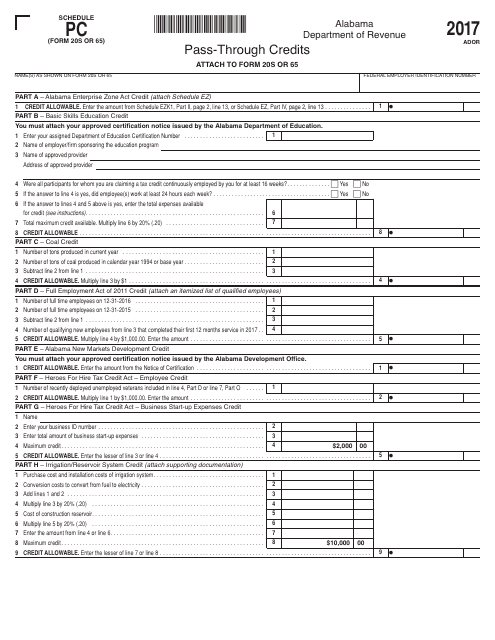

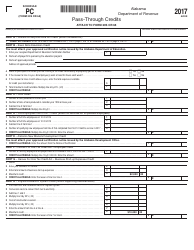

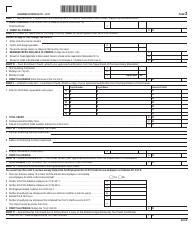

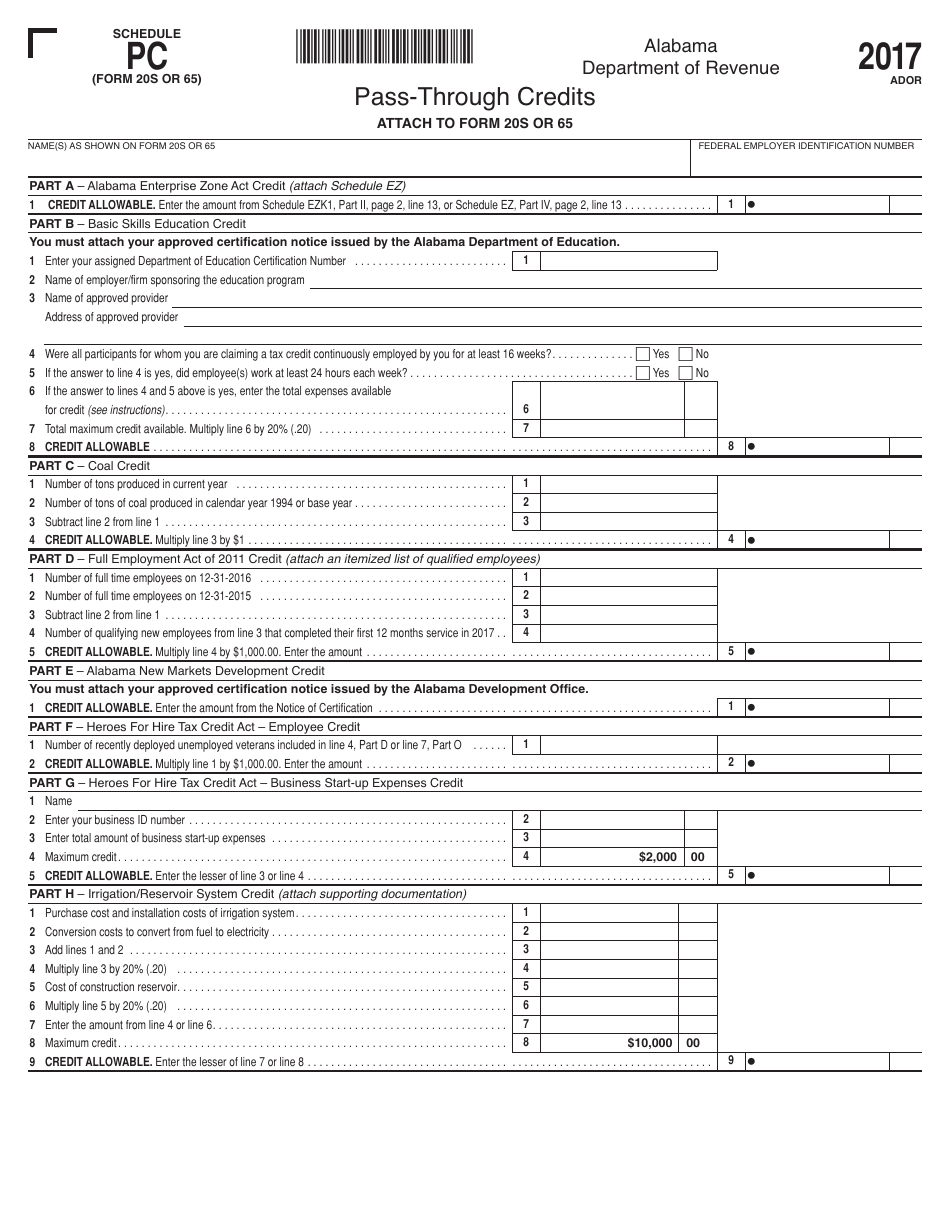

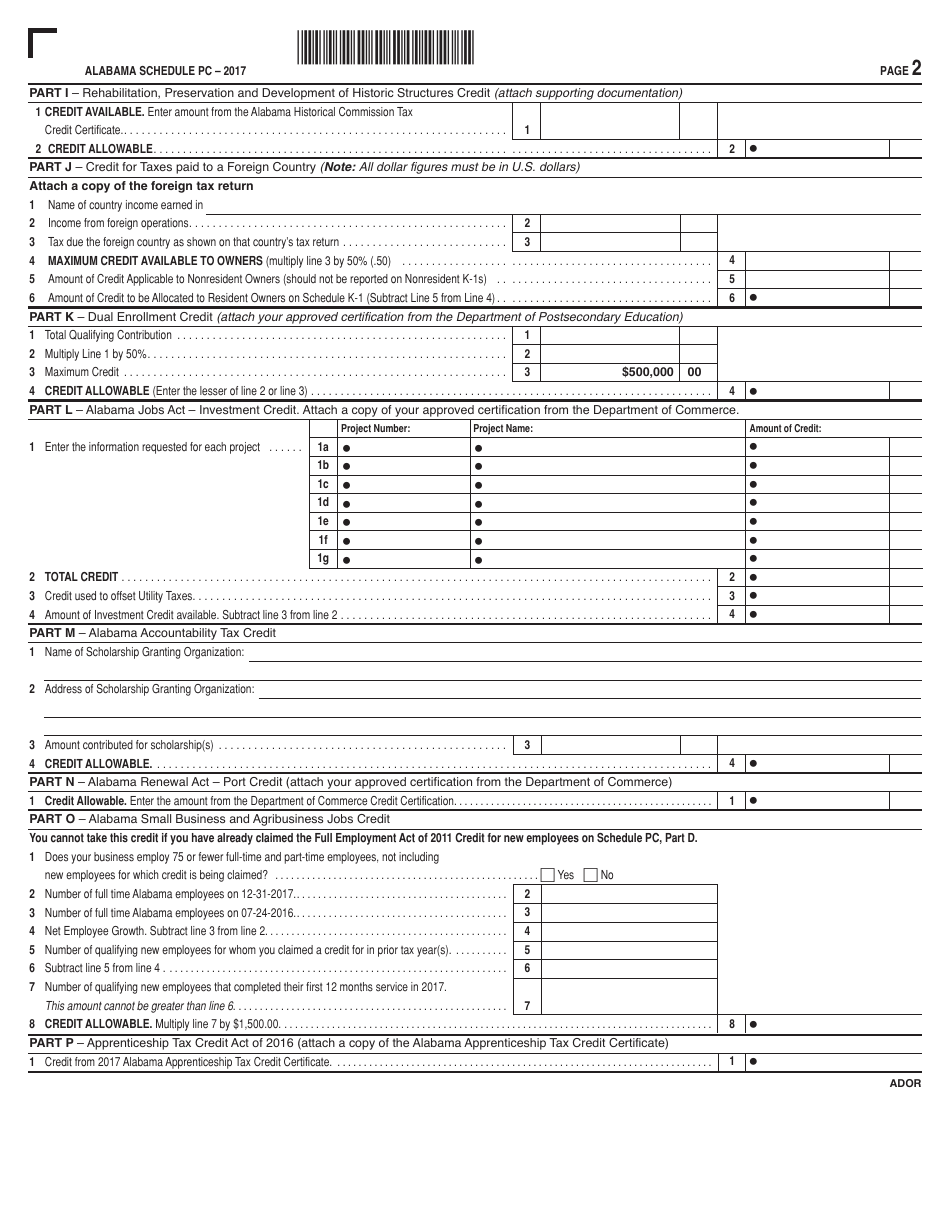

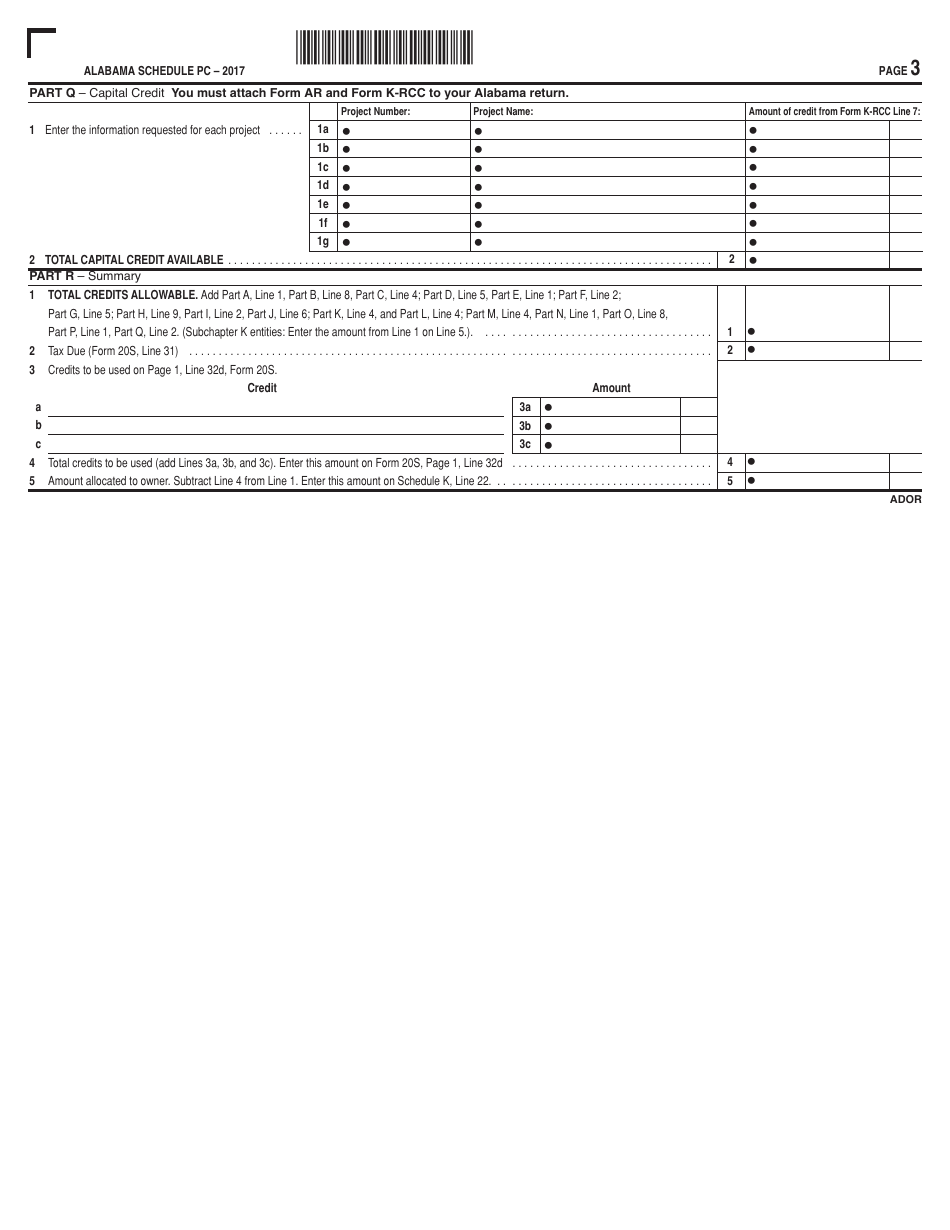

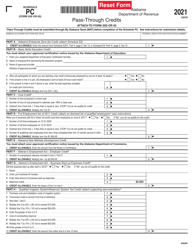

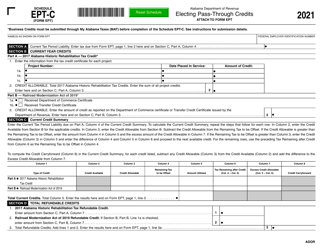

Form 20S Schedule PC Pass-Through Credits - Alabama

What Is Form 20S Schedule PC?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 20S Schedule PC?

A: Form 20S Schedule PC is a tax form used in Alabama for pass-through entities to report pass-through credits.

Q: What are pass-through entities?

A: Pass-through entities are business entities that do not pay taxes at the entity level, but instead pass the tax liability to the owners or members.

Q: What are pass-through credits?

A: Pass-through credits are tax credits that are available to pass-through entities and can be used to offset the owner's or member's tax liability.

Q: Who needs to file Form 20S Schedule PC?

A: Pass-through entities in Alabama that have pass-through credits to report need to file Form 20S Schedule PC.

Q: When is the deadline to file Form 20S Schedule PC?

A: The deadline to file Form 20S Schedule PC is the same as the deadline for filing the entity's Alabama tax return, which is typically April 15th.

Q: Are there any penalties for not filing Form 20S Schedule PC?

A: Yes, failure to file Form 20S Schedule PC can result in penalties imposed by the Alabama Department of Revenue.

Q: What should I do if I have questions about Form 20S Schedule PC?

A: If you have questions about Form 20S Schedule PC, you can contact the Alabama Department of Revenue or consult a tax professional for assistance.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 20S Schedule PC by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.