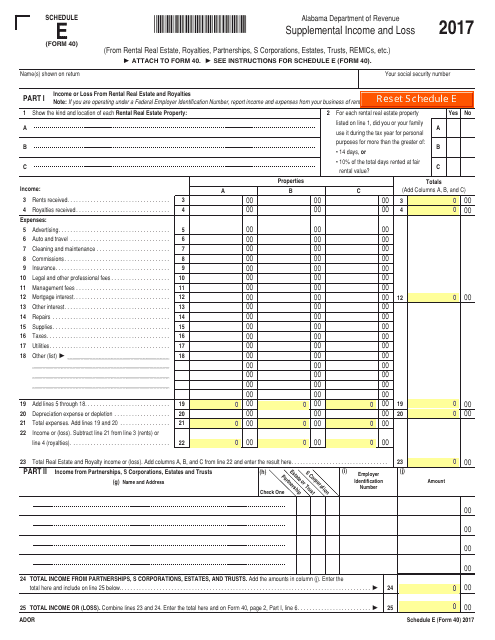

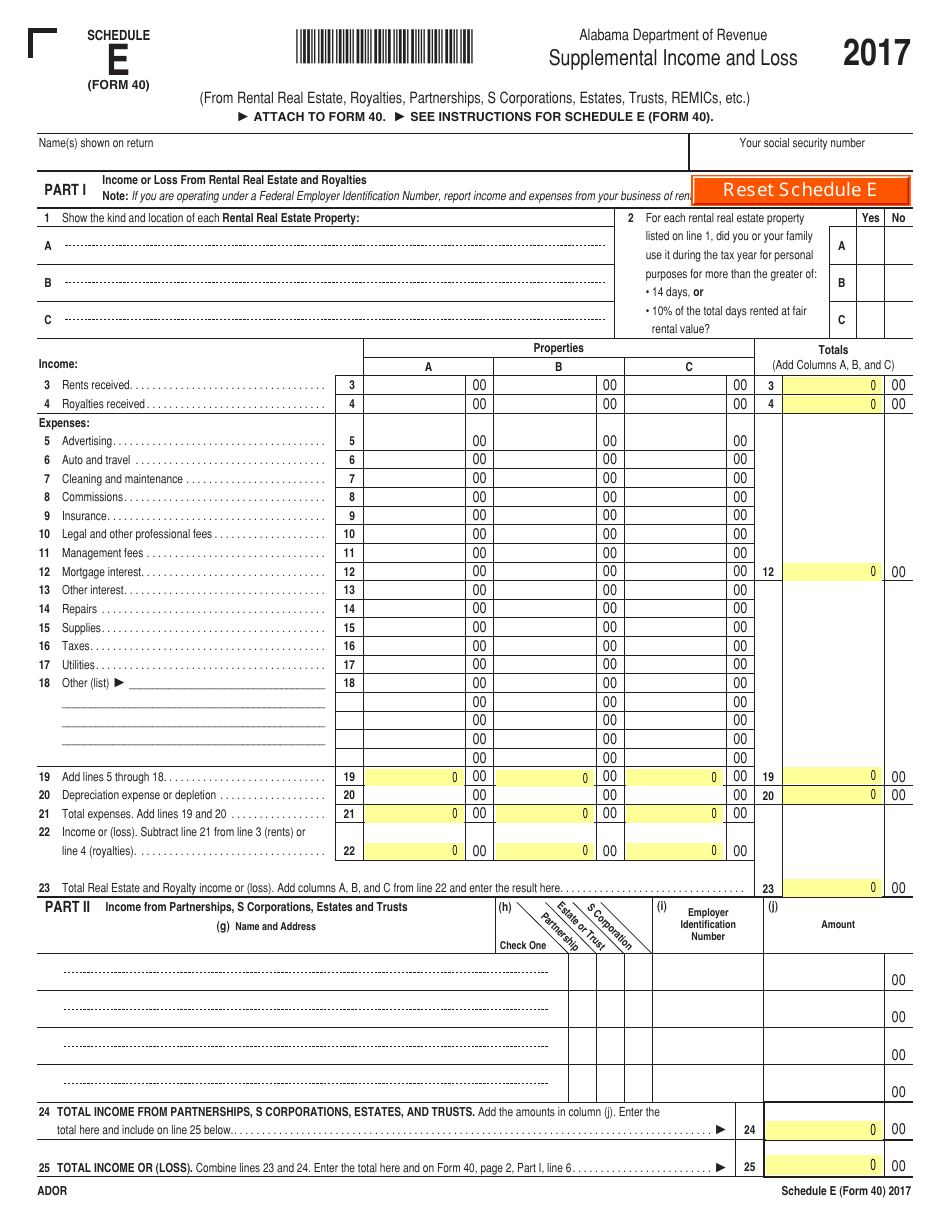

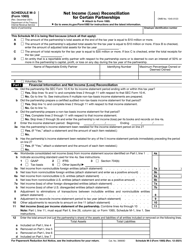

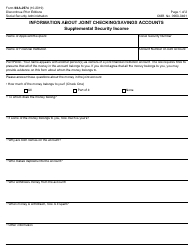

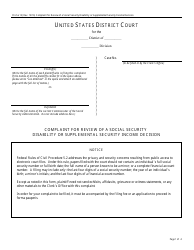

Form 40 Schedule E Supplemental Income and Loss - Alabama

What Is Form 40 Schedule E?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40 Schedule E?

A: Form 40 Schedule E is a supplemental form used to report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

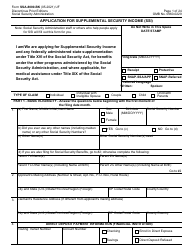

Q: Who needs to file Form 40 Schedule E?

A: If you have rental income, royalties, or income from partnerships, S corporations, estates, trusts, or REMICs in the state of Alabama, you may need to file Form 40 Schedule E.

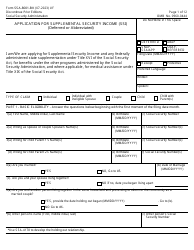

Q: How do I fill out Form 40 Schedule E?

A: To fill out Form 40 Schedule E, you will need to provide information such as your name, social security number, description of the property or activity generating income, and the corresponding income or loss amounts.

Q: When is the deadline to file Form 40 Schedule E?

A: The deadline to file Form 40 Schedule E in Alabama is the same as the deadline for filing your Alabama income tax return, which is generally April 15th or the next business day if it falls on a weekend or holiday.

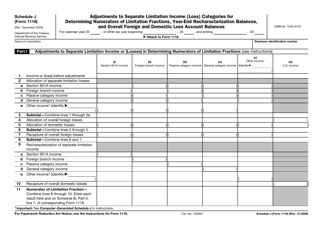

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40 Schedule E by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.