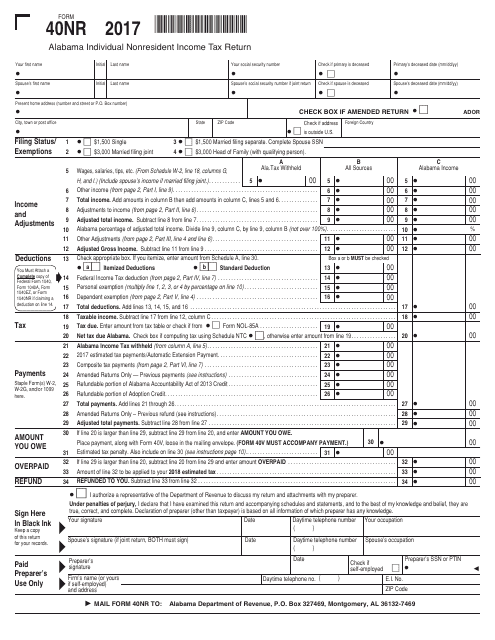

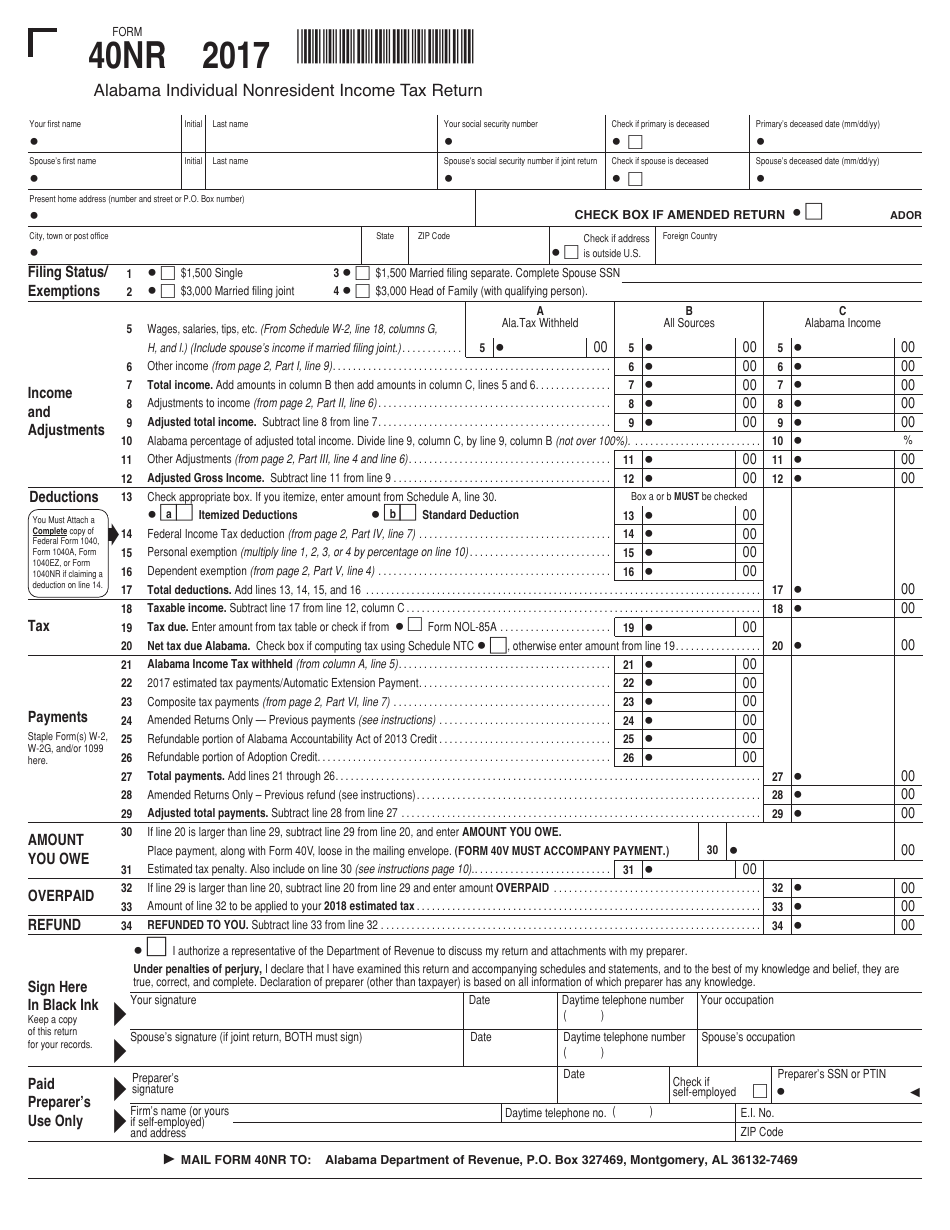

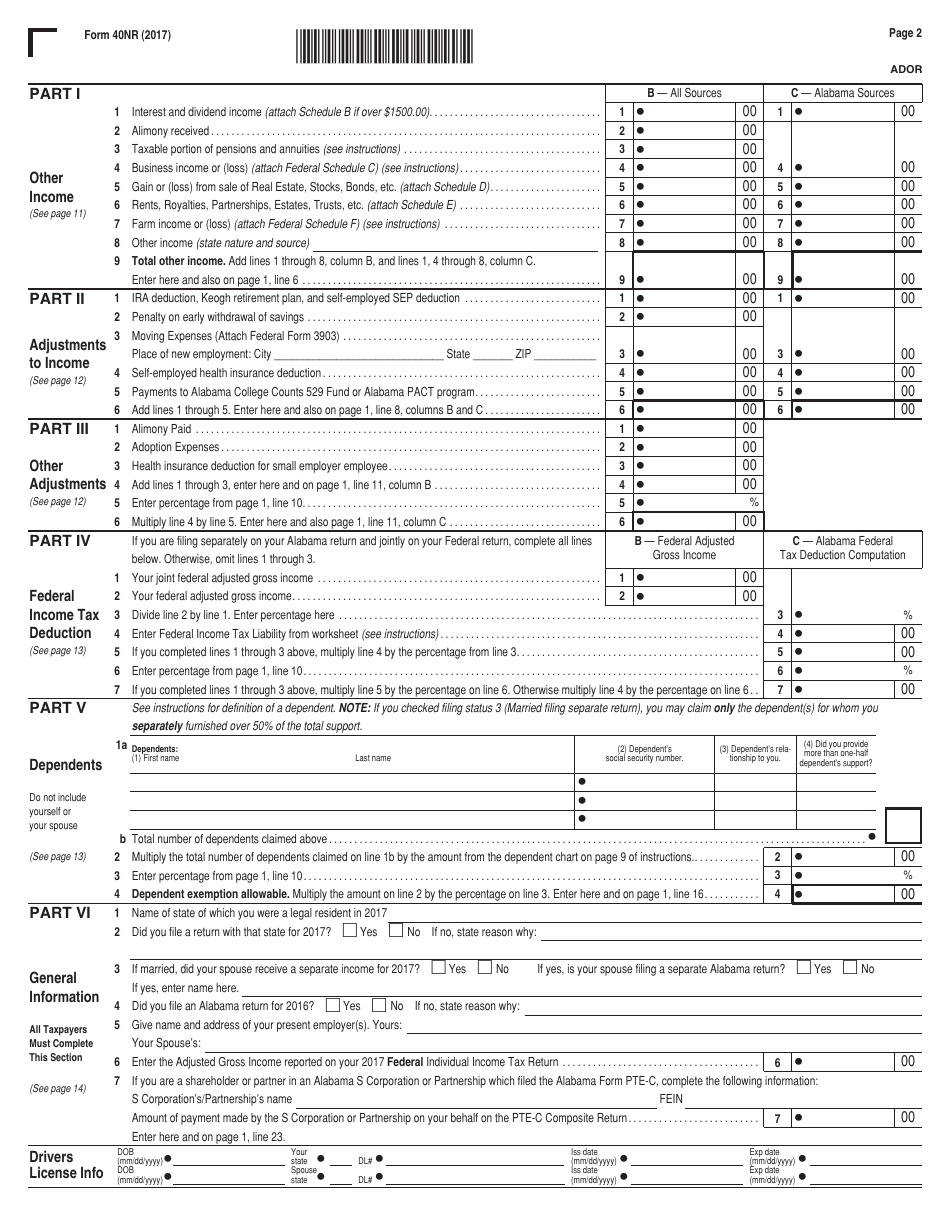

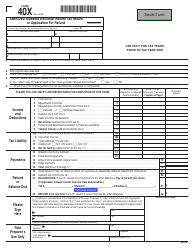

Form 40NR Alabama Individual Nonresident Income Tax Return - Alabama

What Is Form 40NR?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40NR?

A: Form 40NR is the Alabama Individual Nonresident Income Tax Return.

Q: Who needs to file Form 40NR?

A: Nonresidents of Alabama who earned income in Alabama during the tax year need to file Form 40NR.

Q: What is the purpose of Form 40NR?

A: The purpose of Form 40NR is to report and calculate the amount of income tax owed by nonresidents of Alabama.

Q: What information do I need to complete Form 40NR?

A: You will need information about your income earned in Alabama, deductions, and any tax credits or payments made during the tax year.

Q: When is the deadline for filing Form 40NR?

A: The deadline for filing Form 40NR is the same as the federal tax filing deadline, which is typically April 15th.

Q: Are there any penalties for late filing of Form 40NR?

A: Yes, there may be penalties for late filing or underpayment of taxes. It is important to file your tax return on time to avoid penalties.

Q: Can I e-file Form 40NR?

A: No, Alabama does not currently offer e-filing for Form 40NR. It must be filed by mail.

Q: Can I get a refund if I overpaid my Alabama income tax?

A: Yes, if you overpaid your Alabama income tax, you can request a refund by filing Form 40NR and indicating the amount you would like refunded.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 40NR by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.