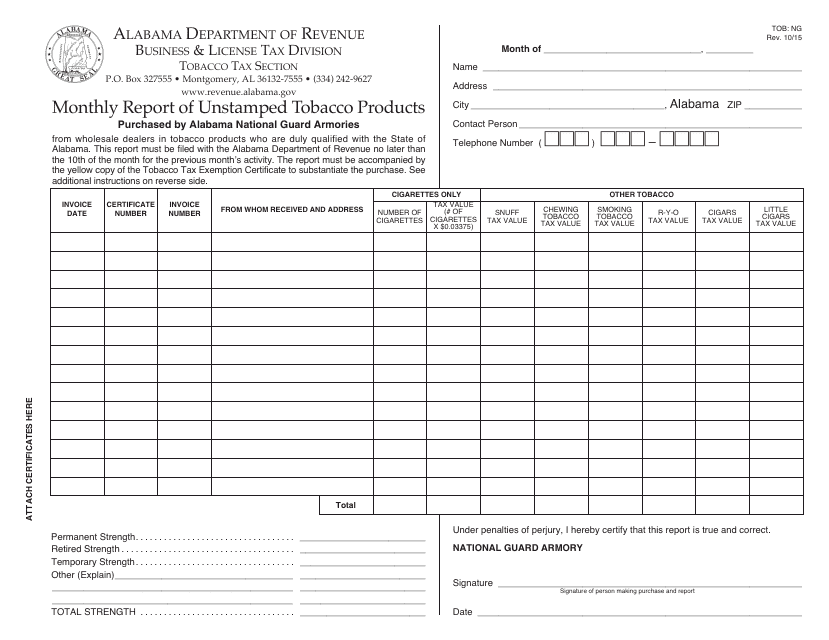

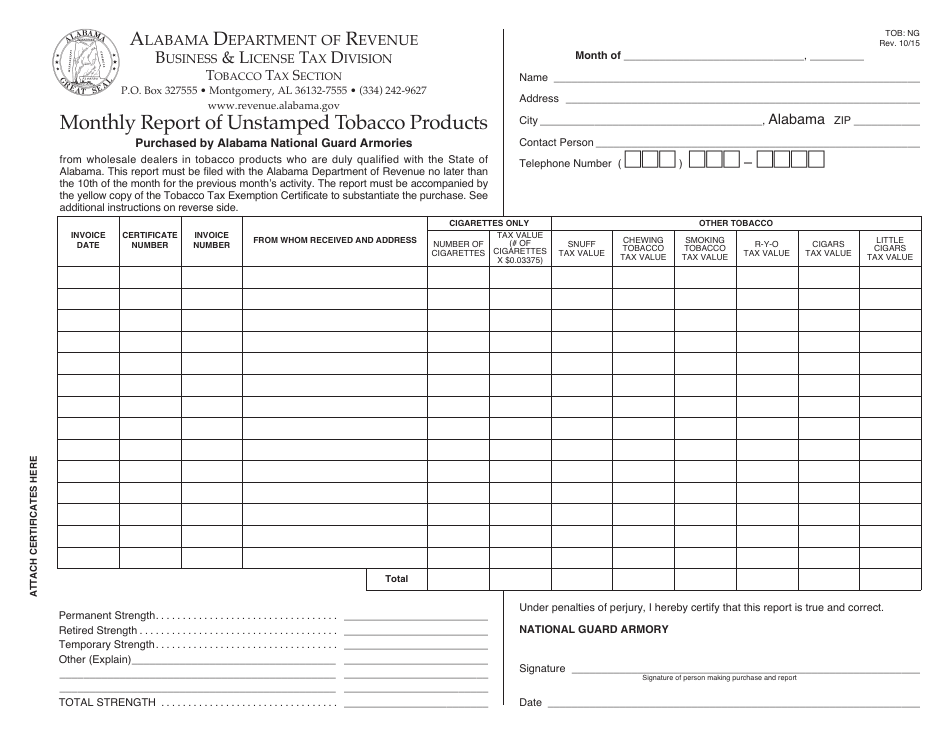

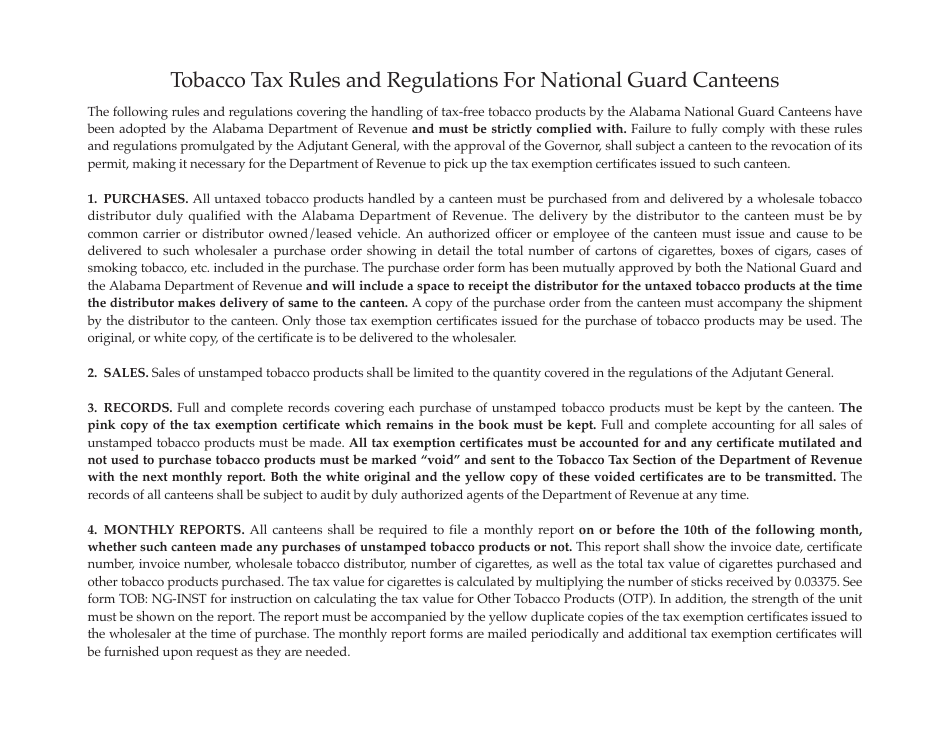

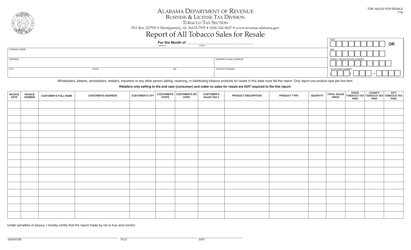

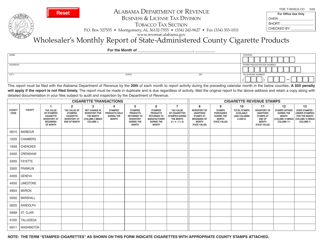

Form TOB: NG Monthly Report of Unstamped Tobacco Products - Alabama

What Is Form TOB: NG?

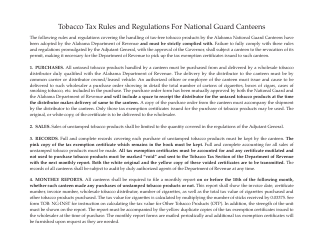

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a TOB?

A: TOB stands for Tobacco ProductsTax Report.

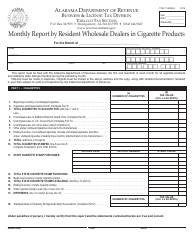

Q: What is the purpose of the NG Monthly Report of Unstamped Tobacco Products?

A: The purpose of the report is to track and monitor the sale and distribution of unstamped tobacco products in Alabama.

Q: Who needs to file the NG Monthly Report of Unstamped Tobacco Products?

A: Any person or entity engaged in the sale or distribution of unstamped tobacco products in Alabama needs to file this report.

Q: How often should the NG Monthly Report of Unstamped Tobacco Products be filed?

A: The report should be filed on a monthly basis.

Q: What information needs to be included in the NG Monthly Report of Unstamped Tobacco Products?

A: The report should include detailed information about the sale and distribution of unstamped tobacco products, including the quantity, type, and price of the products.

Q: Are there any penalties for not filing the NG Monthly Report of Unstamped Tobacco Products?

A: Yes, failure to file the report or filing a false or inaccurate report may result in penalties and legal consequences.

Q: Is there a deadline for filing the NG Monthly Report of Unstamped Tobacco Products?

A: Yes, the report must be filed by the 20th day of the month following the reporting period.

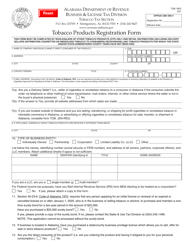

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TOB: NG by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.