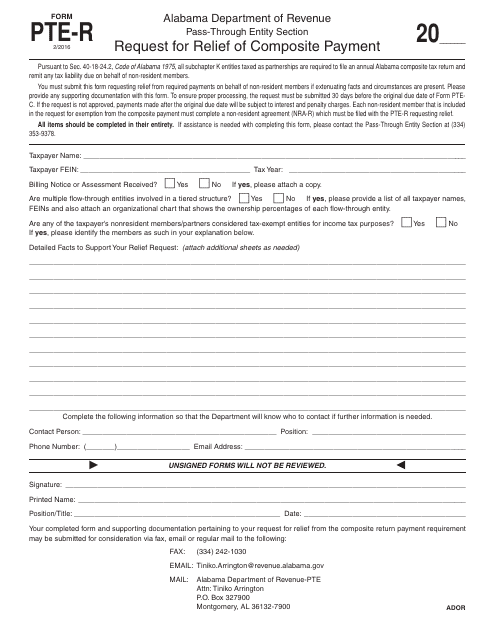

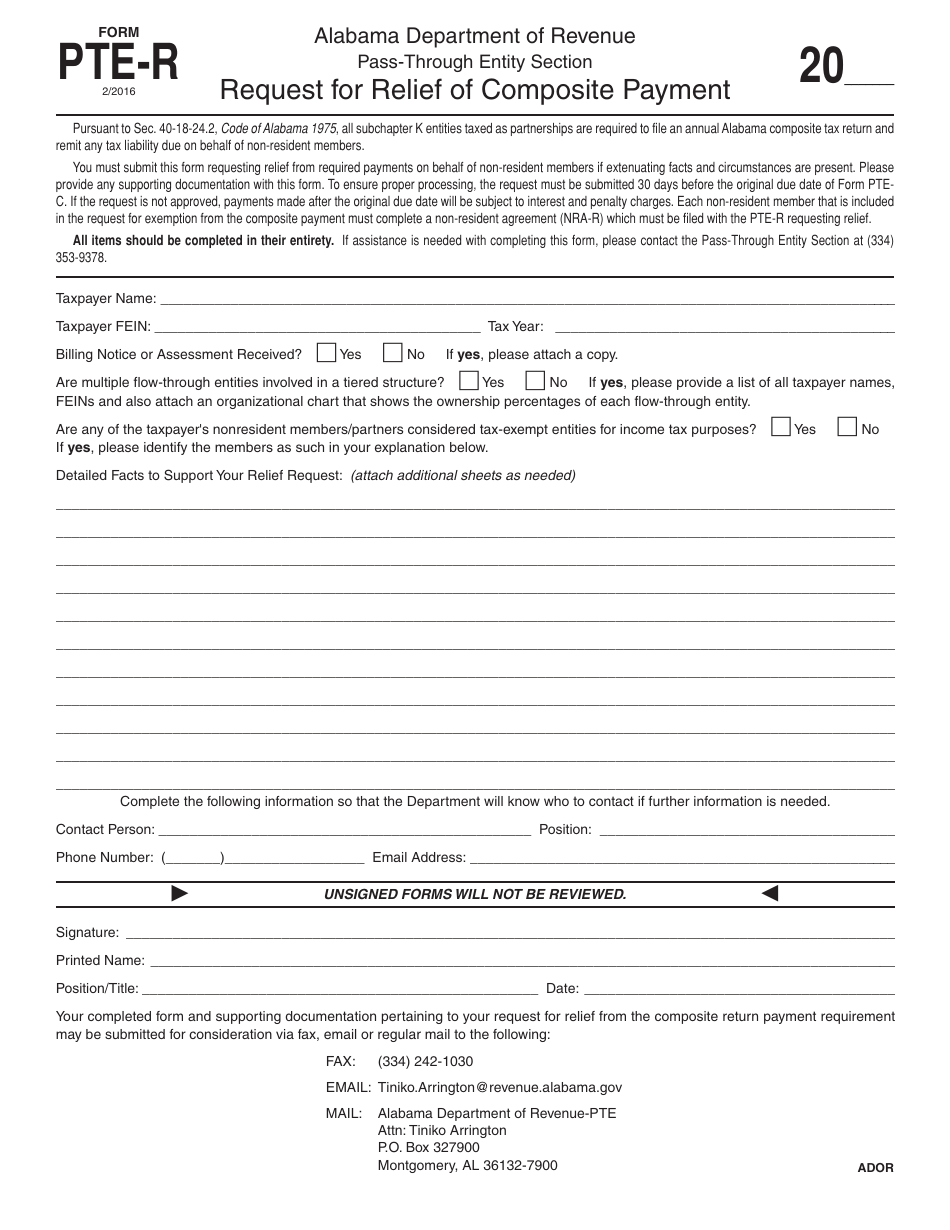

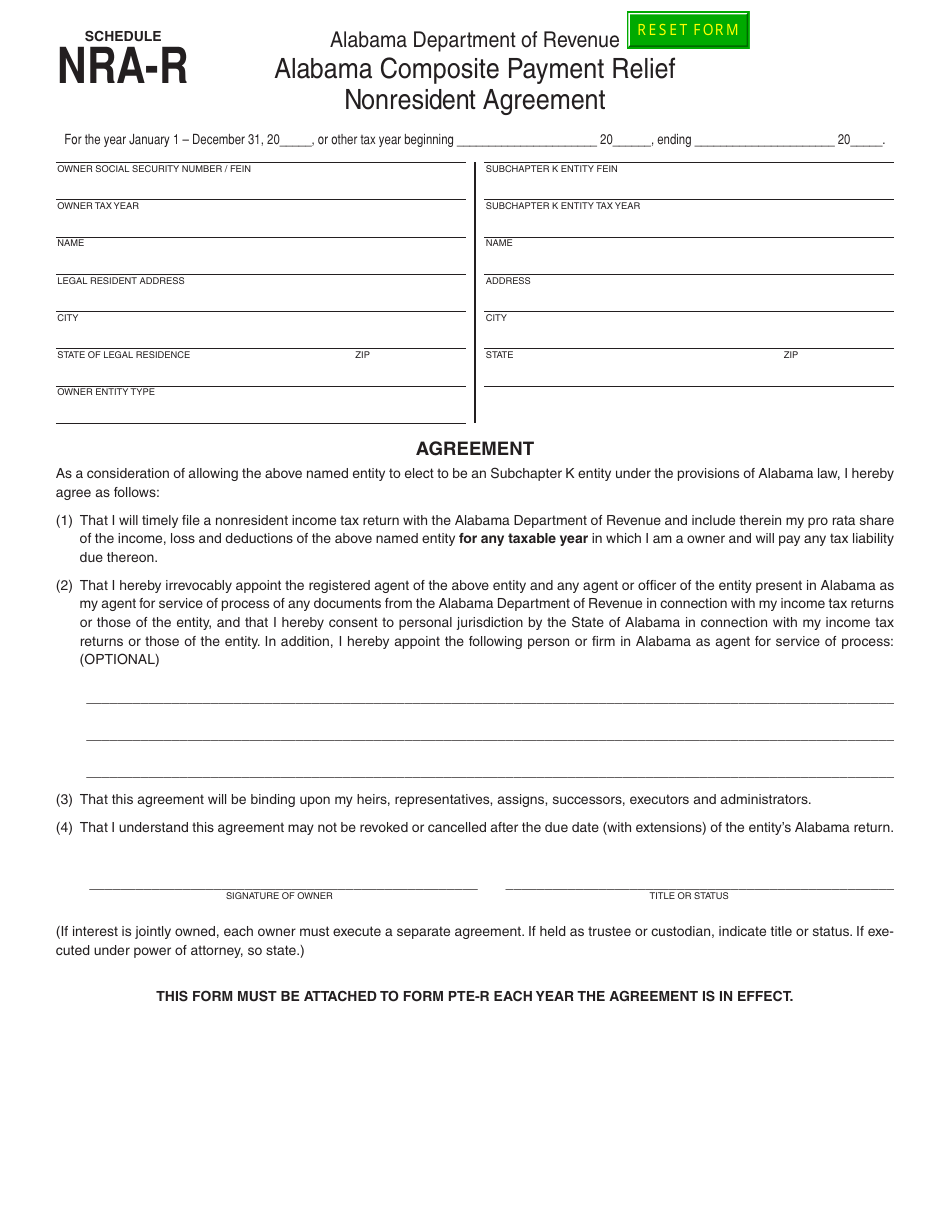

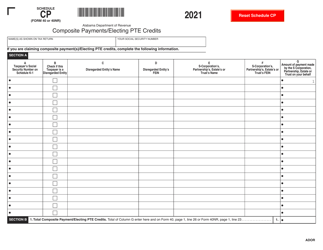

Form PTE-R Request for Relief of Composite Payment - Alabama

What Is Form PTE-R?

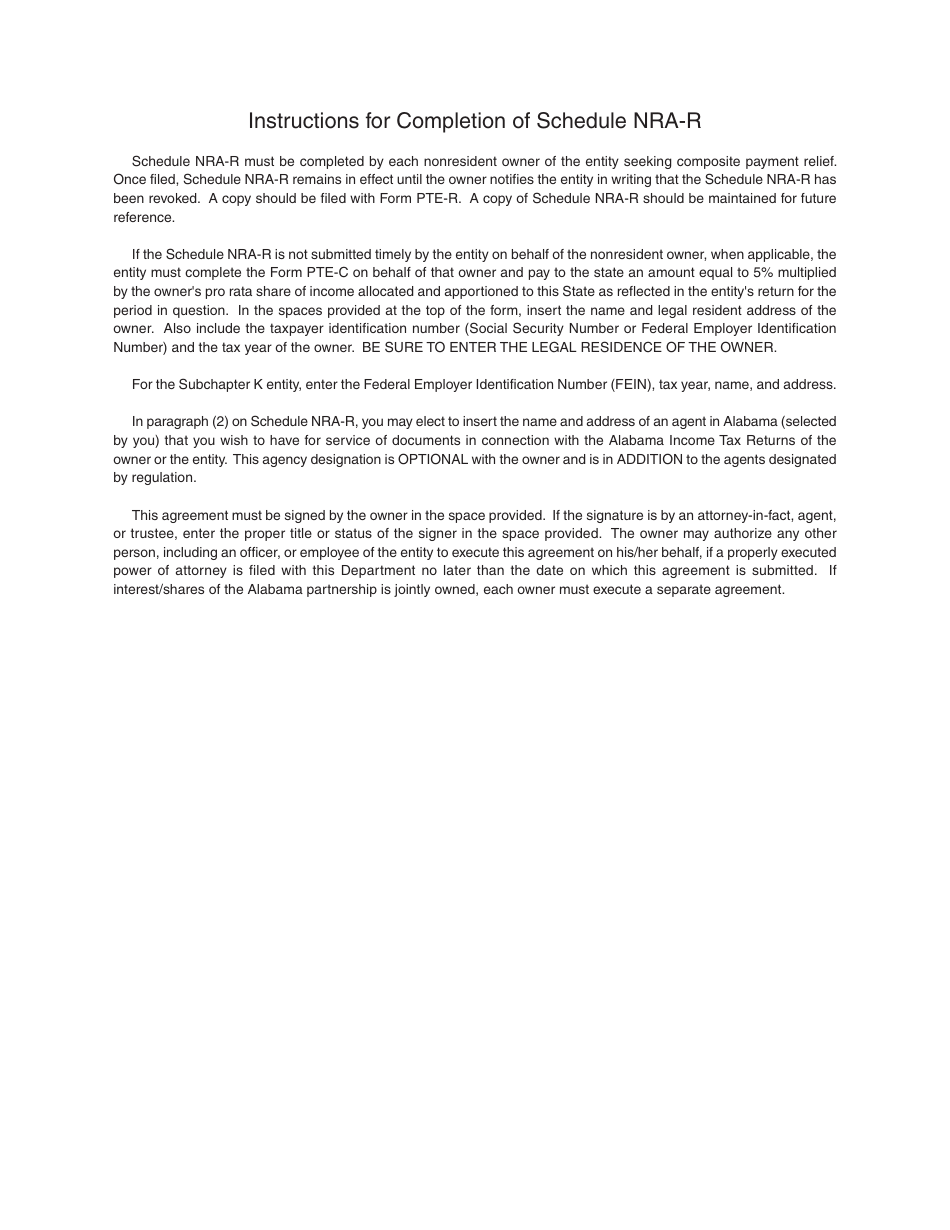

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-R?

A: Form PTE-R is a Request for Relief of Composite Payment.

Q: What is the purpose of Form PTE-R?

A: The purpose of Form PTE-R is to request relief from composite payment for a nonresident partner or shareholder.

Q: Who needs to complete Form PTE-R?

A: Nonresident partners or shareholders who want relief from composite payment in Alabama need to complete Form PTE-R.

Q: What is composite payment?

A: Composite payment is a tax payment made by a pass-through entity on behalf of its nonresident members.

Q: When should Form PTE-R be filed?

A: Form PTE-R should be filed on or before the due date of the pass-through entity's return.

Q: Is there a fee for filing Form PTE-R?

A: No, there is no fee for filing Form PTE-R.

Q: Are there any penalties for not filing Form PTE-R?

A: Yes, failure to file Form PTE-R may result in penalties or interest.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTE-R by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.