This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule IRC

for the current year.

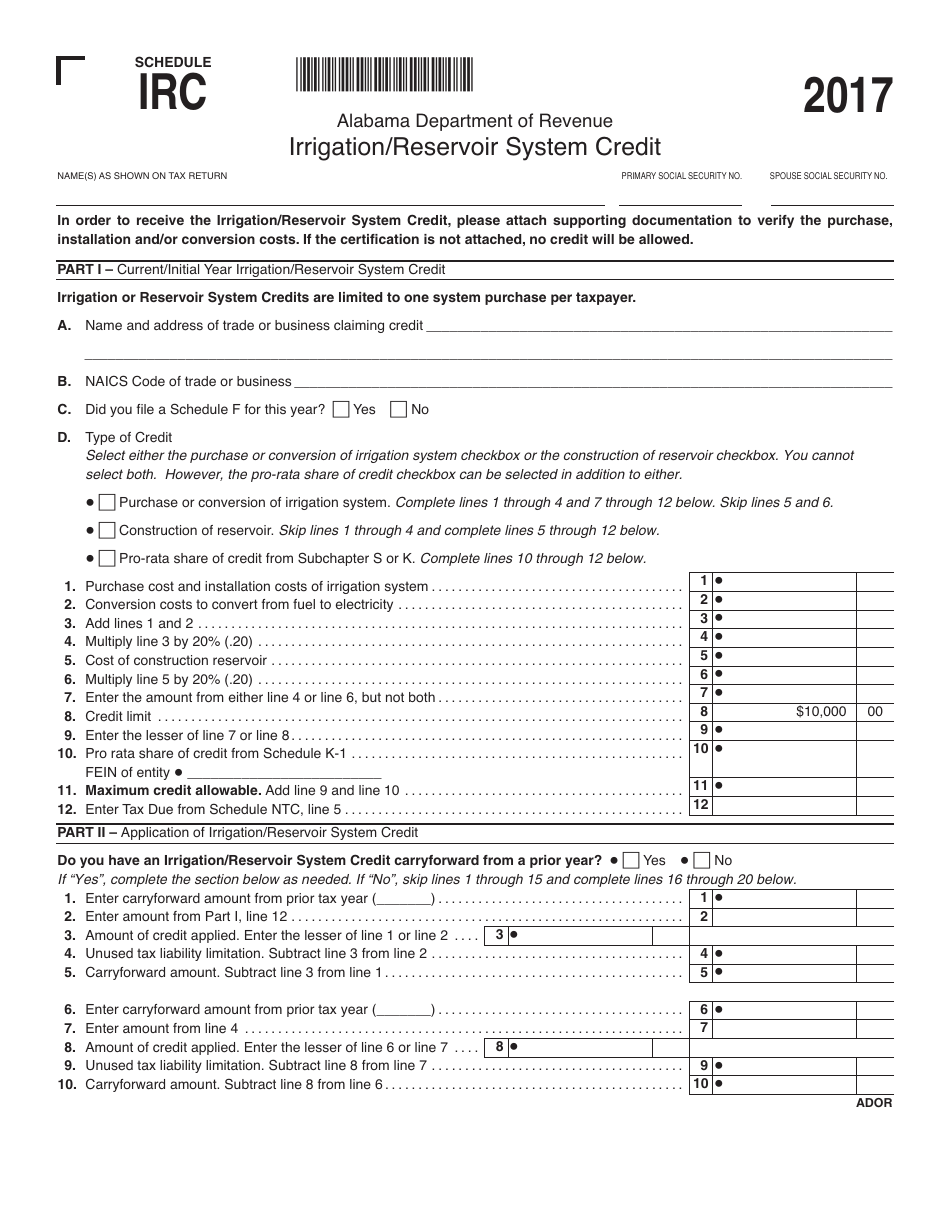

Schedule IRC Irrigation / Reservoir System Credit - Alabama

What Is Schedule IRC?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IRC Irrigation/Reservoir System Credit in Alabama?

A: The IRC Irrigation/Reservoir System Credit in Alabama is a tax credit that encourages the use of irrigation reservoirs for agricultural purposes.

Q: How can I qualify for the IRC Irrigation/Reservoir System Credit?

A: To qualify for the IRC Irrigation/Reservoir System Credit, you must have an eligible project that meets the requirements set by the Alabama Department of Revenue.

Q: What are the benefits of the IRC Irrigation/Reservoir System Credit?

A: The IRC Irrigation/Reservoir System Credit provides a tax credit equal to 20% of the cost of constructing an eligible irrigation reservoir system.

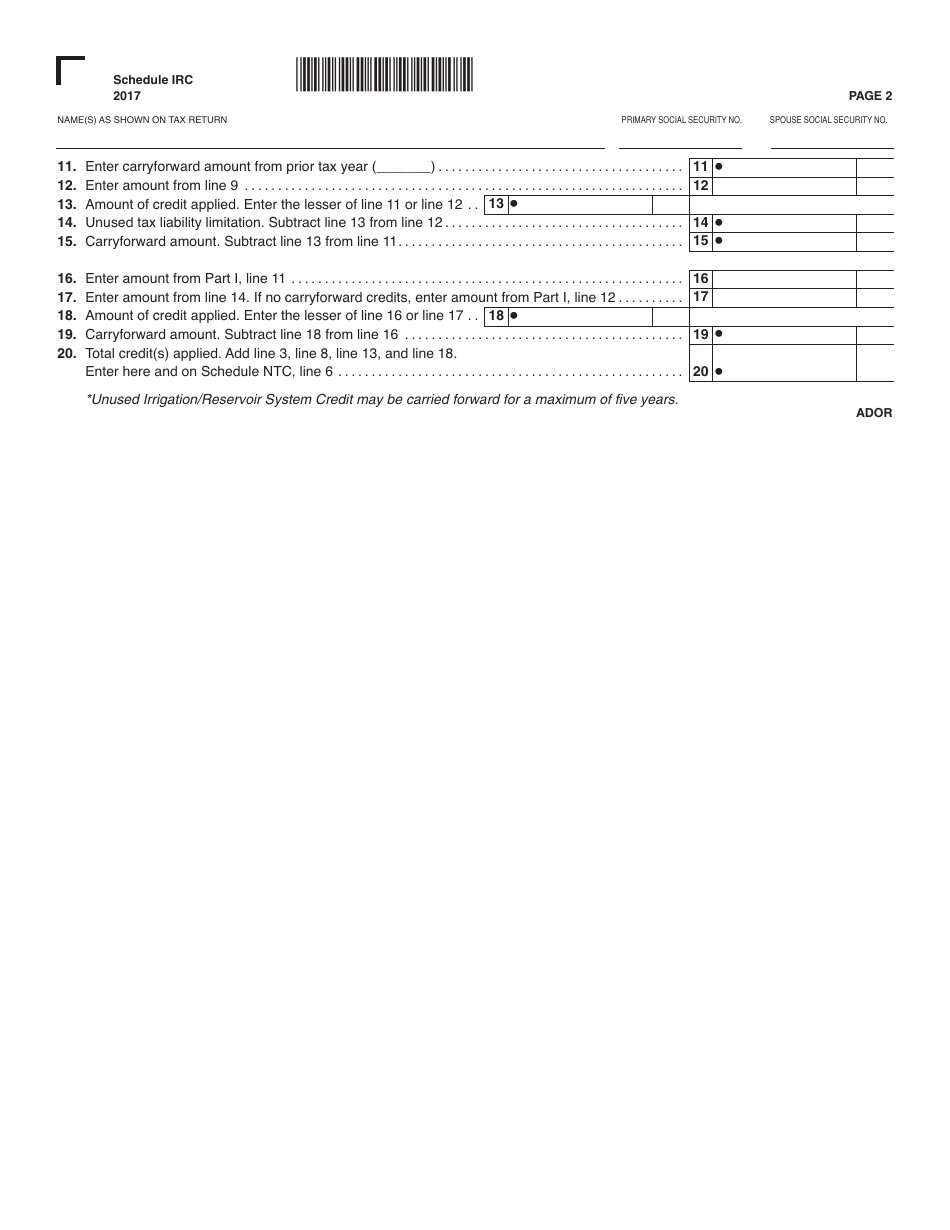

Q: Are there any limitations or restrictions for the IRC Irrigation/Reservoir System Credit?

A: Yes, there are certain limitations and restrictions for the IRC Irrigation/Reservoir System Credit, such as a maximum credit amount and a limited carryover period for unused credits.

Q: How can I apply for the IRC Irrigation/Reservoir System Credit?

A: You can apply for the IRC Irrigation/Reservoir System Credit by filing Form IRC-108 with the Alabama Department of Revenue.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule IRC by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.