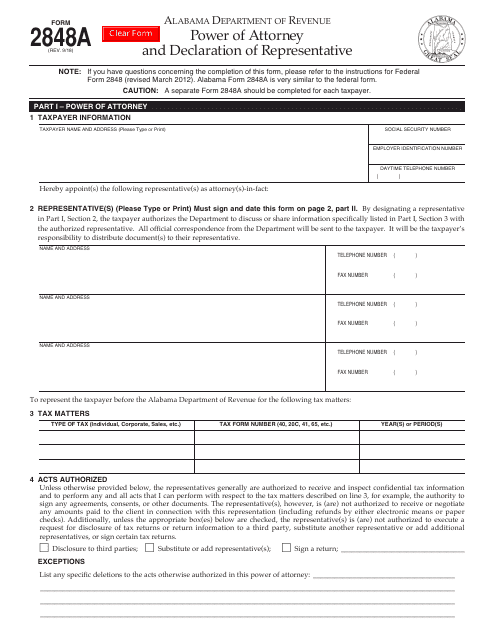

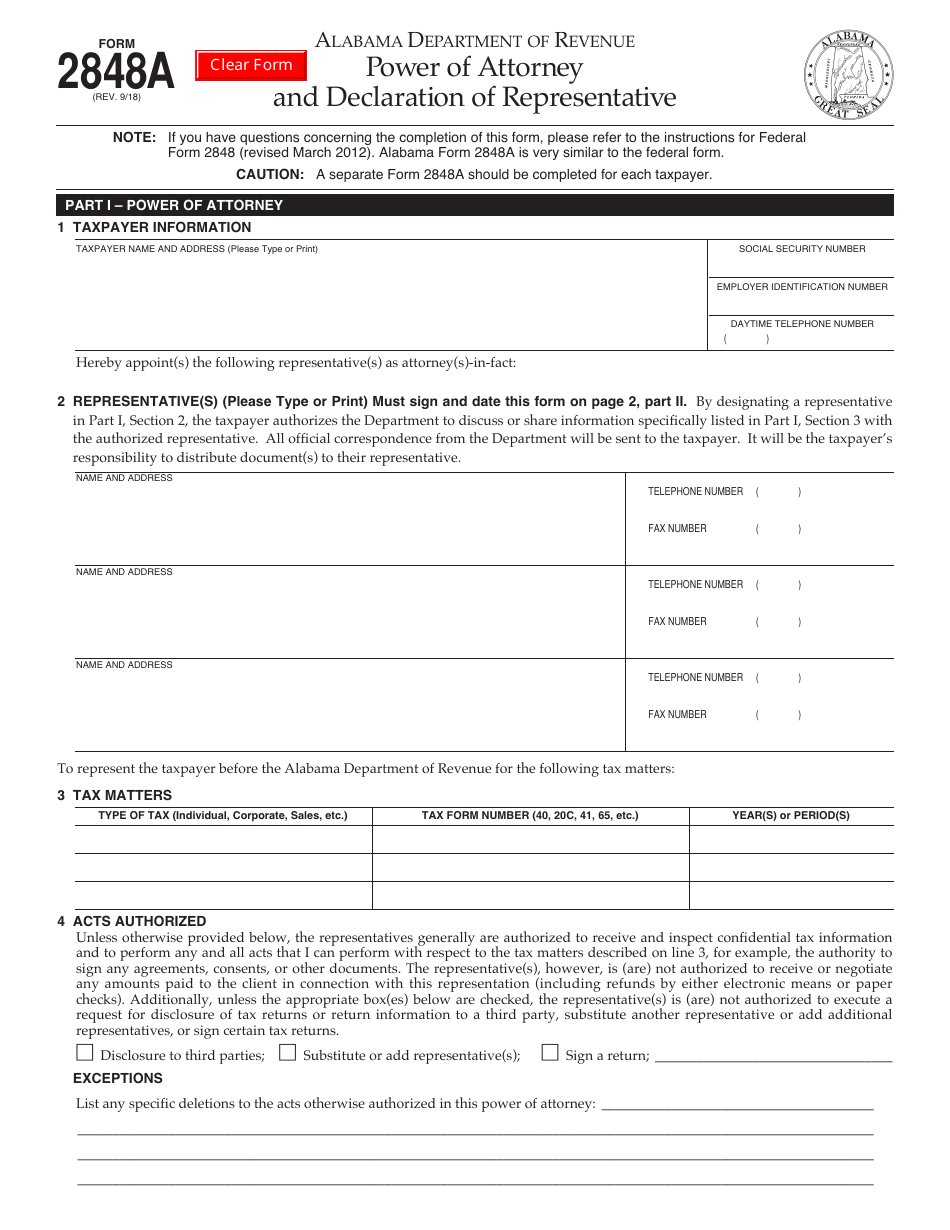

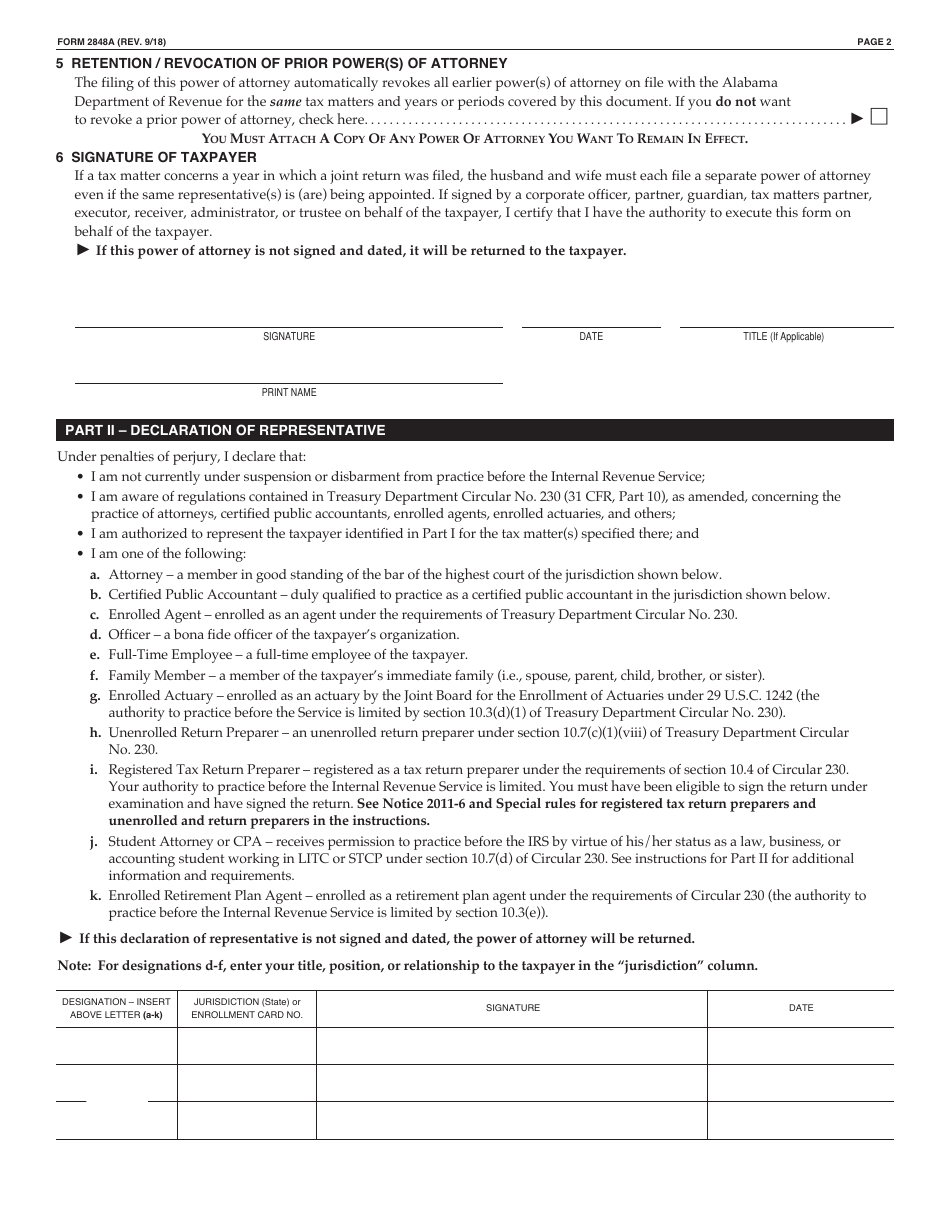

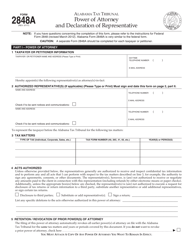

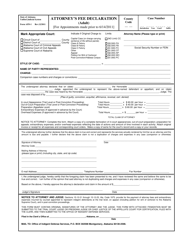

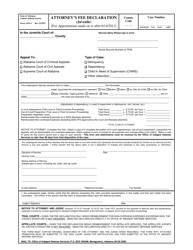

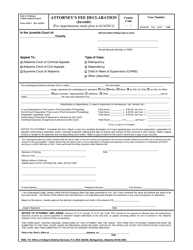

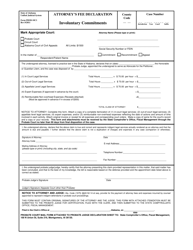

Form 2848A Power of Attorney and Declaration of Representative - Alabama

What Is Form 2848A?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2848A Power of Attorney and Declaration of Representative - Alabama?

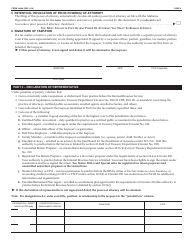

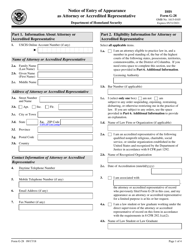

A: Form 2848A is a legal document that allows you to authorize someone else to represent you before the Alabama Department of Revenue.

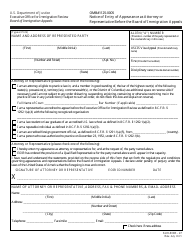

Q: Who can use Form 2848A?

A: Form 2848A can be used by individuals or businesses who want to appoint a representative to handle tax matters with the Alabama Department of Revenue.

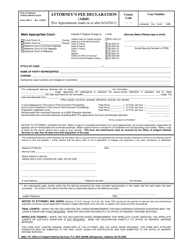

Q: What information is required on Form 2848A?

A: You will need to provide your personal information, the representative's information, and specify the scope of the representative's authority.

Q: How do I fill out Form 2848A?

A: You need to accurately fill in all the required information on the form, including your name, contact details, and the representative's information. Be sure to clearly state the specific tax matter(s) the representative is authorized to handle.

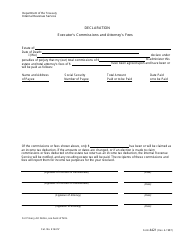

Q: How long is Form 2848A valid?

A: Form 2848A remains in effect until revoked or superseded by a new power of attorney.

Q: Can I cancel or revoke Form 2848A?

A: Yes, you can revoke the power of attorney by filing a new Form 2848A with the Alabama Department of Revenue or by sending a written statement of revocation.

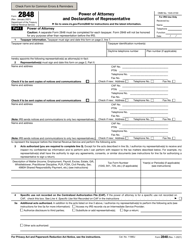

Q: Can I use Form 2848A for federal tax matters?

A: No, Form 2848A is specific to Alabama state tax matters. You need to use Form 2848 for federal tax matters.

Q: Are there any fees associated with filing Form 2848A?

A: No, there are no fees required to file Form 2848A with the Alabama Department of Revenue.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2848A by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.