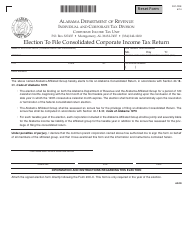

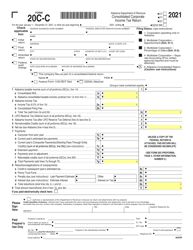

Instructions for Form 20C-C Consolidated Corporate Income Tax Return - Alabama

This document contains official instructions for Form 20C-C , Consolidated Corporate Income Tax Return - a form released and collected by the Alabama Department of Revenue.

FAQ

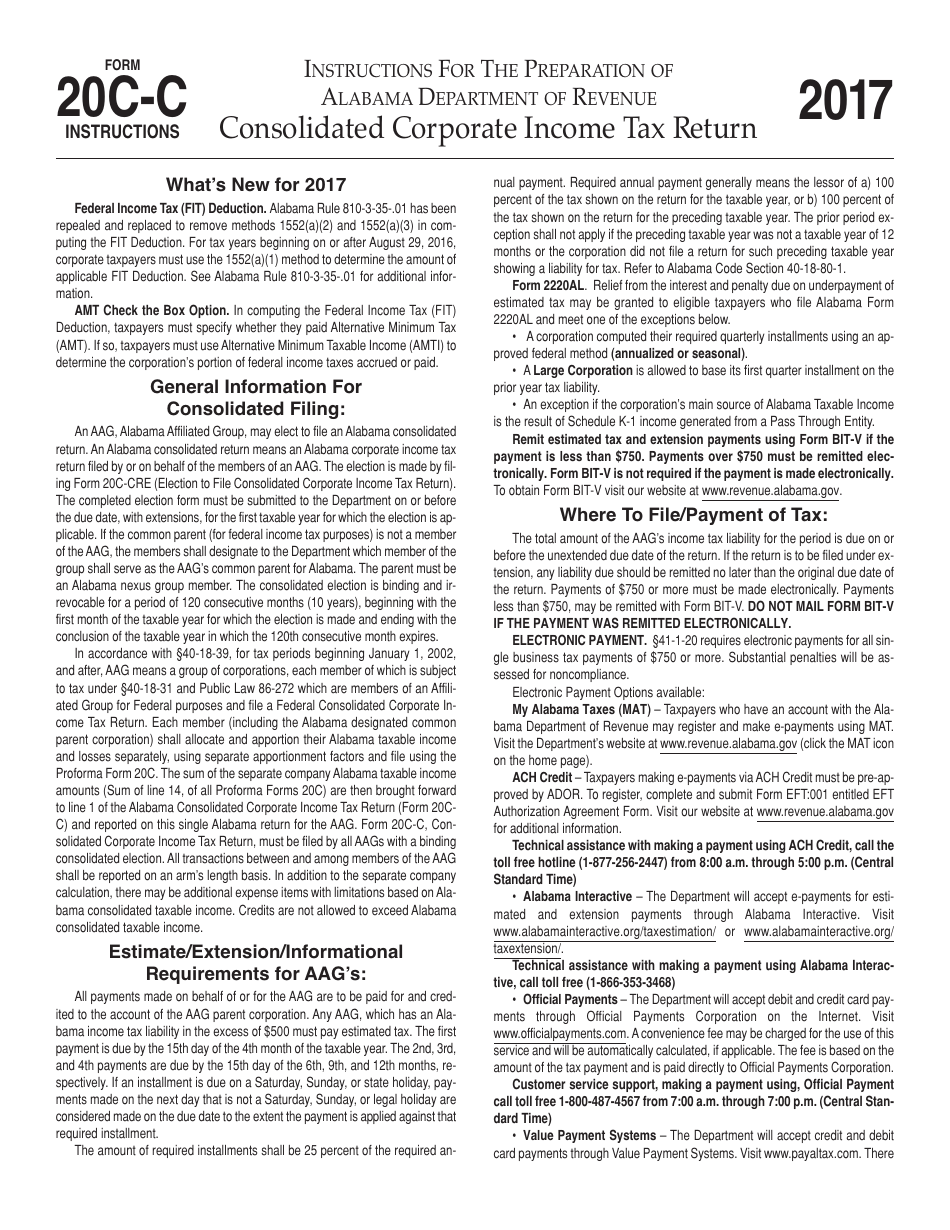

Q: What is Form 20C-C?

A: Form 20C-C is the Consolidated Corporate Income Tax Return in Alabama.

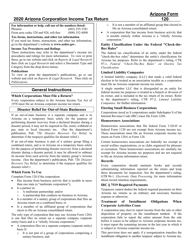

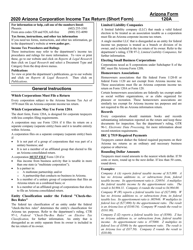

Q: Who needs to file Form 20C-C?

A: Any corporation that is part of a consolidated group for Alabama corporate incometax purposes needs to file Form 20C-C.

Q: What is a consolidated group?

A: A consolidated group is a group of corporations related through common ownership that elect to file a consolidated return for tax purposes.

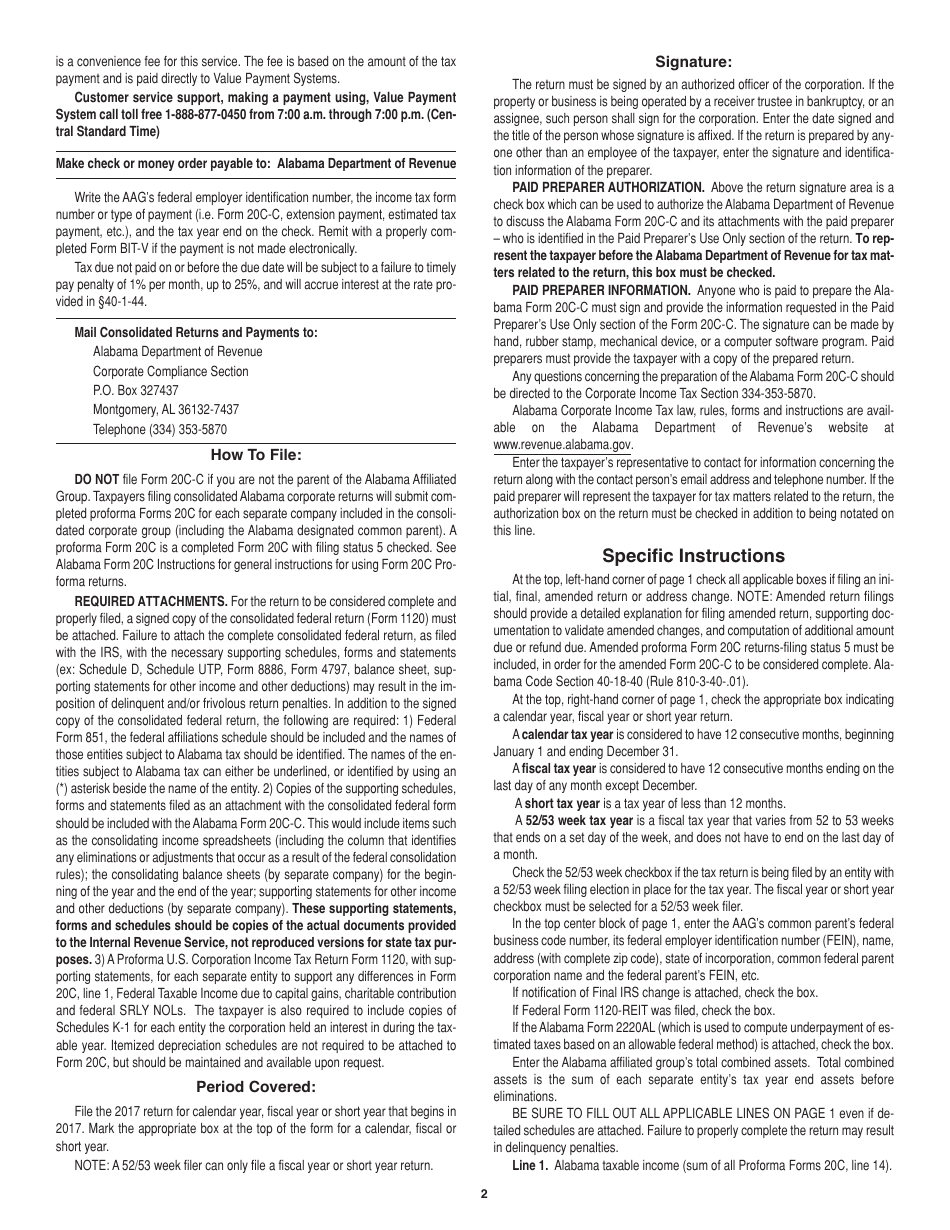

Q: How do I complete Form 20C-C?

A: You should follow the instructions provided with the form to complete it accurately.

Q: When is the deadline to file Form 20C-C?

A: Form 20C-C is due on or before the 15th day of the third month following the close of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, so it's important to submit your Form 20C-C by the deadline.

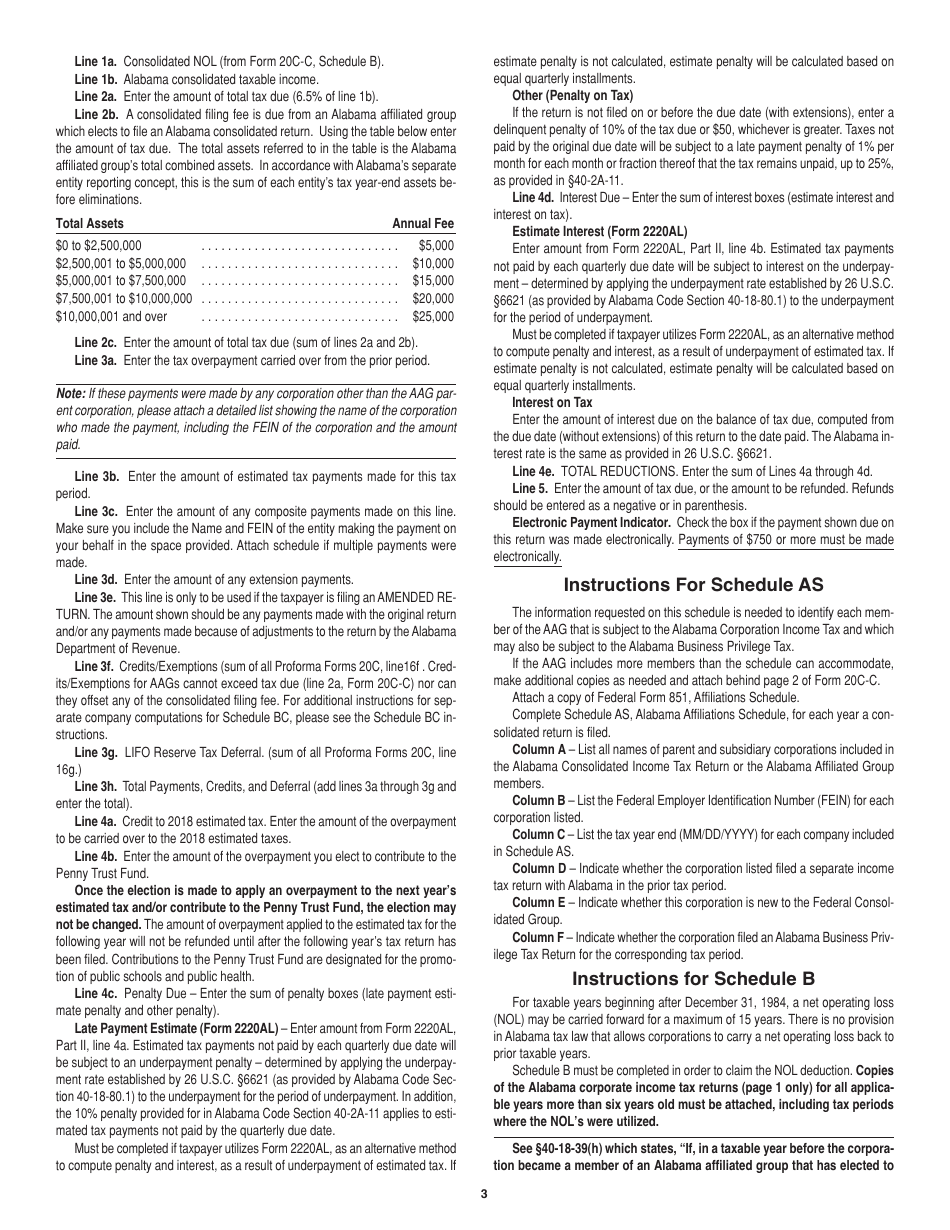

Q: Can I e-file Form 20C-C?

A: No, e-filing is not currently available for Form 20C-C in Alabama.

Q: Is there a separate form for consolidated corporate income tax in Alabama?

A: Yes, Form 20C-C is specifically for consolidated corporate income tax in Alabama.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.