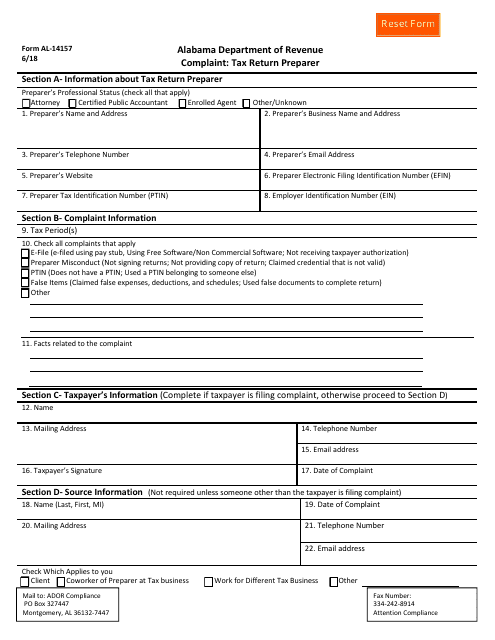

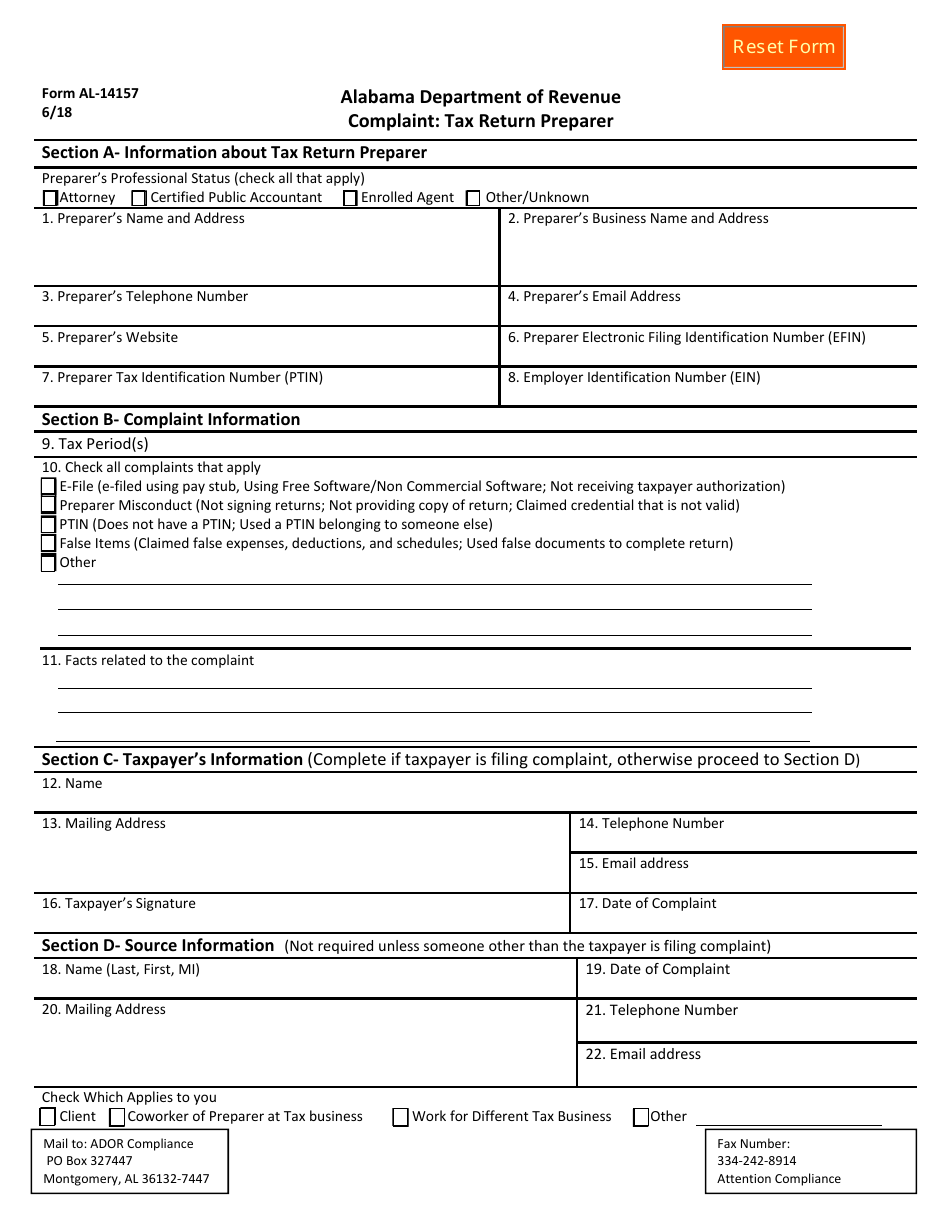

Form AL-14157 Tax Return Preparer Complaint Form - Alabama

What Is Form AL-14157?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AL-14157?

A: Form AL-14157 is the Tax Return Preparer Complaint Form in Alabama.

Q: Who can use form AL-14157?

A: Anyone can use form AL-14157 to file a complaint against a tax return preparer in Alabama.

Q: What is the purpose of form AL-14157?

A: The purpose of form AL-14157 is to report any fraudulent or abusive behavior by a tax return preparer in Alabama.

Q: How should I fill out form AL-14157?

A: Fill out form AL-14157 with all the relevant information about the tax return preparer and the nature of the complaint.

Q: What should I do with form AL-14157 once it's filled out?

A: Once you have filled out form AL-14157, you should submit it to the Alabama Department of Revenue.

Q: Is there a deadline for submitting form AL-14157?

A: There is no specific deadline mentioned for submitting form AL-14157, but it is recommended to file the complaint as soon as possible.

Q: Can I remain anonymous when submitting form AL-14157?

A: Yes, you can choose to remain anonymous when submitting form AL-14157.

Q: What happens after I submit form AL-14157?

A: After you submit form AL-14157, the Alabama Department of Revenue will review your complaint and take appropriate action if necessary.

Q: Is there any cost associated with filing form AL-14157?

A: There is no mention of any cost associated with filing form AL-14157 in the document.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AL-14157 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.