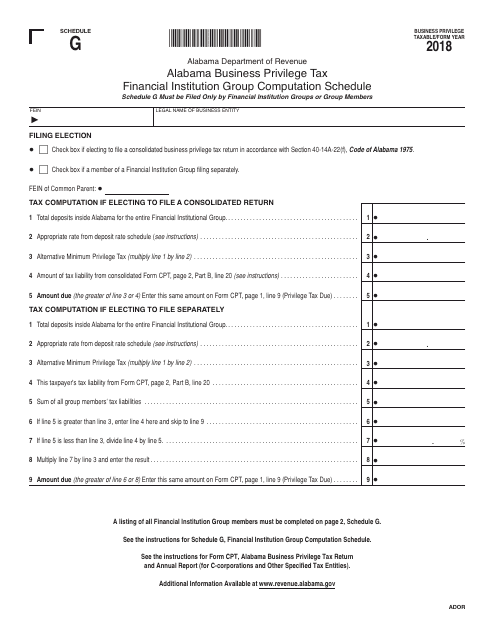

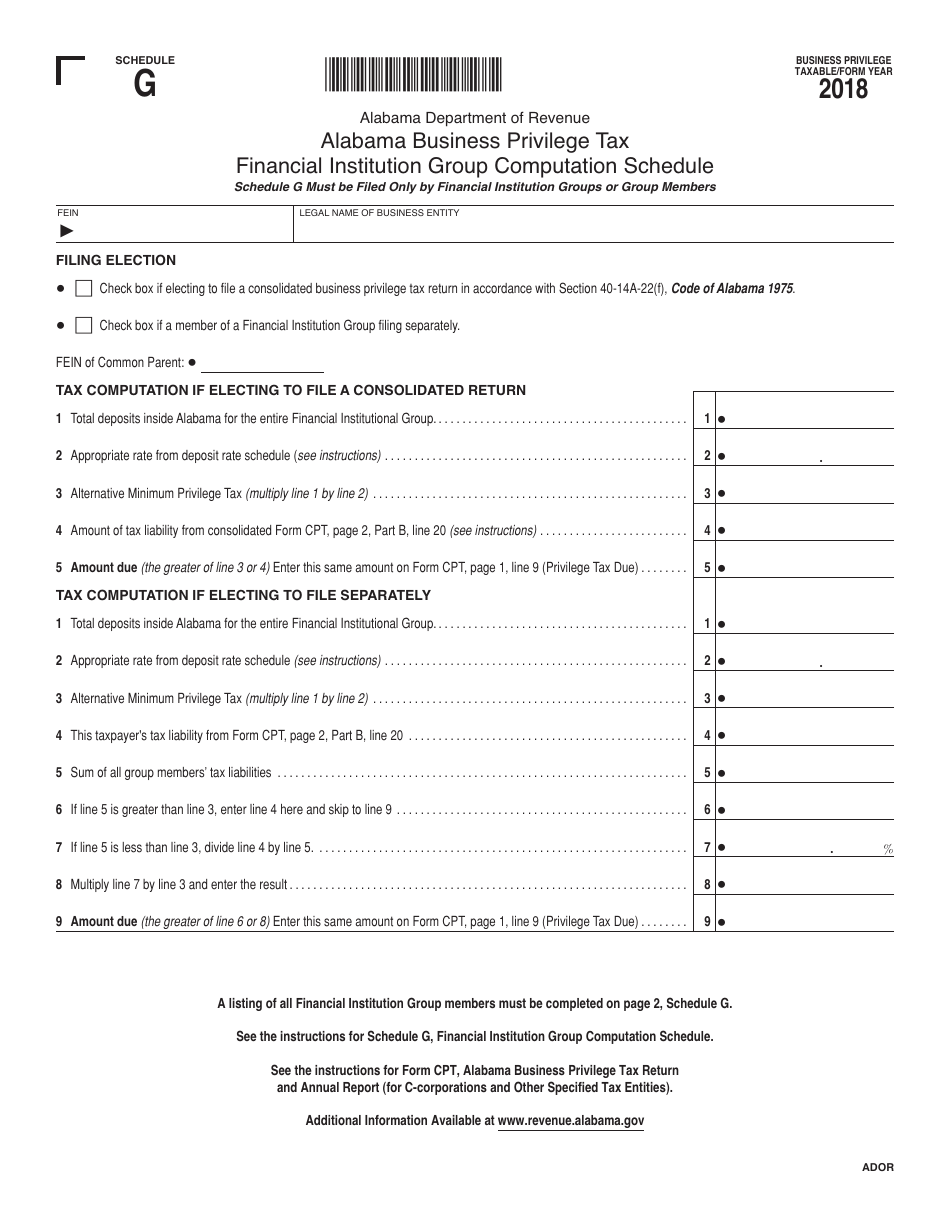

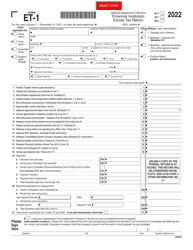

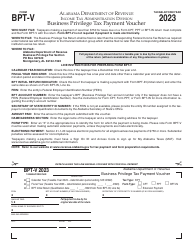

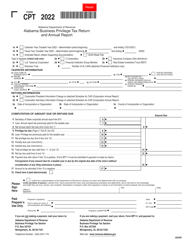

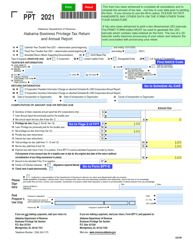

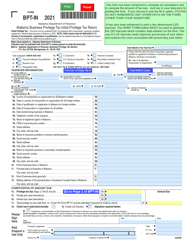

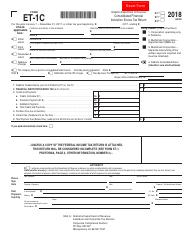

Schedule G Alabama Business Privilege Tax Financial Institution Group Computation Schedule - Alabama

What Is Schedule G?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule G?

A: Schedule G is a computation schedule used for the Alabama Business Privilege Tax for Financial Institution Group.

Q: What is the Alabama Business Privilege Tax?

A: The Alabama Business Privilege Tax is a tax imposed on businesses operating in Alabama.

Q: Who needs to file Schedule G?

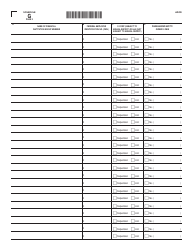

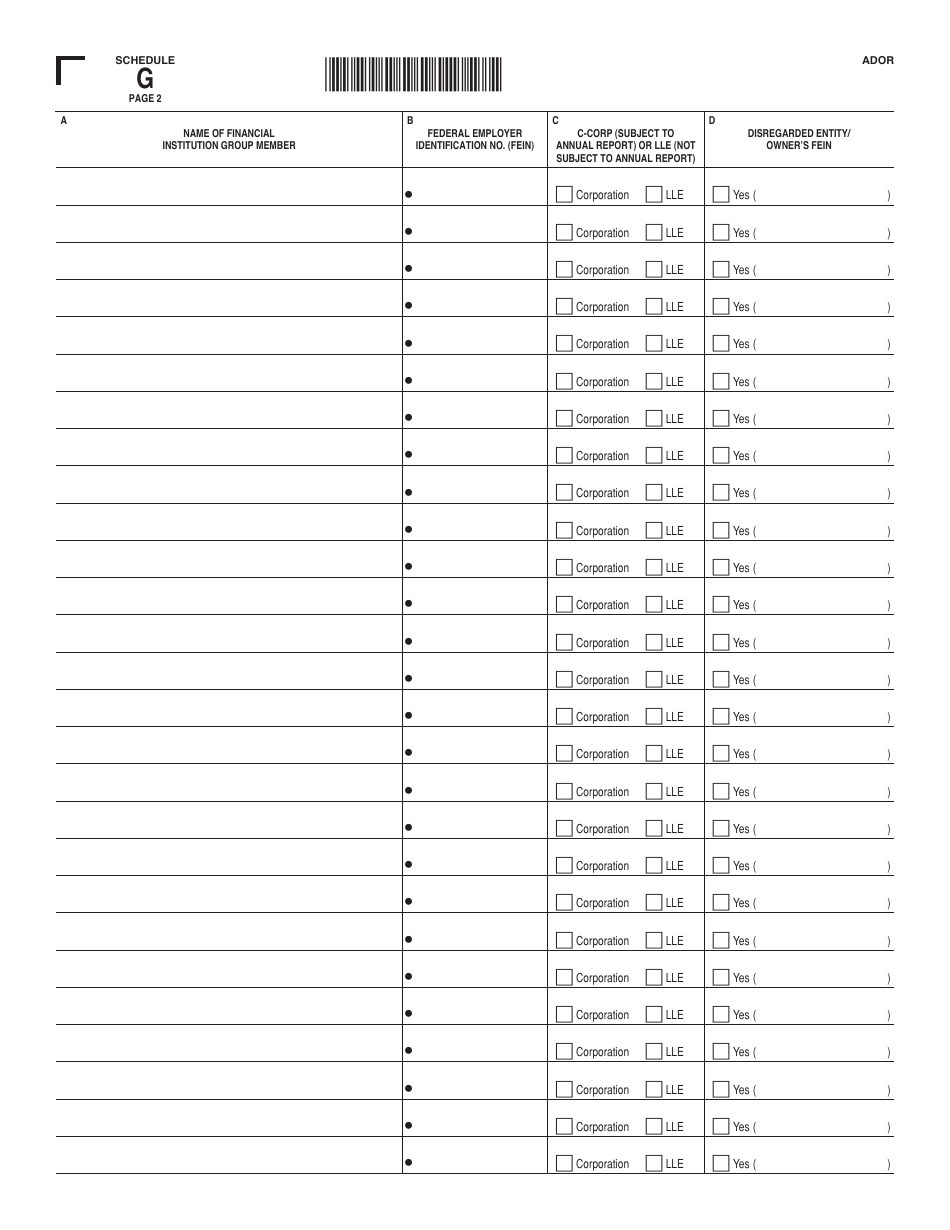

A: Financial institutions that are part of a group need to file Schedule G for the Alabama Business Privilege Tax.

Q: What information is needed for Schedule G?

A: Schedule G requires detailed financial information about the financial institution group.

Q: Is Schedule G the same for all businesses?

A: No, Schedule G is specific to financial institution groups filing the Alabama Business Privilege Tax.

Q: What is the purpose of Schedule G?

A: The purpose of Schedule G is to compute the financial institution group's tax liability for the Alabama Business Privilege Tax.

Q: Are there any instructions for completing Schedule G?

A: Yes, the Alabama Department of Revenue provides detailed instructions for completing Schedule G.

Q: When is Schedule G due?

A: The due date for Schedule G is the same as the Alabama Business Privilege Tax filing deadline, which is typically April 15th of each year.

Q: Is there a penalty for not filing Schedule G?

A: Yes, failure to file Schedule G or file it correctly may result in penalties imposed by the Alabama Department of Revenue.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule G by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.