This version of the form is not currently in use and is provided for reference only. Download this version of

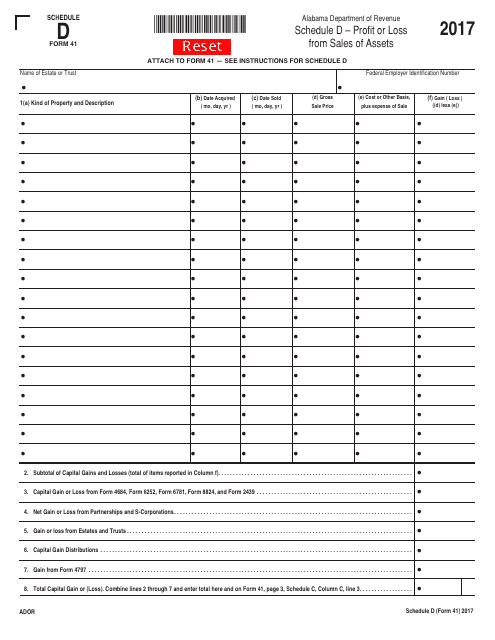

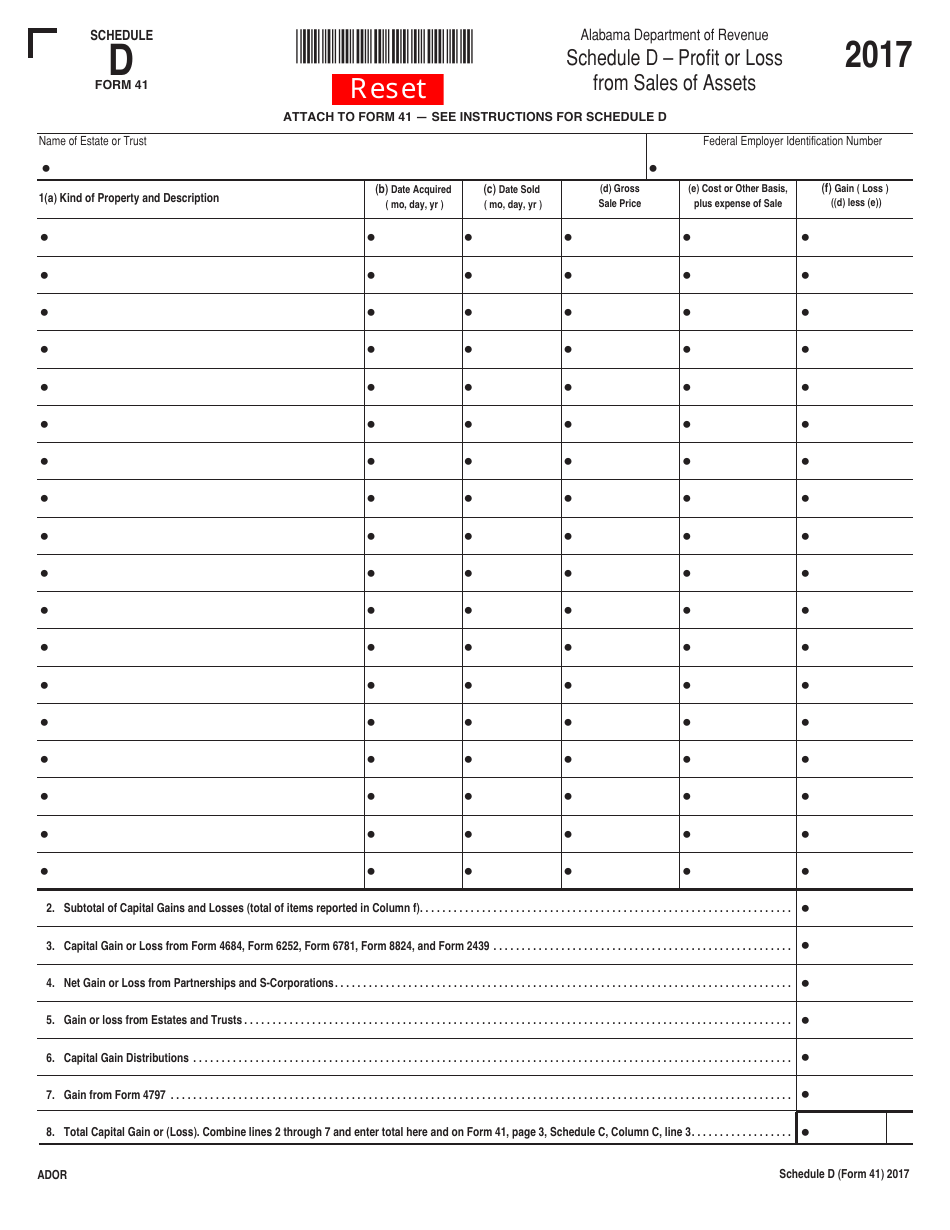

Form 41 Schedule D

for the current year.

Form 41 Schedule D Profit or Loss From Sales of Assets - Alabama

What Is Form 41 Schedule D?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama.The document is a supplement to Form 41, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41 Schedule D?

A: Form 41 Schedule D is used to report the profit or loss from sales of assets.

Q: Who needs to file Form 41 Schedule D?

A: Individuals or businesses in Alabama who have sold assets and made a profit or loss.

Q: What information is required on Form 41 Schedule D?

A: You need to provide details of the asset sold, the purchase price, the sale price, and any associated expenses.

Q: When is the deadline to file Form 41 Schedule D?

A: The deadline to file Form 41 Schedule D is the same as the deadline for your Alabama state tax return, usually April 15th.

Q: Are there any additional forms or documents required with Form 41 Schedule D?

A: You may need to attach supporting documentation, such as receipts or invoices, to support your reported sales and expenses.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41 Schedule D by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.