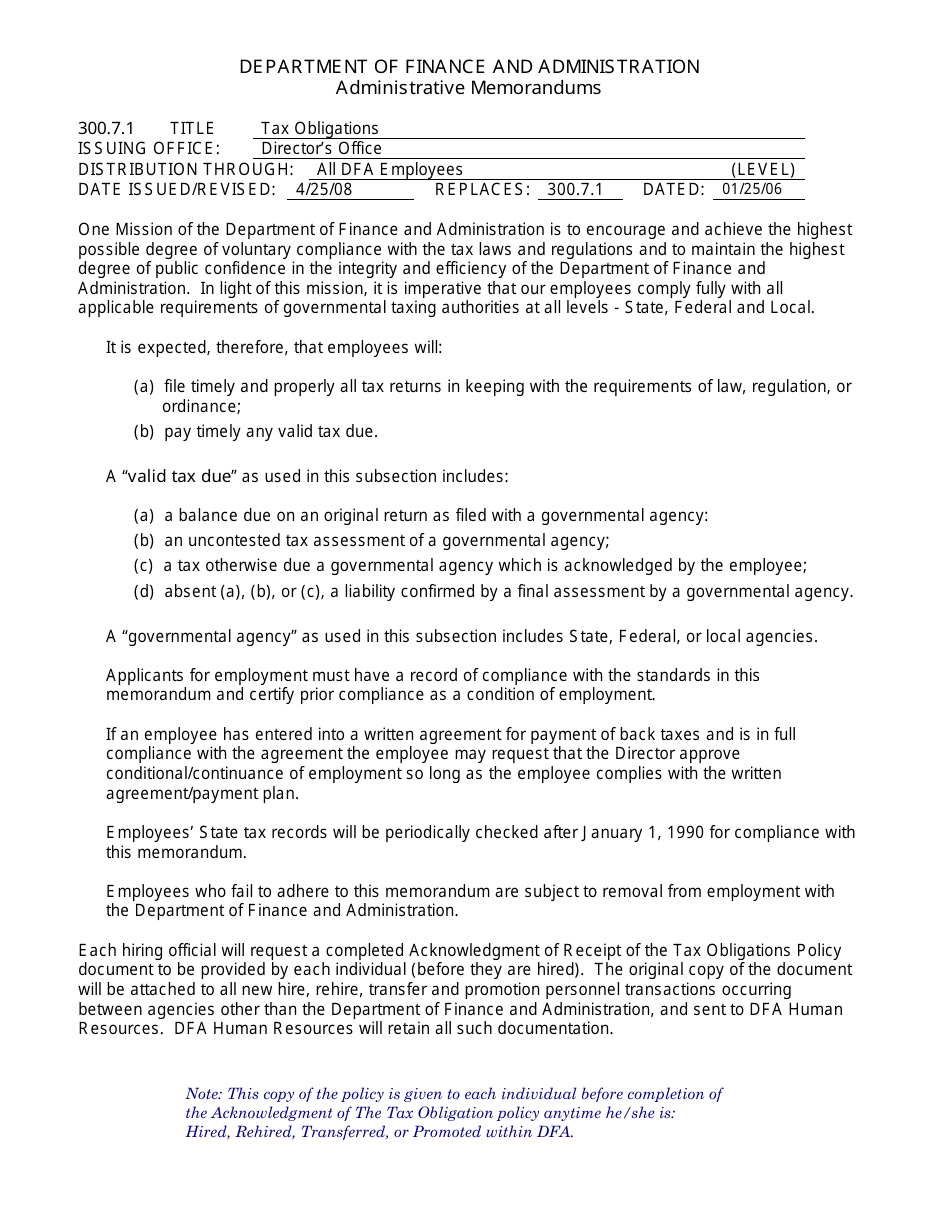

Acknowledgment of Receipt of Tax Obligation Policy - Arkansas

Acknowledgment of Receipt of Tax Obligation Policy is a legal document that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas.

FAQ

Q: What is the tax obligation policy in Arkansas?

A: The tax obligation policy in Arkansas refers to the legal requirement for individuals and businesses to pay taxes to the state government.

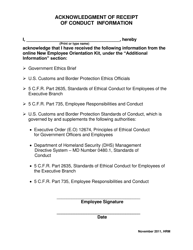

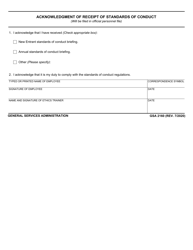

Q: What does the acknowledgment of receipt refer to in this document?

A: The acknowledgment of receipt in this document refers to a confirmation that the tax obligation policy has been received and understood by the individual or business recipient.

Q: Is it mandatory to comply with the tax obligation policy in Arkansas?

A: Yes, it is mandatory to comply with the tax obligation policy in Arkansas. Failure to do so may result in penalties.

Q: What happens if I do not pay my taxes in Arkansas?

A: If you do not pay your taxes in Arkansas, you may face penalties such as fines, interest charges, or legal action.

Q: Who is responsible for paying taxes in Arkansas?

A: Both individuals and businesses are responsible for paying taxes in Arkansas, based on their income, property ownership, or other taxable activities.

Form Details:

- Released on August 1, 2016;

- The latest edition currently provided by the Arkansas Department of Finance & Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.